BREAKOUT

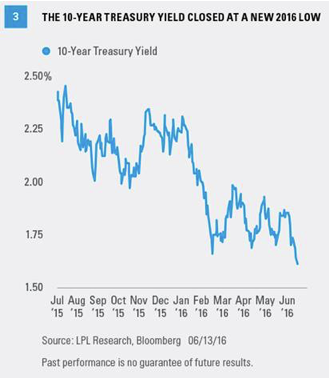

The 10-year Treasury yield broke below the low end of a multi-month range last week [Figure 3], another sign of slow economic growth. The flattening of the yield curve is a reflection of lower long-term yields; but because long-term bond yields can be broken down into an economic growth expectation and an inflation expectation, absolute yields send a message in their own right. The break to a new yield low also suggests a view of a sluggish economic growth for the U.S., and that the pace of growth on a global basis remains fragile, especially with Fed rate hikes looming.

Inflation expectations, as measured by Treasury Inflation-Protected Securities (TIPS) pricing, remain near multi-year lows at 1.5%, despite the recent improvement in oil prices—a key driver of inflation expectations. This expected inflation is calculated by subtracting the yield on a conventional Treasury from a comparable TIPS. Bond pricing indicates that looming rate hikes may squash any attempt for higher inflation to take hold.

INSATIABLE DEMAND

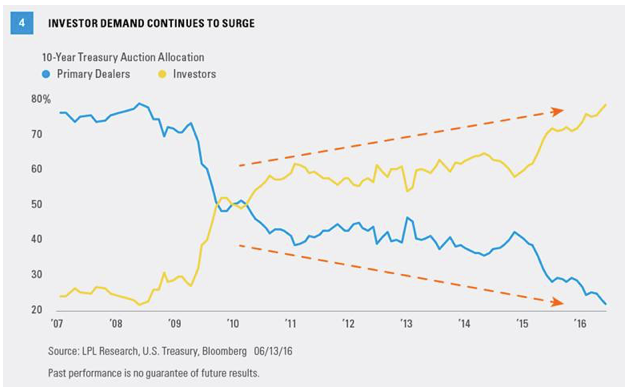

Investor demand, led by overseas investors, has been insatiable, however, and investors need to take the flatter yield curve and low 10-year Treasury yield with a grain of salt. Extraordinary policies underway in Japan and Europe have led to ultra-low yields (in some cases negative) and spurred demand for U.S. bonds, especially with the European Central Bank’s (ECB) corporate bond purchase program kicking off last week (see last week’s Bond Market Perspectives, “ECB Corporate Purchase Program” for more detail).

Investor demand at last week’s 10-year Treasury auction reached a new record, leaving bond dealers with a limited inventory of bonds [Figure 4]. Demand at the 30-year auction was also strong and a testament to investors’ need for yield despite potential interest rate risks. Last week’s auction results follow record investor demand at the Treasury’s 2-, 5-, and 7-year auctions two weeks prior.

Furthermore, corporate bond markets have generally been resilient, which run counter to slow growth concerns. True economic worries would translate into weaker corporate bond prices, which, with the exception of market activity for the two trading days ending June 13, 2016, have been absent—but bears watching.

CONCLUSION

Markets continue to price in a low chance of rate hikes over the next couple of months, though expectations rise to about 60% by the December 2016 meeting; however, Fed speakers continue to point to a more probable hike sometime this summer as long as the trajectory of recent economic data doesn’t deteriorate. Overseas central bank policies cloud the message from the bond market but do not offset it. The broad message from the bond market, as measured by the steepness of the yield curve, the path of the 10-year Treasury yield, and inflation expectations, suggests the Fed should tread cautiously and more rate hikes may be a headwind for the economy.

Anthony Valeri is investment strategist for LPL Financial.