The presidential candidates have clear ideas about how the prosperous should be taxed. Democrat Hillary Clinton thinks the rich should pay more. Fair, she calls it. Republican Donald Trump proposes to cut taxes for all, with the affluent and business owners saving the most. Beautiful!

For advisors and their well-off clients, taxes are at stake in the November 8 election, and the call to action could be immediate. “Year-end tax planning will be critically important for high-income clients since there could be significant marginal tax rate increases in 2017 under a Clinton administration, or significant decreases if Trump prevails,” depending on the outcome of the congressional elections, says Blake Christian, a CPA and partner at accounting firm HCVT in Long Beach, Calif., and Park City, Utah.

Should Trump win, consider deferring income to 2017 and accelerating expenses into this year. If Clinton is victorious, consider doing the opposite—accelerating income and deferring certain expenses—which will generally be more beneficial, Christian says. Additional year-end tax-planning ideas appear in a separate article.

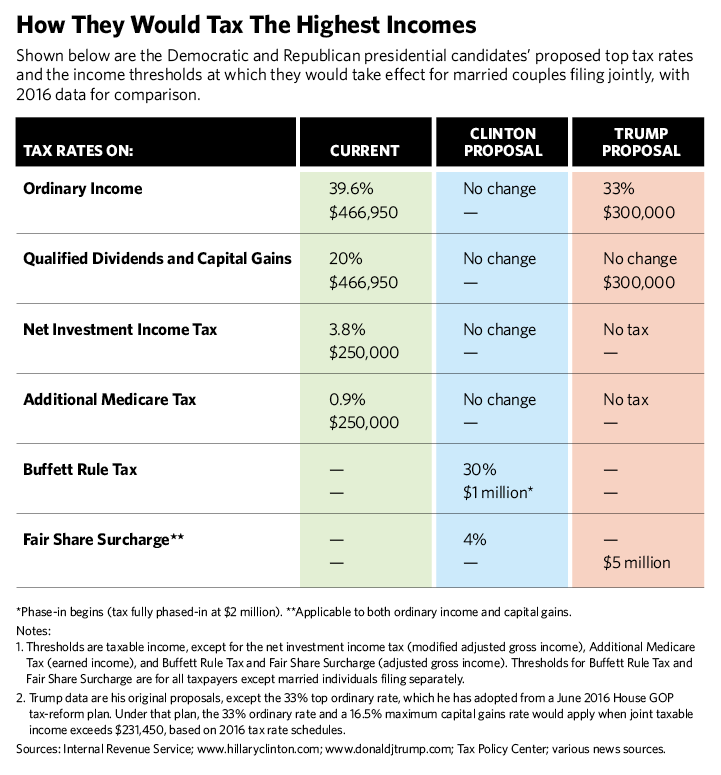

The candidates’ plans for affluent clients are summarized in the accompanying chart. That said, the Clinton campaign website lacks certain specifics, forcing reliance on other sources, while many of Trump’s positions as of this mid-September writing were (depending on your view) contradictory, changing or incomplete. The original tax plan he issued in 2015 was lifted from his website after an August 8 speech in Detroit and was later found buried in the Internet Archive.

The candidates do appear to agree on one thing. Both wish to tax hedge fund managers’ carried interests as ordinary income.

The Status Quo And Then Some

Clinton’s tax platform is viewed by observers as a modest tweaking of the current tax system, which is to say it preserves provisions that presently stalk prodigious earners. The 39.6% top ordinary rate and the Obamacare tax twins, i.e., the surly 3.8% net investment income tax and its picayune sibling, the 0.9% Additional Medicare Tax on earned income, would live on.

Clinton’s tweaks, unfortunately for the wealthy, would come largely at their expense. Of the $3.3 trillion in new revenue her proposals are forecast to generate over 20 years, more than 75% would come from the top 1% of households, according to an analysis issued in March by the Tax Policy Center of the Urban Institute and Brookings Institution. It said the top 1% of earners would experience a nearly 5% drop in 2017 after-tax income.

Indeed, the affluent have the leading role in the Democratic nominee’s tax slogan. “A Fair Tax System: Making sure the wealthy, Wall Street, and corporations pay their fair share in taxes,” reads www.hillaryclinton.com.

Clinton’s plot against the rich starts where the 28% tax bracket ends, at $231,450 for joint filers and $190,150 for singles, based on 2016 tax rate schedules. That’s because 28% is her proposed maximum tax savings from a bevy of breaks, which would curtail for higher-bracket clients the benefit of muni-bond interest, moving expenses, contributions to 401(k) plans, individual retirement accounts and health savings accounts, itemized deductions (except charitable contributions) and more, according to the Tax Policy Center.

At $1 million of adjusted gross income (AGI), Clinton envisions a 30% effective tax rate beginning to phase in, with the rate fully phased in at $2 million. This is her Buffett Rule, “to ensure the wealthiest Americans do not pay a lower tax rate than hardworking middle-class families,” her site explains. The Tax Policy Center says clients could count toward the 30% requirement their regular income tax, any alternative minimum tax owed, the 3.8% net investment income tax, the employee portion of payroll tax, plus a proposed 4% surcharge on the client’s AGI above $5 million.

This 4% “fair share surcharge,” as Clinton has dubbed it, would apply to both ordinary income and capital gains and would touch the top 0.03% of taxpayers, based on 2014 tax return data published by the Internal Revenue Service on August 31. (The figure was cited as 0.02%, based on 2013 data, when Clinton first proposed the tax for mega-earners.)

For investors, Clinton would seek significant changes to the capital gains holding-period requirement to encourage long-term investing. She wants ordinary rates to apply when investments are sold within two years of purchase. After two years, her plan’s top cap gains rate is 36%. Then it falls 4% for each additional year the asset is held until bottoming at 20% after six years.

Regarding the estate tax, Clinton eyes reverting to the rules in effect in 2009 under the Bush tax regime—namely, to a $3.5 million per person estate tax exemption, a $1 million gift tax exemption (where there is no indexing of either figure) and a 45% top rate on taxable transfers.

Paint It, Orange

The Donald isn’t looking to merely color over the existing tax law. He wants to yank out whole parts with his little hands. To be deported from the code are the death tax, the alternative minimum tax and the Obamacare taxes. Yuge!

Trump’s original plan virtually quadruples the present standard deduction to $50,000 for joint filers and $25,000 for singles. Clients earning more would see a phase-out of their itemized deductions other than charitable donations and mortgage interest.

A 25% top ordinary bracket graced the candidate’s original proposal. But he has since adopted the 33% top rate set forth in House Republicans’ June tax-reform road map.

Trump has proposed taxing all business income at 15%, whether from a corporation, partnership, limited liability company or sole proprietorship. Observers say this could make workers want to be classified as independent contractors in order to qualify their earnings as business income taxable at 15%, which is less than they’d owe on wages received as an employee.

Another proposal for businesses is allowing them immediate write-offs of capital investments. “But with a 15% tax rate, deductions would no longer be meaningful for the business owner. There isn’t enough tax savings,” opines Tom Wheelwright, CEO of the accounting firm ProVision Wealth Strategists, in Tempe, Ariz.

In short, Trumpian fiscal policy would demand new approaches to providing tax advice. “There’s no question Trump is upsetting the applecart,” Wheelwright says.

For example, in a world without a federal death tax, “Estate planners would put a greater emphasis on income tax planning. We would be using non-grantor trusts to shift income to lower-bracket family members,” among other techniques, says Las Vegas estate planning attorney Steve Oshins, a partner at Oshins & Associates LLC.

The 10-year cost of Trump’s original plan, which bears the label “fully paid for,” is $10.14 trillion according to the conservative Tax Foundation, and that’s after the think tank factored in the potential economic growth generated by Trump’s proposed tax cuts. The Tax Policy Center pegs the drop in government revenues a little lower at $9.5 trillion. After Trump raised the top marginal rate from 25% to 33%, Larry Kudlow, a Trump economic advisor, estimated it would increase the deficit by only $3 trillion.

Less discussed is the Trump campaign’s estimate that the proposed increase in the standard deduction would boost the number of American households not paying federal income tax.

On paper, the candidates’ tax plans stake out contrasting philosophies. Yet as a practical matter, if the winning candidate doesn’t implement the promises, or can’t, then these proposals are just so much political jabber at best.