Blurring The Lines - By Russ Alan Prince , Hannah Shaw Grove - 08/1/2007

In the inaugural issue of Private Wealth, we discussed some of the proprietary research we conducted with the senior management of 97 private banks, 78 brokerage firms and 94 multifamily offices. We looked at their "ideal clients," their new business development efforts and their perception of the competitive environment. We now turn our attention to their use of alternative investments for their wealthy clients and the provision of noninvestment management services.

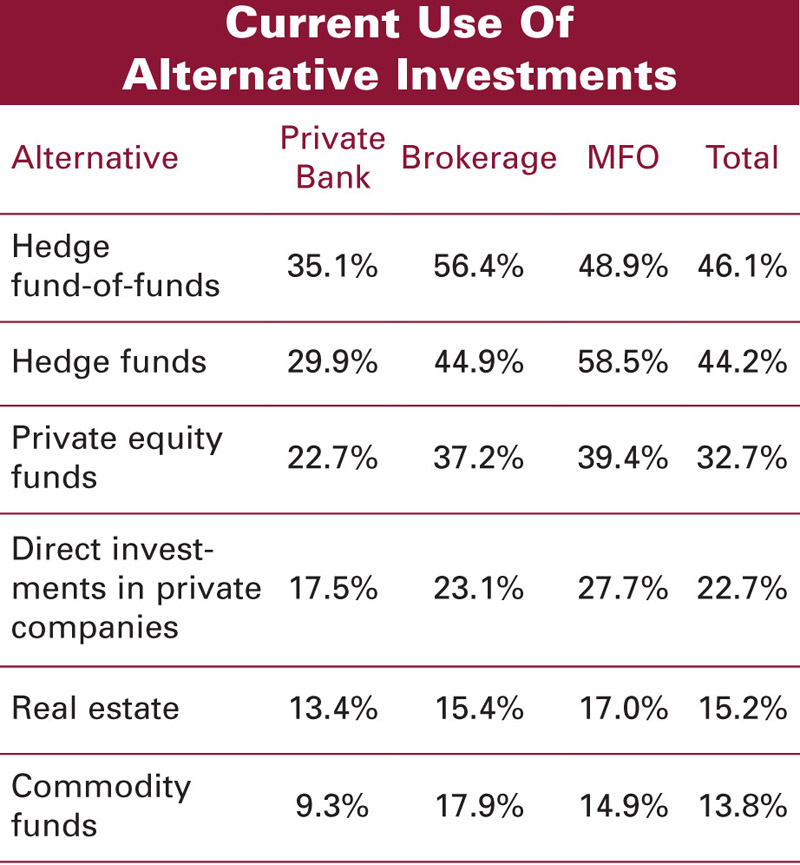

Use Of Alternative Investments

Hedge

funds-of-funds, followed closely by individual hedge funds, are used by

about half the financial firms for their wealthy clients (Figure 1).

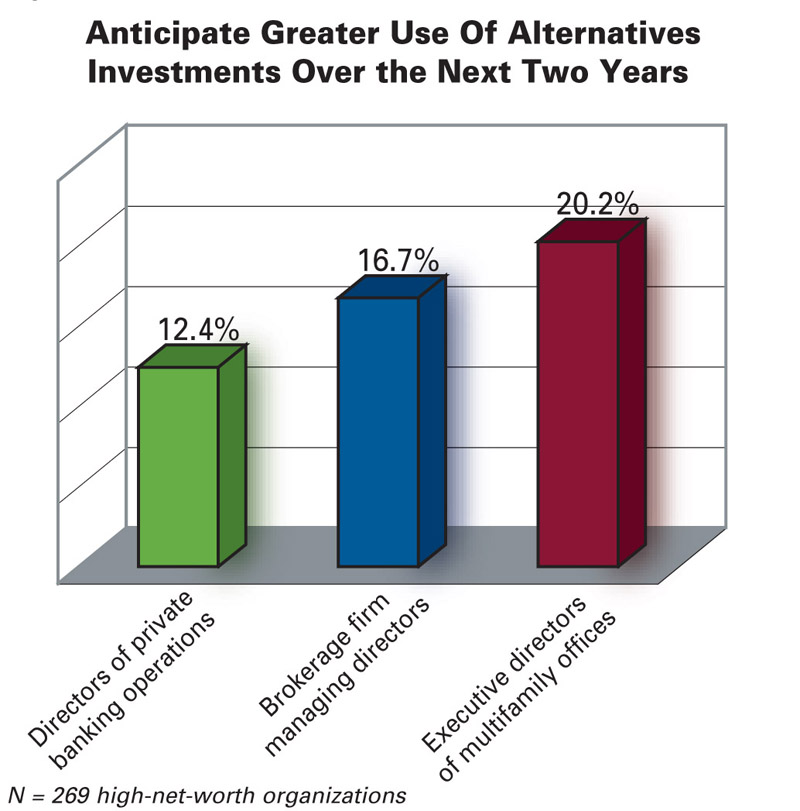

Brokerage firms prefer the former while multifamily offices tend to opt for the later. Private equity funds are employed by about a third of the financial firms and about a fifth are directly investing in private companies on behalf of their affluent clients. Fewer financial firms are investing in real estate or commodity funds. It's worthwhile to note that in our sample, relatively fewer private banks are using each of the various types of alternative investments than either the brokerage firms or the multifamily offices. Also, proportionately more of the multifamily offices use alternative investments for their wealthy clients, which is directly related to the higher levels of client wealth. Looking ahead over the next two years, we find that about a fifth of the multifamily offices expect to make greater use of alternative investments for their clients (Figure 2).

Relatively fewer of the brokerage firms or the private banks expect to do the same. Once again, these findings correlate with the average level of wealth of each financial firm's clientele. We can conclude that the wealthier the clientele is, the greater the use of alternative investments.

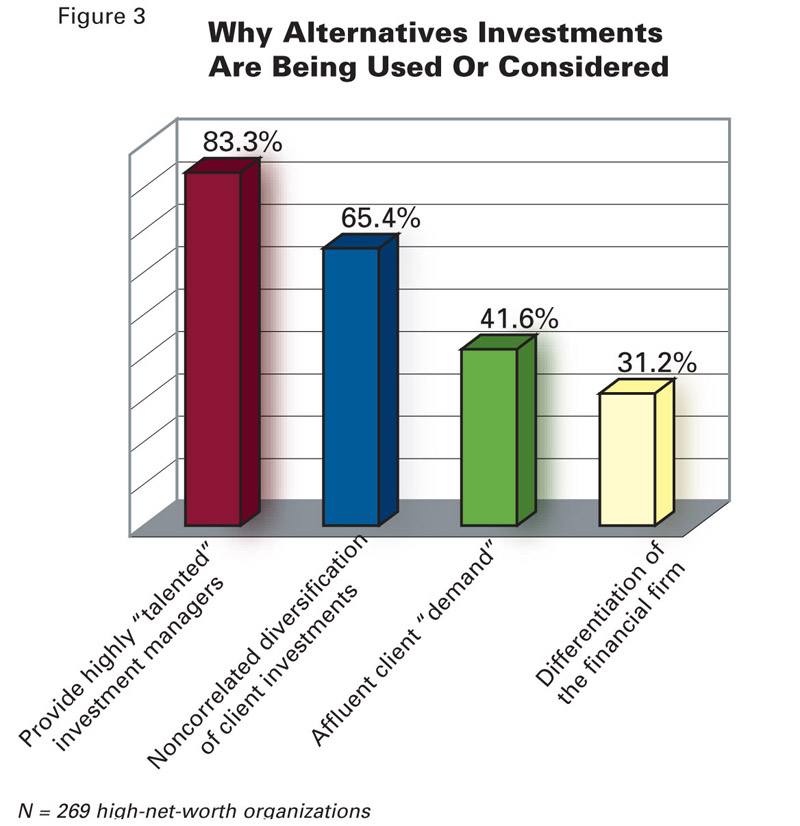

All the senior managers reported that they are either using or considering using alternative investments for their wealthy clients. The reason cited most frequently for this trend is the perception that alternatives are the best way to access the investment industry's best talent (Figure 3).

For about 65% of those surveyed, the noncorrelated nature of the alternative investments is a major attraction. About two-fifths cited client demand and a little less then a third said providing alternatives was a good way to differentiate their financial firms.

NonInvestment Management Services

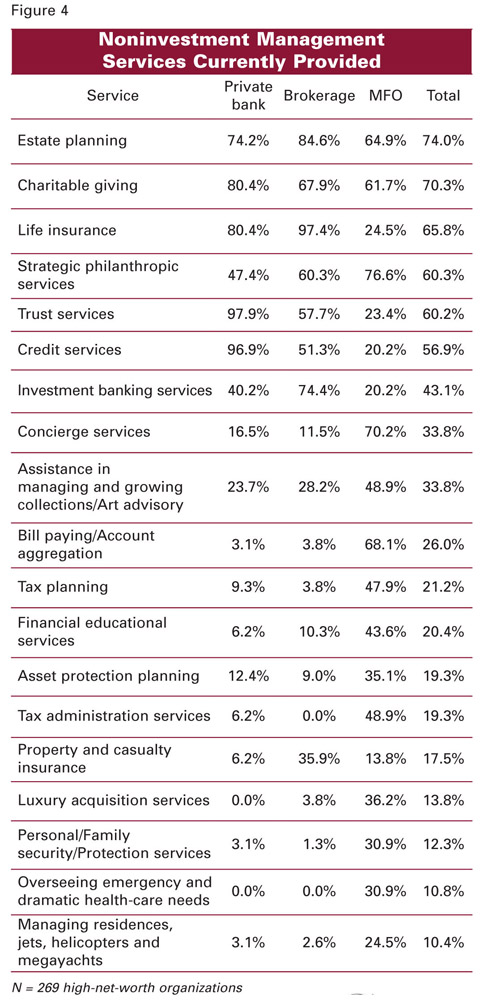

Increasingly,

financial firms are moving beyond investment management and offering an

array of related services and products (Figure 4).

Overall, estate planning services are presently offered by nearly three-quarters of the financial firms we spoke with. This expertise is closely followed by a related planning service-assistance with charitable giving. Slightly fewer provide life insurance; most financial firms are licensed to sell life insurance but prefer to enter joint ventures with dedicated life insurance professionals when it comes to serving the

ultra-affluent.

Motivation To Provide Noninvestment Management Services

It's

important to note that the services and products have a different level

of appeal to the three types of financial firms. The multifamily

offices tend to be proportionately more involved in services such as

strategic philanthropy, concierge services, art advisory, bill paying

and other lifestyle services. Meanwhile, the brokerage firms are more

likely to offer investment banking services, along with both life

insurance and property and casualty insurance. The private banks are

proportionately more focused on trust and credit services.

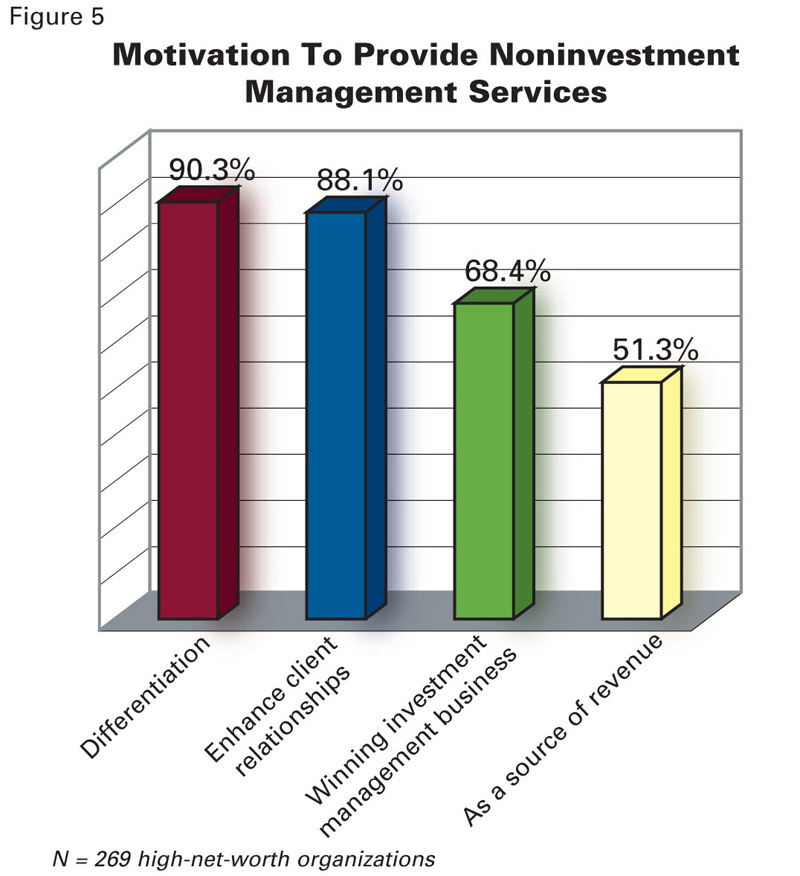

For nine out of ten senior managers, the logic of providing noninvestment management services is differentiation (Figure 5).

For these financial firms, the objective is to move beyond an investment-only orientation and reposition themselves more competitively against similar providers. About the same percentage see offering these services as a way to offer a broader range of capabilities to their affluent clients and, in turn, enhance their relationships. In this respect, these additional services become an important part of the relationship-building process.

Nearly 70% look at these services as a means of winning investment management business. The rationale is that by wrapping value-added products and services around the core business of money management, the financial firm can offer a more attractive platform to an existing or new client. Lastly, about half of them expect these services, on a stand-alone basis, to bring revenue to the organization and have an impact on the bottom line. Life insurance, for instance, can be exceedingly profitable.

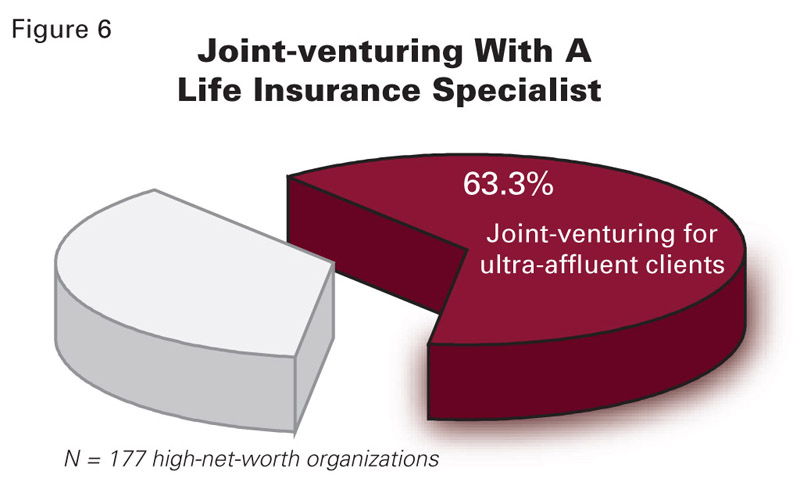

While most firms have begun to expand their platform of products and services, more often than not more complex and technical offerings are being delivered through joint ventures. Take life insurance as an example. All of the firms that offer life insurance have the necessary licenses in place to do so, however more than 60% of them are currently working with a life insurance specialist outside their firms to cater to the needs of their ultra-affluent clients (Figure 6).

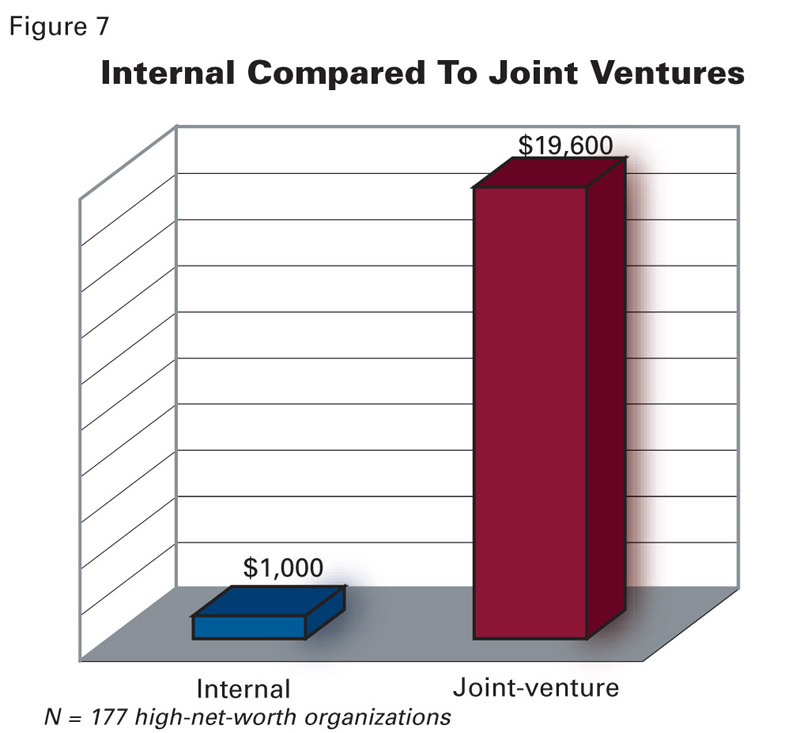

Even more interesting is that the firms that have established such a joint venture are doing significantly more business-19.6 times the life insurance revenue-than those firms that choose to do everything internally. In dollar terms, that means that firms in a JV generate $19,600 in commissions for every $1,000 generated by a firm with a self-contained insurance program (Figure 7).

This difference can easily cover the revenuesharing arrangements with external life insurance specialists and still deliver profit to the sponsoring organization.

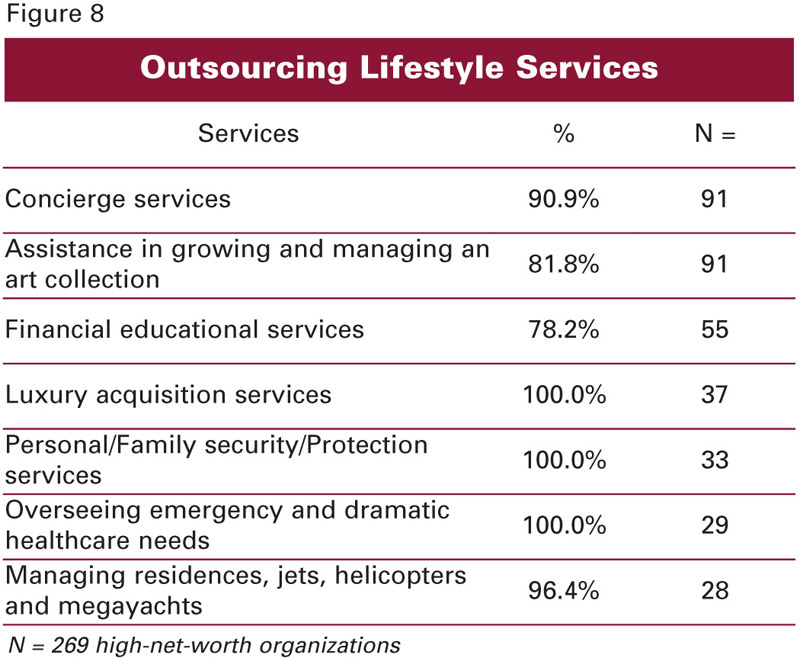

When we move beyond the scope of pure financial services, the majority of senior managers have opted to outsource those services that complement, but don't overlap with, their core financial expertise (Figure 8).

This is clearly the case with lifestyle services such as:

Concierge services

Art collection development and management

Financial educational services

Luxury acquisition services

Personal/Family security/Protection services

Medical and Health-care concierge services

Residence and vessel management

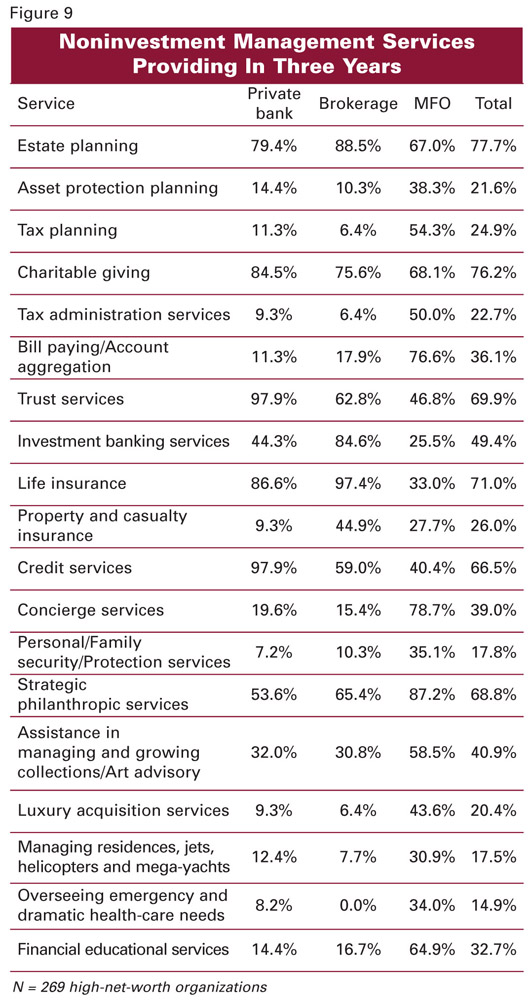

Broadly speaking, senior managers at private banks, brokerages and multifamily offices anticipate greater expansion into the noninvestment management space over the coming three years (Figure 9).

The firms that have already begun to offer products and services that fall outside the strict scope of investment management expect to continue doing so, while many firms that have not yet taken those steps plan to do so in select categories within the next 36 months.

It's no secret that serving an ultra-affluent clientele is a continually demanding process for both individual practitioners and their firms. Part of earning and keeping a wealthy client's business is being able to offer the right range of products and services at the right time. Given the fluid nature of life, problems arise, babies are born, couples are married and divorced and remarried, diseases strike, business are bought and sold, vacations are planned, inheritances are passed, purchases are made and priorities shift.

At the same time, laws change, advancements are made, currencies fluctuate, technology reinvents itself, innovations surface, markets surge and retreat, and political regimes are replaced. All of this means that clients have new and changing needs and their providers are faced with challenges and opportunities for growth. Top-notch financial firms must find a way to manage the change, stay abreast of their client's current concerns, and continually evaluate and modify the resources at their disposal to be an essential partner to their very wealthy clients.