The Times They Are A-Changin’ | The Times They Are A-Changin’ (1964)

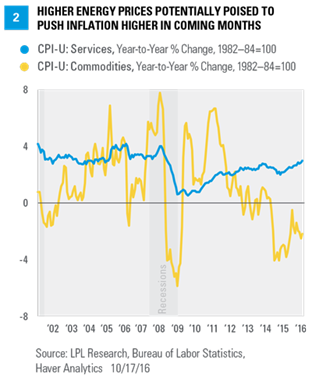

Generally speaking, financial markets prefer gridlock in Washington, D.C., and if the current polls are accurate, gridlock is likely next January as a new president is sworn in and the 115th Congress takes its seats in the Capitol. As we noted in our Midyear Outlook 2016: A Vote of Confidence [Figure 1], while history shows that gridlock is good for markets, gridlock may limit policy action at a time when it is needed on several fronts (taxes, entitlement reform, immigration, infrastructure, national security, etc.). With three weeks left until Election Day, markets continue to assess the outcome of the race for the White House and Congress, looking ahead to the legislative and policy agenda for 2017 and beyond. A key test for any new bipartisan spirit may come in mid-March 2017, when the U.S. hits the debt limit, forcing Congress to cooperate to avoid yet another wrenching debt ceiling debacle.

—It’s all new t’ me, like some mystery, It could even be like a myth—

I Don’t Believe You (She Acts Like We Never Have Met) | Another Side of Bob Dylan (1964)

The Congressional Budget Office (CBO) is the non-partisan arm of Congress charged with “scoring” any tax and spending bills proposed by Congress. In mid-2015, Congress passed a resolution that required the CBO to incorporate “macroeconomic feedback” into its scoring of tax and spending bills. This is known as “dynamic scoring.” Since its inception in the 1970s, the CBO has used “static scoring,” so this shift to dynamic scoring represents a big change to how the CBO, and ultimately Congress, views the federal budget. Although there is wide disagreement among market participants, government officials, and academics alike, dynamic scoring would make it easier to cut taxes without offsetting those tax cuts with spending cuts elsewhere in the budget. This ability may help to pave the way for a substantial tax reform deal in Congress in 2017.

—Because something is happening here, But you don’t know what it is, Do you, Mister Jones?—

Ballad of A Thin Man | Highway 61 Revisited (1965)

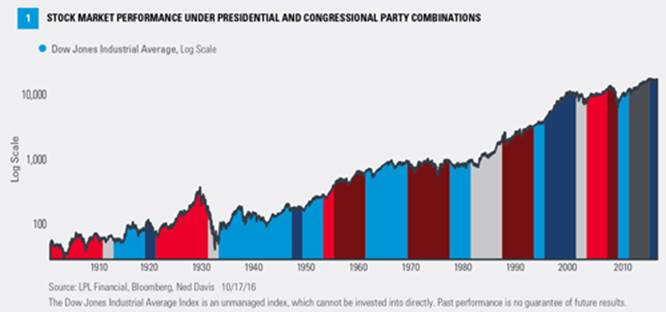

This Tuesday, October 18, 2016, the Bureau of Labor Statistics (BLS) will release the September data on the Consumer Price Index (CPI). According to the consensus of economists compiled by Bloomberg News, the market expects the CPI to accelerate from 1.1% year over year in August 2016 to 1.5% in September, led by an increase in energy prices. Inflation in services (two thirds of CPI) is also expected to accelerate and move further above 3%. Service sector inflation has been accelerating since late 2009, but overall headline CPI has been held down by the collapse in goods inflation (one third of CPI), led by lower food and energy prices [Figure 2]. With oil prices stabilizing near $50 per barrel, gasoline prices remain near $2.40 per gallon, well above the $2.26 average price in the fourth quarter of 2015 and the $2.00 average in the first quarter of 2016. Thus, if gasoline prices stay where they are today through the end of the first quarter of 2017, the goods portion of CPI will quickly move from deflation to inflation and push the overall CPI above the Fed’s target of 2.0%.