For many US investors, domestic bonds have been the cornerstone of a “core” fixed-income allocation. While this approach may have served investors well in the past, we believe a changing fixed-income landscape may prompt a consideration of new approaches, including expanding one’s fixed-income horizons to international bonds.

We believe investors should understand three potential benefits of diversifying their core bond holdings beyond benchmarks such as the Barclays US Aggregate Bond Index into global bonds – and that they should understand the potential role of currency hedging in seeking to manage the risk and returns of bond allocations. Here, we explore the reasons we believe global bonds are worth investors’ attention now.

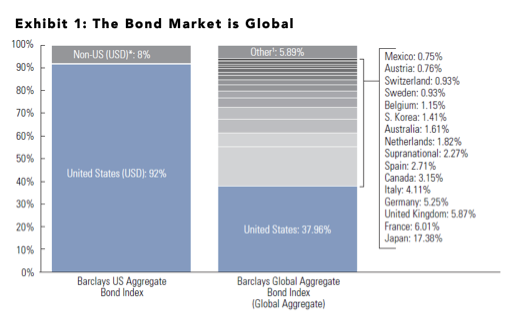

1. Today’s opportunity set is global. With historically low interest rates and the potential for rate increases by the Federal Reserve in the coming months and years, many investors may see limited opportunity in US fixed income. We would point out that the US market is only part of the story of global bonds (See Exhibit 1). Worldwide, other major central banks’ monetary policy remains accommodative. In our view, the European Central Bank (ECB), to take one example, may not enact tighter policy for years. We believe the policy divergence between the US and other world central banks may create a number of potentially attractive investment return opportunities for global bond portfolios.

Source: GSAM, Barclays. As of 3/31/16. *Non-US refers to USD-denominated emerging and developed market exposure. 1 Other refers to countries with less than 0.5% exposure. Past performance does not guarantee future results, which may vary.

All charts are based on indices and do not represent any Goldman Sachs fund. Diversification does not protect an investor from market risk and does not ensure a profit.

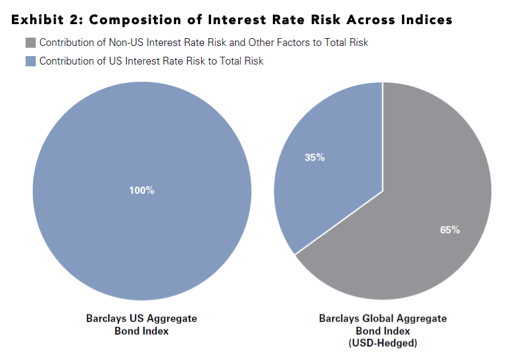

2. Going global may help investors diversify interest rate risk. Although global interest rate movements are frequently synchronized, monetary policy divergence between major global central banks remains a key theme. We believe a portfolio’s exposure to US interest rates should be complemented with exposures outside the US. Although currency-hedged global bonds (as represented by the benchmark Barclays Global Aggregate USD-Hedged Index2) have exhibited a higher overall duration3 than the Barclays US Aggregate Bond Index, their sensitivity to US rates has been smaller.4 For US investors, we believe that global bonds provide investors with the potential opportunity to diversify their US interest rate risk into global rate risk.

Source: GSAM as of 3/31/16. Please reference additional disclosures. Past performance does not guarantee future results, which may vary.

All charts are based on indices and do not represent any Goldman Sachs fund.

2. The Barclays Global Aggregate Bond Index hedged to the U.S dollar is an unmanaged index, provides a broad-based measure of the global investment-grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The Index figures do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index.

3. Duration: a measure of the sensitivity of a bond’s price to interest-rate changes.

4. Currency-hedged global bonds are represented by the benchmark Barclays Global Aggregate USD-Hedged Index.