The message from the bond market suggests that the next Federal Reserve (Fed) interest rate hike may not be as big of a threat to bond prices that many investors fear. Futures are pricing in almost no chance (2%) of a rate hike for this week’s meeting and only a 23% chance for one in July, despite comments from Fed Chair Janet Yellen and other Fed officials that a rate hike is forthcoming. The behavior of the yield curve and the 10-year Treasury indicate that the bond market is sending a message of caution to the Fed, however, and is not convinced that a rate hike is in the best interests of the global economy.

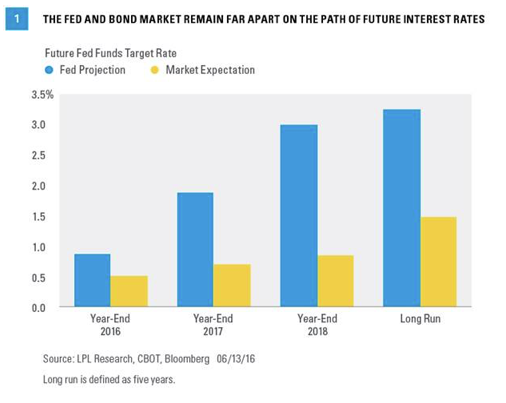

The Fed and bond market remain far apart on the path of future interest rate hikes [Figure 1]. The gap between what the Fed says it will do and what the market expects from the Fed has increased once again after narrowing through the first few months of 2016. The implied overnight lending rate five years from now is a mere 1.5%, implying slightly less than one rate hike per year over the next five years.

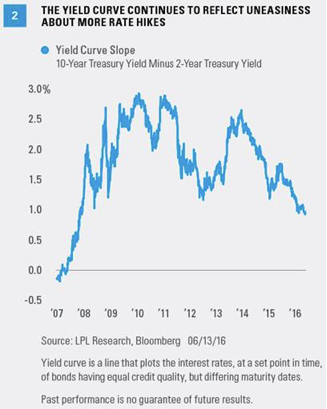

YIELD CURVE FLATTENING

The yield curve is sending a slower economic growth message in response to the prospects of more rate hikes. The yield curve, as measured by the difference between 2- and 10-year Treasury yields, has been hovering near the narrowest levels since late 2007 and is at its “flattest” since just before the recession [Figure 2]. Conversely, when the yield curve steepens (longer-term rates rise more than short-term rates), the bond market is sending a growth signal.

However, the yield curve is not currently in immediate danger of inverting (a precursor to recession); instead, it is just slightly below the 25-year average level of steepness of 1.2%. The fact that 2-year Treasury yields have been increasing more (or in recent weeks, decreasing less) than 10-year Treasury yields indicates that markets believe that a rate hike (which will impact short-term maturities most) will lead to slower growth in the intermediate and long term. This is a sign that the market believes a rate hike may not push the economy into recession, but it may be a headwind for future growth.