The latest Beige Book suggests that the U.S. economy is still growing near its long-term trend, and that the drag from a stronger dollar and weaker energy prices is fading. However, oil production—which has continued to decline despite the run-up in oil prices from the mid-$20 per barrel range in January 2016 to near $50 today—is weighing on economic conditions in the energy-producing states. In addition, our analysis of the Beige Book confirms that there continues to be some spillover of weakness from the energy and manufacturing sectors to other parts of the economy. Comments in the Beige Book also continue to indicate that some upward pressure on wages is beginning to emerge; but the wage pressures are not accelerating quickly, which should keep the Federal Reserve (Fed) from raising interest rates aggressively this year.

Overall, the Beige Book described the economy as expanding at a “modest or moderate” pace in 7 of the 12 districts, about the same as in recent editions of the Beige Book. In general, optimism regarding the economic outlook far outweighed pessimism throughout the Beige Book, as it has for the past two years or so, but pessimism continues to run high in the energy-producing regions of the U.S.

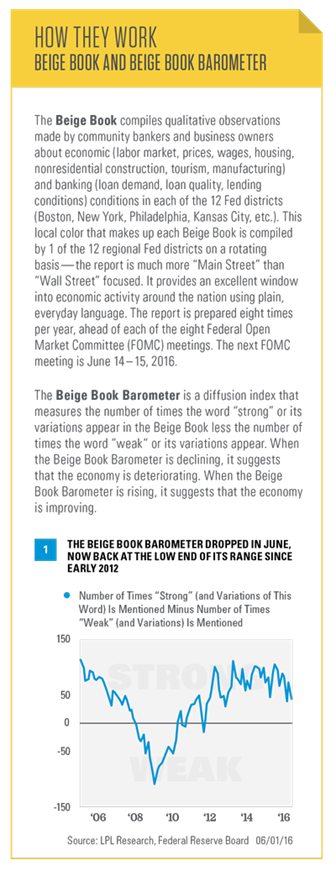

The Beige Book is a qualitative assessment of the U.S. economy and each of the 12 Fed districts individually. We believe the Beige Book is best interpreted by measuring how the descriptors change over time. The latest edition of the Fed’s Beige Book was released Wednesday, June 1, 2016, ahead of the June 14–15Federal Open Market Committee (FOMC) meeting, the fourth Fed policy meeting of 2016. The qualitative inputs for the June 2016 Beige Book were collected from mid-April through May 23, 2016. Thus, they captured Main Street’s reaction to:

• A period of relative calm in U.S. and global financial markets

• Rising oil prices but falling oil production

• Falling odds of a summer Fed rate hike in early May that gave way to rising odds of a summer hike by late May, which sent the dollar on a round trip—weaker at first before rallying in the past month or so

• Economic and inflation data for February, March, April, and May 2016 that disappointed from February through early May and then began to exceed expectations over the rest of the month

• Increased discussion in the financial media about rising inflation and rising wages in the U.S.

Sentiment Snapshot