It may seem a little self-serving when the manager of a large-company stock fund says large company stocks will likely perform better than small caps in 2011. But the observation carries a bit more weight when someone who runs one of the largest small company funds in the country makes the same observation.

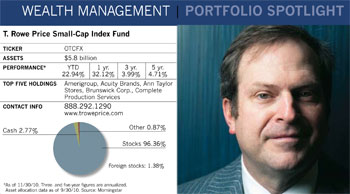

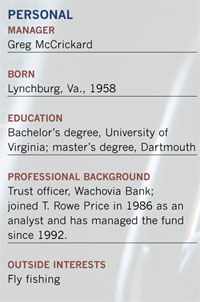

"I don't think small company stocks are going to see a correction, but I believe large companies will lead the market this year," says Greg McCrickard, who has managed the $5.8 billion T. Rowe Price Small-Cap Stock Fund since 1992. "At this point, I'd say no more than a neutral weighting in small caps is warranted, and more conservative investors might even think about an underweight position."

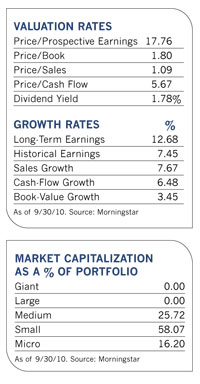

Concerns about small company stock valuations lie at the heart of the 52-year-old manager's sentiments. After a strong surge following the market rebound in 2009, those stocks are trading at high valuations relative to their historical averages and growth prospects. Large company stocks, which have not recovered as sharply since the beginning of the rebound, look more attractively valued by comparison.

Still, investors who want to maintain an allocation to small caps can squeeze some juice out of companies that are positioned to increase earnings as the economic recovery takes shape.

An upturn in commercial construction, for example, would benefit fund holding Acuity Brands. A leading provider of lighting fixtures and related products and services for industrial and outdoor use, the company has a strong niche in education, government and health care facilities as well as an emerging business in LED lighting and other energy-efficient lighting products.

Brunswick Corporation, which manufactures outboard engines, fitness equipment and boats, looks set to remain profitable and increase earnings as cost-cutting measures kick in and the market for its products improves. Convinced that the company was serious about cutting costs, McCrickard began building on the fund's position after the stock fell sharply in 2008.

Old Fund, New Tricks

Small company stocks have rotated in and out of favor many times since Small-Cap's predecessor, the Over-The-Counter Securities Fund, was launched over 54 year ago. The oldest small company mutual fund in the country traces its roots back to 1956 when Ralph Coleman, who wrote and published a newsletter on over-the-counter stocks, launched the first mutual fund to invest in what was then unfamiliar territory to most investors.

The original fund grew to about $50 million under Coleman's management and after his death it changed hands several times, including a stint with Boston-based Wellington Management in the 1980s. According to a New York Times article, then-manager Binkley Shorts dubbed it the "Under the Counter" securities fund because of the large number of small company holdings that most investors had never heard of.

When T. Rowe Price purchased the $173 million fund from a large property/casualty insurer in 1992, McCrickard, then a 34-year-old analyst who had been with T. Rowe Price for six years, kept many of its features, such as broad diversification, a combination of value and growth stocks and a long-term holding period. "The basic strategy didn't change much under our management, and we have managed the portfolio with the same process since the first day," he says.

McCrickard and his staff of six analysts look for a proven business model, an attractive valuation relative to future earnings or cash flow, cost controls and a catalyst for change such as new management. To avoid "froth," he will sell a stock when a company's problems appear to have lasting implications, valuations become too expensive, its market capitalization leads it into mid-cap territory or its premise has played out and he finds better ideas.

Unlike many of its peers, which often morph into closet mid-cap offerings as they get bigger to avoid wreaking havoc with their out-sized trades, this one remains true to its small-cap roots. As of September 30, its median market capitalization was $1.5 billion.

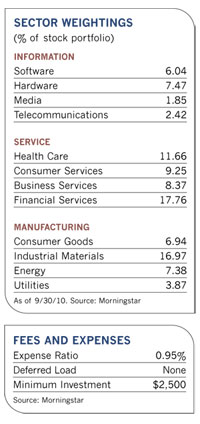

The fund spreads its assets over a large swath of over 300 names, with each one typically accounting for no more than 1% of assets. It's also dispersed among a variety of sectors, with industrial and business service companies leading the way at 19.7% of assets.

Having a lot of irons in the fire has not led to the asset bloat that plagues some funds, says Standard & Poor's mutual fund analyst Todd Rosenbluth. "The fund has a very low turnover, and the fact that it isn't churning in and out of names means the analysts really get to know them," he observes. "It consistently scores well based on performance, risk and cost factors, and its strategy and investment philosophy has remained intact since McCrickard took over in the early 1990s."

Although the expansive list of holdings makes it difficult for the best picks to drive returns, it also helps prevent blowouts that can plague more concentrated funds in down markets. In 2008, for example, its shares declined 33.3%, compared to a drop of 36.6% for its Morningstar small blend peer and 37% for the Standard & Poor's 500 index. But it can also set the pace in a bull market, as it did in 2009, when it beat its average Morningstar peer by nearly seven percentage points.

The fund also did well in 2010, despite some laggards in the financial and utilities sectors, and was up nearly 18% during the first ten months of the year. Strong showings included stocks such as Mariner Energy, an offshore oil exploration and production firm that surged after a takeover bid from Apache that eventually led to a merger in November. Another contributor to performance, Baldor Electric, benefited from strong demand for its energy-efficient industrial motors, as well as aggressive cost-cutting measures that will magnify the tailwind from an economic recovery.

Investments in a number of consumer discretionary stocks have also paid off. Automotive parts maker TRW saw a bounce after earnings came in well above analyst expectations, and the firm is prospering despite fears about its European auto business. AnnTaylor Stores, recently a top ten holding, continues to post strong comparable sales at its women's specialty stores.

Expectations In Check

McCrickard says the midterm elections have done little to provide direction for the investors and the economy and is keeping his expectations in check for the coming year. While he believes demand from emerging and international markets will continue to help U.S. companies that do business overseas, weakness in the housing market will cast a shadow over the economy.

"I think things will be OK in 2011 and I don't see a double-dip recession," he says. "But economic growth isn't likely to go above 3%."

Still, he sees improved long-term profitability for companies such as Infinity Property & Casualty, which specializes in automobile insurance for higher-risk customers. "Non-standard policies will be one of the first areas to come back when the property/casualty sector recovers," he says. "And Infinity has a lot of the qualities we like, including strong management, strong cash flow and the potential to capitalize on those strengths when the economic recovery solidifies." The company has also repurchased a large number of its shares, and its publicly traded stock has fallen from 21 million shares in 2005 to 13.5 million shares today.

While manufacturing poles for utility, lighting and wireless communications equipment may sound like a mundane business, Valmont Electric has a strong grip on the market as well as a backlog of transmission projects in the works. Its volume and profit margins should tick up over the next couple of years as demand for electricity increases. The company, which also makes irrigation equipment for agricultural applications, is growing sales as farmers increase their investment in new equipment to take advantage of higher crop prices. Like other companies in the portfolio, Valmont derives a significant portion of its revenue from countries outside the U.S., which will allow it to take advantage of growth in emerging markets.

In the health-care sector, the fund owns a number of names that will benefit from increased coverage of the population under health-care reform. Amerigroup, a health maintenance organization that serves Medicaid recipients, should see business expand as near-universal health care mandates increase the number of people who are eligible to use its facilities. LifePoint Hospitals, another company active in the Medicaid market, will be able to pare bad debt expenses and improve profitability as the government steps in to help cover the uninsured.

More recent additions to the portfolio include athletic apparel maker Under Armour. McCrickard first bought the stock in the spring of 2010, when it was trading at valuations comparable to Nike, its slower-growing and substantially larger competitor. Since then, the stock has risen and trades at a significant premium to Nike. Another newer holding, Kilroy Realty, has well-located office and industrial properties in California. McCrickard believes that the company's attractive valuation, high-quality portfolio and dividend yield are key attractions as investors wait for the real estate market to improve.