Vincent Edward “Bo” Jackson was an incredible athlete of the rarest kind. In 1986, he was picked 1st overall in the National Football League (NFL) Draft and selected in the 4th round of the Major League Baseball (MLB) Draft. He initially opted for a career in baseball, before deciding to wear both hats after completing his rookie season with the Kansas City Royals. To this day he holds the NFL record for running the 40-yard dash, at a jaw dropping 4.12 seconds. His 1989 season included 32 home runs for the Kansas City Royals, and 950 rushing yards for the Los Angeles Raiders in just 11 games. He was the only athlete to ever be selected to both the NFL Pro Bowl and the MLB All-Star Game. He ran over superstar linebackers, covered the outfield by running up walls in Spider-Man like fashion, and broke baseball bats over his head and knee like they were No. 2 pencils.

There’s a reason Bo’s career was so spectacular and his legacy has reached mythological status. It simply doesn’t happen that often. It’s rare like a rainbow unicorn. Nike taught us in the late 1980’s that “Bo Knows” and we learned that there was scarcely anything in the athletic realm that he didn’t know!

As rare as this may be in the world of sports, it may be even rarer in business. This is one of the reasons we believe it is critical to understand the vision and purpose of any company we own. We need to know that a business meets a clear economic need and management is focused on singular objectives. Business is a battleground and success requires this type of focus. The probability of winning is dramatically increased with as few adjacencies or competing interests as possible.

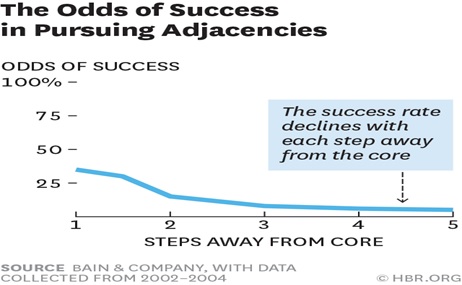

Chris Zook of the Harvard Business Review has done some great work in this area. He estimates that only one in four adjacent business ventures are successful. The chart below shows that each successive move away from the core business further decreases the probability of success:

Perhaps this gives insight as to why Google Wallet or Apple Pay have been black holes with relatively minor user adoption, while PayPal (PYPL – a portfolio owned company) has maintained an 80% market share and successfully extended its reach into the world of offline transactions. The aforementioned tech darlings and many like-minded companies seem to seek the legendary status of Bo Jackson, but placing odds on that kind of success is not investable. Core competencies matter and building around them is where M&A activity makes sense.

One of our portfolio companies, TEGNA (TGNA) clearly understands the need for focus. TEGNA owns 46 TV stations covering 36 million households or about one-third of the U.S. Market. The consensus perception surrounding broadcast television is at a low-point and recent headwinds haven’t helped. Investors or traders who have owned television companies to play the political or Olympic cycles have been disappointed, and the stocks have reached new lows. This is when the contrarian bones in our value bodies wake up. Local TV is still American’s #1 choice to consume news by a wide margin: 25% choose it over the 10% who prefer the internet. Cable companies are paying to transmit content to their subscribers, and total fees paid to TEGNA have more than doubled in the past 3 years alone. A recent change in advertising strategy by Proctor & Gamble may be indicative of a broader undercurrent among large brands. P&G recently announced it will strategically move away from Facebook ads that target specific customers, and is instead shifting back towards television. P&G is rediscovering the most effective way to broadly reach the world.

TEGNA also owns Cars.com and 53% of CareerBuilder. In June of 2015, TEGNA moved itself to the left of the above chart by spinning off its newspaper businesses in the form of Gannett (NYSE: GCI). The spin-off has allowed TEGNA and Gannett to operate independently, and orient all their respective resources towards maximizing value in a more focused way. The move was also opportunistic; it unlocked value against a backdrop of historically dour investor sentiment towards the newspaper business.

TEGNA made an additional move towards the left last week. They announced that CareerBuilder was buying a business (Workterra) that handles post-hiring needs such as employee-benefit plans. This acquisition is tangential to TEGNA’s core business of television programming, so we reached out to management to understand how this fits the larger vision. It took less than a day for them to answer. TEGNA announced it will plan a spin-off of its non-core assets. In 2017, shareholders will receive shares of Cars.com in a tax-free distribution. TEGNA is also exploring strategic alternatives for CareerBuilder.

They are setting these non-core assets up in a way to give them success as stand-alone companies, while again sharpening TEGNA’s core focus. TEGNA’s Chief Executive, Gracia Martore stated, “each business will have increased strategic, operating, and financial flexibility at a time when the broadcast and digital sectors are both rapidly evolving.” Outside of these operational benefits, TEGNA is recognizing the attractive valuation currently afforded to its digital assets and is willing to jettison them in a business environment where internet valuations are prized.

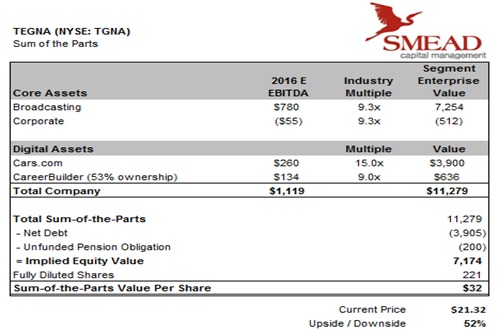

In light of this, we’ve updated our sum-of-the-parts analysis for TEGNA:

We like to see a 30-50% margin of safety when we place capital, and we prefer to not have to find the next Bo Jackson. We believe TEGNA has that margin, even using the low multiples currently ascribed to its “old media” assets. If the academic underpinnings continue to prove correct, TEGNA will grow its core business into a more dominate position within the TV industry. As followers of our work know, we analyze companies as if we could buy the whole company at current prices, and sit with them for long-duration periods of time. Bo Jackson was a spectacular athlete who exceeded normal physical limitations during a relatively short career. Entertaining as this statistical outlier may be, we’ll place odds on more focus/industry dominance and applaud a management team that understands how this can positively impact a company’s long-term moat.

William Smead is CEO and chief investment officer at Smead Capital Management.