The FPA Business Solutions 2011 conference in Boston had many great insights into how advisors can improve their businesses. One common theme was around segmenting a book of business and focusing on growing using an ideal client profile.

The benefits of segmenting a book.

Mike Watson, director of product management of TD Ameritrade Institutional, said, "Client segmentation is one of the top priorities to driving profitability." He explained that it allows advisors to create disciplined service models to deliver the service level that is appropriate.

By setting up models, advisors can manage their time and their staff's time better, along with their clients' expectations.

Advisors should have a strategic focus to be effective managers. Watson believes having a focus allows advisors to offer narrowed services and allows staff to concentrate on a well-defined set of deliverables. By refining the service offering and staffing models, advisors can reduce organizational complexity and create economies of scale.

How to segment clients.

"Quantitative data can be a method," Watson explained. Assets per household, revenue, ROA (return on assets) and other measurables were given as common examples.

He also discussed what to do if a client calls every single week, challenges every decision, never sends referrals or just isn't an advocate of the services provided. He suggested asking, "Are they a great referral source? Do I like them? How many hours are [spent] on clients? Is it a profitable [relationship]?"

To prove his point, Watson talked about an advisor who has a client that gives haircuts. On paper, this individual would not look like a client who should receive the best service. But because the small business was located in an affluent area, referrals from this client led to 15 new accounts.

Watson said advisors should look at several criteria in assessing a client, such as revenue, assets, ROA, strength of relationship, referrals, trust and future potential. He suggested advisors assign a score for each client using a sliding scale from 1 to 4. "Put the information of client ranks in your CRM," he said. Then determine what services they get, like face time with the principals, wrap accounts for smaller clients, etc.

Identify ideal clients.

"Some firms are seeing a lot of people, but they are not the right people. A lot of firms have not put an ideal client profile on paper. And if they have, they have not shared it with the right people-clients, centers of influence," said Todd Fithian, managing partner of The Legacy Companies.

To provide the best service, it makes sense to focus on the best clients. "To create the ideal client profile, you need to evaluate your client base. Know your 80/20 rule," Watson said. "Who do you enjoy working with? Who values your services? Who generates a higher level of referrals? Identify commonalities, like demographics."

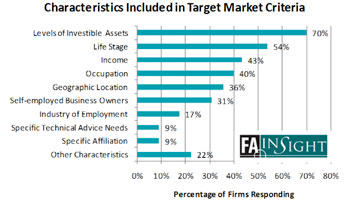

Dan Inveen, principal and director of research at FA Insight, shared his firm's research on how to segment ideal clients.

"Understanding whom the firm serves and the value of the firm delivers is key," Inveen said. Not surprising, he saw that the more successful advisors had a higher profit per client. What was more interesting was that these advisors know who they serve. "They have a laser like focus," he said. "Standout firms have a more defined target market. They also have a definition and adhere to a discipline to the client acceptance process." He thought by doing this, "A lot of problems become resolved. Advisors become more efficient and they have better service for clients."

Matt Matrisian, vice president and director of practice management at Genworth Financial Wealth Management, said, "Develop the target market around a passion. Enjoy time spent with clients. Look for commonalities between clients."

How to market more effectively.

"More contacts [with your clients] create raving fans," said Watson. "The more you are in front of clients, the more opportunities you have to find new business. Top performers have higher client minimums and revenue per client."

Segmenting allows for a refined marketing focus. He showed how "A" clients get intimate dinners or maybe golf outings, while "B" clients just get group events.

Watson said, "Be deliberate about your firm's identity and value proposition. Know your ideal client. Develop your value proposition. It will increase the quality and quantity of prospective leads."

Regarding how to develop your value proposition, Watson asked, "What does your firm do and for whom? What is unique that you do that nobody else does?"

The right service.

Deena B. Katz, chairman of Evensky & Katz Wealth Management, said advisors should ask, "What do your clients value? What do you and your staff value? Is there a disconnect?"

It also makes sense to research best clients. Watson stated, "Client surveys are very powerful, as a client might not tell you something on the phone, but an independent survey can deliver true feedback." He suggested finding out:

Why do clients work with you?

What services do they value the most?

What services do they value the least?

Then simply look at the results and match services, understanding how much it costs to deliver services and how revenue is derived.

"Create a match between your service offering and ideal clients," Watson said.

"Set up a client advisory board around a target market and ask, 'How do I get more of you? What can I do to target more people like you?'" Matrisian said. He cited a Bill Cosby quote: "I don't know the key to success, but the key to failure is trying to please everybody."

Mike Byrnes founded Byrnes Consulting to provide consulting services to help advisors become even more successful. His expertise is in business planning, marketing strategy, business development, client service and management effectiveness, along with several other areas. Read more at www.byrnesconsulting.com.