Editor's Note: This is the first in a series of stories on strategic business development in the ultra-affluent universe.

When it comes to the importance of referrals in reaching high-net-worth markets, the good news is that nearly everyone is on the same page.

In late 2010, the research firm HNW found that 90% of advisors include referrals as part of their client acquisition efforts. Similarly, advisory members of the Family Office Exchange attributed 95% of their new business to some form of referral. Hannah Shaw Grove's research (conducted with Private Wealth editor-at-large Russ Alan Prince) reveals that roughly 85% of individuals with net worths exceeding $20 million said they found their advisor by referral.

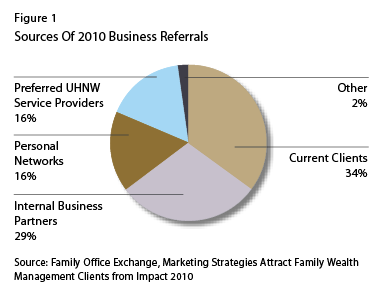

The not-so-good news about referrals is that this is where the unanimity appears to end. There are many types of referrals but not a lot of clarity about how they differ in execution and effectiveness. For instance, the Family Office Exchange identifies four referral sources: Current clients are responsible for referring 34% of new business; internal business partners, 29%; centers of influence, 16%; and personal networks, 16% (Figure 1). The data shows that the types of referrals used vary depending on an individual's net worth and priorities; the wealthier and more private a person is, the less likely he is, to rely on social contacts for guidance. Wealthier clients will instead turn to a trusted authority they already know, such as a tax attorney or a business manager.

An equivalent phenomenon is occurring among advisors and wealth management providers. A narrowly focused advisor-one who earns 80% or more of his income from a single product category, say investments-typically relies more heavily on client referrals. A more sophisticated provider, such as a wealth manager or multifamily office that delivers a broad range of integrated services, gets most new business from professionals in complementary fields, such as accounting, concierge medicine or P&C insurance.

Follow The Leader

The economic crisis has helped to spotlight weaknesses in the advisor-client dynamic and create a more discerning consumer. Individuals no longer respond to generic or nebulous messages and, instead, are seeking someone with whom they can have a deeper emotional connection. The savviest professionals adapted quickly to the changing circumstances, but the implications for the rest of the industry are far reaching. The result is a paradigm shift in how private wealth management organizations will think about and pursue growth.

By isolating the techniques used by advisors and firms with the highest client retention and satisfaction levels, and then comparing them to the preferences and priorities of ultra-affluent households, we can begin to identify a best practices benchmark for referrals. What we've learned is insightful and can help you focus your efforts on the people and opportunities with the greatest probability of success.

What's Wrong With This Picture?

ADVISOR: I'm glad you could join me for golf today, and even happier that my team and I could help you beat the S&P last year. If you're as pleased as I am, I hope you'll consider recommending me and my firm to a friend or associate.

CLIENT: Absolutely! No one comes to mind just now, but let me give it some thought and I'll get back to you.

Although asking for a referral is proactive, most advisors shift into a reactive mode once the request has been made and let it languish. While rounds of golf and fancy dinners certainly help build relationships, they alone will not result in consistent referrals. A request like the one above transfers too much responsibility to your clients, leaving them with the task of finding and evaluating leads. Not surprisingly, very little ever comes of these vague and open-ended appeals. As a point of comparison, if you took the initiative to identify and investigate someone in your client's network-Alexei, the owner of nine fast food franchises, for instance-and then asked for an introduction to him by name, it would be much easier for your client to respond positively to your request. Simply put, the lack of structure, process and specificity surrounding most referrals undermines the effort.

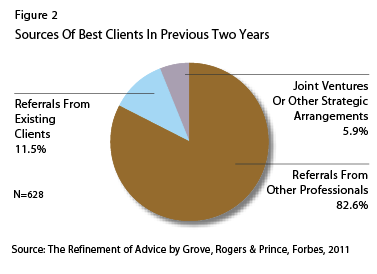

Additionally, very few advisors evaluate their own results and use the insights to operate more effectively. Three-quarters of advisors perceive client referrals as the most important method of building their business, but a recent survey conducted on behalf of Forbes found that advisors attribute 88% of their 2009-2010 business to professional referrals or joint ventures and just 12% to client referrals (Figure 2). This disconnect between perception and reality probably means that a significant majority of advisors are putting their energy into prospecting activities that don't deliver the results they desire.

Finally, not enough effort is spent on selecting and cultivating professionals as referral sources. Too many advisors have low standards (or worse, no standards) for their referral sources. They don't bother to learn about each professional's business, clientele or objectives to determine if they fit well with their own goals, and instead drop off stacks of business cards and brochures at accounting and law firms hoping they will be at the top of the list the next time an opportunity surfaces. Any professional with a robust high-net-worth business knows that referring his clients to other professionals for specific services is both an implied endorsement and a form of currency. They should, at a minimum, receive more attentive service and cooperative marketing support from the recipient of the referral, but very few get anything more than a "thank you" note.

What's Changing?

On the heels of consolidation in the financial services sector and only finite opportunities to increase business from an existing customer base, there is mounting recognition among wealth management firms that future growth must come from new relationships. As a result, most firms are taking a closer look at their client acquisition activities. We have observed a shift in thinking from "Can we win the business?" to "What business do we want?" This demonstrates a more proactive and selective approach that forces organizations to be clear about their target client sectors and more thoughtful in the allocation of key resources.

This focus has also helped spotlight the central role of referrals in reaching high-value clients and set in motion a mission to understand the process and to make it more systematic and reliable for a broader cross-section of practitioners. This new mindset is still more of a theory than a reality, but it signals a desire to be strategic in tackling the growth conundrum and a willingness to try new approaches to create a sustained pipeline of new business, irrespective of macro-economic conditions or investment performance.

Wealthy clients are also becoming more selective and prudent in their review of professional services firms, demanding greater transparency and evidence of ethical business standards. Most affluent prospects will attempt to qualify a potential provider by triangulating with someone in their own personal or professional network.

The Critical Component

The more you know about someone, the more likely it is that you can connect with him or her on a level (or through a third party) that inspires trust and confidence. Until recently, most advisors gathered information about their clients through conversations, questionnaires, profiling tools or online searches. While these methods work and can yield important insights, they will not be sufficient as competition accelerates for the ultra-affluent. In truth, the financial elite are more discerning and less accessible than most and it will often take something more to win their business.

Possessing the best and most detailed intelligence about prospects and clients is an exceptional advantage for any advisor, but people have a tendency to underestimate the value of data because it is an intangible commodity and one that, in many cases, can be acquired for free. We believe wealth managers and multifamily offices need to expand their specialist networks to include researchers who can help them profile potential clients-the same way they collaborate with estate planning attorneys or private security specialists.

Proactive Profiling

In Private Wealth, we have long espoused the importance of holistic client profiling. More recently, leading practitioners are expanding on the concept and seeking specifics in such areas as sources of wealth, family members, business associates, philanthropic involvement, passions and hobbies, board and club memberships and political affiliation in an effort to gauge how well a particular individual fits with them, their capabilities and their business models. On the whole, this type of intelligence can increase the efficiency of any new business development efforts.

Once you've identified an ideal prospect, those same facts can help you find and interact with the person at the highest level. Such a profile can reveal that you share common interests or activities-say you both have twin girls or you both worked on Reagan's first presidential campaign-and connecting the dots for them can often produce enough comfort and trust to warrant a conversation. Detailed profiles can also help you identify ways to reach the prospect-perhaps she sits on a board with your college roommate's father-in-law. Having a fact-based foundation enables you to initiate more meaningful and consultative interactions with your constituents, spot avenues of access that might otherwise have been hidden and earn business through preparation and focus.

The same is true when working with extended family units. The faster you grasp their unique issues, the more efficiently you can direct them toward the right solution. For instance, if you know that two siblings are suing each other, you might choose to bring a family dynamics counselor to the meeting. If you can use specifics to artfully match their business concerns to the capabilities of your firm-or a passion for kite surfing to that of a colleague-you significantly increase your appeal to these high-end prospects.

Historically, the bulk of work done on behalf of a client came after the sale had closed, but times are changing and more than ever we see a direct correlation between the profitability potential of a relationship and how much advance work will be required. Sadly, many advisors remain reluctant to put in the time to construct such a dossier during the prospecting stage, choosing to delay any extra effort or expenditure until the business has been secured. All too often this decision is the difference between winning the business and losing it to a more ambitious and well-prepared competitor.

Moving Forward

As more providers flock to the high end of the market, the old referral model is not sustainable and practitioners that want to flourish will need to go beyond the traditional referral approach. Without question, it will require more upfront strategic work, rather than relying on serendipity to achieve organic growth, and an understanding of how to leverage client-specific insights in ways that are accretive to planning and prospecting. An informed advisor who arrives with pointed questions will garner the most trust, respect and new business.

David Friedman is co-founder and executive vice president of strategy for Wealth-X, a global provider of ultra-high-net-worth intelligence to multifamily offices, private banks, luxury brands and non-profits. More information can be found at www.wealthx.com.