A recent study by Limra and McKinsey & Co. looked at the distribution challenges faced by companies that sell financial products to financial advisors. The study surveyed nearly 2,000 advisors of various stripes––including RIAs, broker-dealers, banks and insurance companies––and was designed to help financial services companies target those products, services and support offerings that make advisors the most productive.

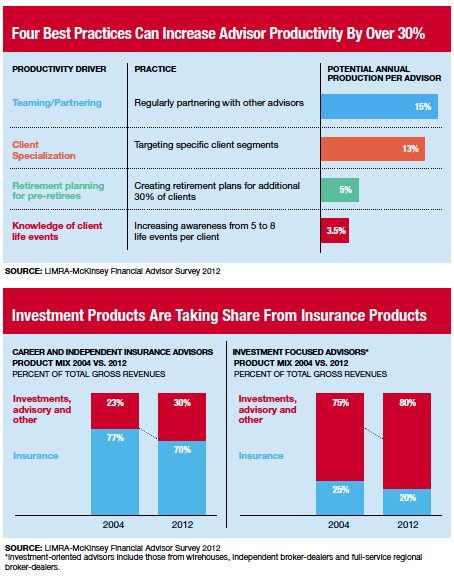

Advisors’ most productive practices, the study found, were regularly partnering with other advisors, specializing in certain clients, creating retirement plans and knowing about important occasions in a client’s life.

“Our study provides new insights into the factors that drive advisor productivity and helps organizations better target their services for advisors,” said McKinsey’s Prashant Gandhi, who led the team that conducted the study.

The study also showed that advisors are selling a larger share of investment products and a smaller share of insurance products. “Shrinking distribution and increasing distribution costs have been significant challenges to insurers’ ability to reach their targeted markets,” said Patrick Leary, leader of the Limra team.

But the study also found that in some ways, financial services companies are spinning their wheels. Though they have boosted the services they offer to their affiliated advisors by 40% over the past 10 years, many of these services aren’t valued or are poorly delivered. Evidently, advisors aren’t too crazy about in-person sales support and marketing services.

The upshot is that these companies need to rethink how they deliver their products and services to best meet advisors’ needs.

Best Practices That Boost Advisor Productivity

January 4, 2013

« Previous Article

| Next Article »

Login in order to post a comment