Last year represented a "normal" economic and investment environment only when compared with the shocking events and one-way markets of 2008 and 2009. It was a year of progress-the deep recession passed and financial market volatility receded. Yet fallout from the credit crisis was everywhere: sovereign debt panic in Europe, muni credit worries in the U.S. and unprecedented aggressiveness by the Federal Reserve to avoid a flameout of the fragile economic recovery.

What follows is an assessment of the opportunities and risks facing high-net-worth investors in the year ahead.

The Fed's announcement of another round of aggressive monetary easing in November indicated that policymakers still believe the recovery is fragile. We concur. An extended period of uncomfortably slow growth is likely-something between recession and prosperity.

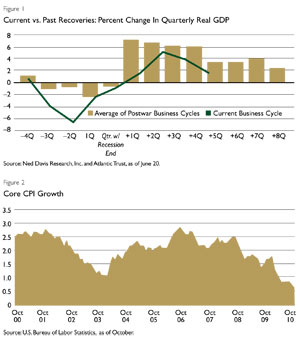

We believe unemployment will remain elevated for years, leading to subdued consumer spending. This should be offset by somewhat better capital investment, as cash-rich businesses attempt to ramp up their productivity. Exports should also be a source of relative strength, as demand from faster- growing overseas economies is likely to be sustained. A real GDP growth rate of 2% to 2.5% through 2011 is likely. (See Figure 1.)

There is great concern that the huge debt accumulation of the government will spark an inflationary money-printing binge. This is a significant long-term risk, but there is too much slack in the economy for inflation to rise anytime soon. Indeed, growth in the 12-month core Consumer Price Index (CPI) slowed to just 0.6% in October, the slowest rate since the U.S. Bureau of Labor Statistics began computing the numbers in 1958. Continued weakness in the job market means there will be minimal wage pressure. Thus, it is likely that inflation will stay quite subdued at least through 2011. (See Figure 2.)

Fiscal Restraint Begins

At this point, the biggest wild card for the economy may be politics and policy.

The decisive midterm election results have begun to clarify the fiscal policy outlook. The Republican takeover of the House of Representatives will blunt many of the Obama administration's plans to further intertwine the federal government and the private sector. Tax policy will also be impacted, as it appears all of the current Bush tax cut rates will be extended for two years, at least temporarily foiling the administration's desire to raise tax rates on upper-income families.

The biggest issue for the economy's long-term health-and perhaps for sentiment in the financial markets in 2011-will be whether the nation's trillion-dollar deficit is addressed by the more balanced (or gridlocked?) power structure in Washington. The election results and investor sentiment polls indicate that both Main Street and Wall Street believe that reducing the size of the federal government and slashing the deficit are high priorities. After his political setback, President Barack Obama has little choice but to adopt the mantle of fiscal responsibility. Meanwhile, Republicans will at least partially own the results of the economy's performance and perceptions about whether government is helping or hurting. We believe the chances are good that a deficit reduction package of modest size will be signed into law in 2011. While it would be a drop in the bucket, as the saying goes, "If you want to pull yourself out of a ditch, the first step is to stop digging." (See Figure 3.)

The Federal Reserve's decision to enact further monetary stimulus has so far produced a classic "buy the rumor, sell the news" reaction. In late August, the Fed telegraphed its intention to implement another round of quantitative easing to counter what looked like a flagging economic recovery. This was a major reason for the 13.5% surge in global stock markets (MSCI World Index) in September and October. Since the November 3 announcement of the Fed's plan to purchase $600 billion in long-term Treasury securities through mid-2011, both stock and bond investors have had second thoughts. The Fed's thesis-that they needed to lower long-term interest rates to stimulate bank credit and avert a double-dip recession and deflation-seems less credible in the face of recent stronger economic reports.