3. Global bonds may offer investors an attractive balance between risk and return – a currency-hedged approach may help. The pros and cons of currency hedging are a frequent topic in equity portfolios, but the subject arises less frequently for bonds. In our view, this is an important omission. We think of currencies’ impact on core bond allocations as a “blunt-force instrument.” In contrast to the lighter impact on equity volatility, currencies can drive a large portion of the month-to-month movement of a bond allocation.

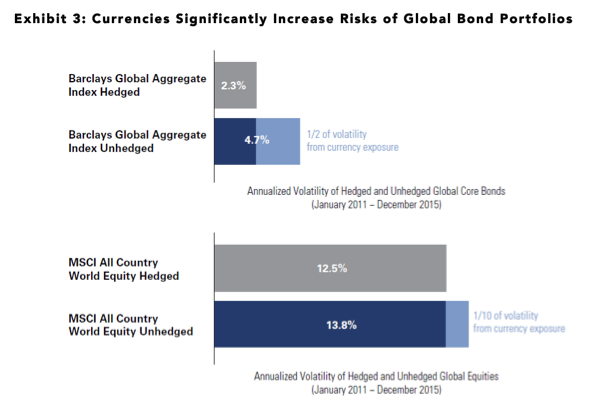

Exhibit 3 shows that over the period of January 2011 – December 2015, currency moves drove about half the volatility of the unhedged global bond index, versus only about one-tenth the volatility of an unhedged approach to global equities.

For many investors, core bonds play a risk-managing role in the overall portfolio in comparison to more volatile equity and low-quality fixed income. If currency exposures cause an increase in risk, the allocation may work against these investors’ intended goals.

Source: Bloomberg, GSAM, covering the five-year period Dec. 31, 2010 through Dec. 31, 2015. Volatility is a statistical measure of the dispersion of returns for a given security or index. See end notes for index definitions and important disclosures. Index returns do not represent any GS Fund. Past performance does not guarantee future results, which may vary.

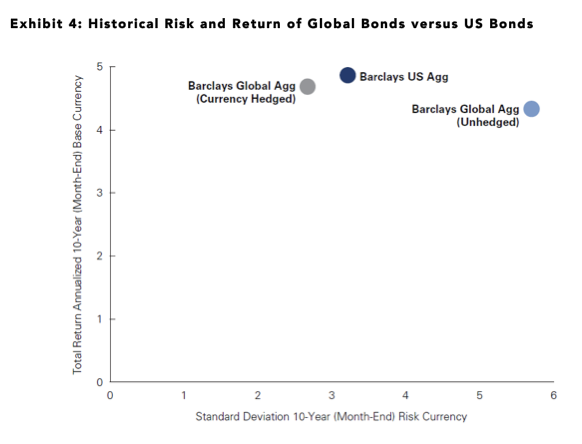

However, currency-hedged global bond portfolios have often delivered more attractive risk-adjusted returns than the unhedged equivalent. Over the five years ending December 31, 2015, hedged global bonds returned 3.9%, while unhedged global bonds returned 0.9%.

As a result of this higher return and lower volatility, hedged global bonds’ risk-adjusted returns have been stronger, with the unhedged index’s Sharpe ratio5 of 0.19 over the period, versus 1.68 for the hedged index (Exhibit 4).

For investors who believe that the US Dollar’s lower volatility will continue (or those who believe that the US Dollar’s strengthening trend since 2014 will continue), we believe these characteristics are arguments for incorporating global bonds into a core fixed income allocation.

In sum, we believe global bond exposure can help enhance investors’ core bond holdings by seeking to deliver additional country and interest rate diversification, while maintaining a similar risk/return profile to that of traditional core fixed income.

Source: Morningstar, 10-Year Annualized total net returns as of 3/31/2016.Past performance does not guarantee future results, which may vary. Index returns do not represent any GS Fund.

Risk Considerations

Investing in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity and interest rate risk. Foreign and emerging markets investments may be more volatile and less liquid than investments in U.S. securities and are subject to the risks of currency fluctuations and adverse economic or political developments. Issuers of sovereign debt may be unable or unwilling to repay principal or interest when due. Investments in mortgage-backed securities are also subject to prepayment risk (i.e., the risk that in a declining interest rate environment, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of the underlying security or benchmark may result in a disproportionately large movement, unfavorable or favorable, in the price of the derivative instrument; risks of default by a counterparty; and liquidity risk (i.e., the risk that an investment may not be able to be sold without a substantial drop in price, if at all). The Fund may invest heavily in investments in particular countries or regions and may be subject to greater losses than if it were less concentrated in a particular country or region.