This second step analyzes the current portfolio using institutional-caliber diagnostic tools that match the client's current allocation against proposed allocations, reveal style and industry exposures, find the client's proximity to the efficient frontier, anticipate cash flows and perform Monte Carle simulations. This analysis can also offer insight into a wide range of investment products used to build portfolios such as mutual funds, individual stocks and bonds, ETFs, SMAs and variable annuities.

It can be simplified by the software, but the analysis can also be as extensive as the advisor wishes to make it. He can set up unique investment universes, asset allocation models or a collection of model portfolios. He can also generate multiple investment proposals, rebalancing plans and investment policy statements. Should he run into problems, he can access technical support, online demonstrations and live question-and-answer sessions.

Actual Case Study: Analysis and Results

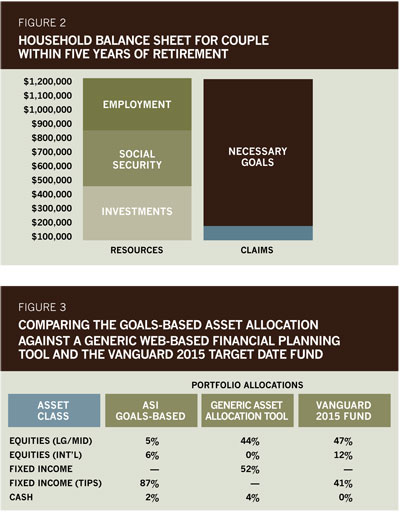

A husband and wife, New York state residents, are within five years of retirement with comparatively little in the way of savings. They have an IRA worth $500,000 and own a house, also currently worth approximately $500,000 with a small mortgage outstanding, but they have decided for emotional reasons to retain the house and not sell it. The husband is still working and earns a base salary of $95,000 per year, which will cease when he retires at age 65. They have estimated that their necessary expenses before retirement are $60,000 per year, which will drop to $48,000 per year after they both finish working. They need to invest their assets and any savings over the next five years to meet their declared level of essential expenses in retirement, since Social Security income will meet only a portion of their retirement needs. (See Figure 2.)

A quick look at their household balance sheet generated by ASI Wealth Manager shows they don't have a great deal of financial flexibility. Their capacity to bear risk is not great, suggesting that an investment of any significant amount of their assets into equities will jeopardize their goal of meeting their necessary expenses of $48,000 per year in retirement. The ASI Wealth Manager suggested allocation is 11% in equities, 87% in bonds (with a large holding of TIPS) and 2% in cash (Figure 3). This solution is based on their declared household goals, so modifying them will potentially change their asset allocation. For example, if they were able to reduce their essential expense level and thereby free up some income for additional saving, then this may enable them to increase their allocation to equities-increasing the expected return on their investment assets though they will also bear additional risk. (See Figure 3.)

Also shown in the figure are the portfolio weights obtained by filling out a client questionnaire and using a generic asset allocation tool on a popular Web site. The results suggest a more aggressive equity allocation of 44% than the goal-based solution of 11%, and a less conservative fixed income position of 52% instead of 87%. The Vanguard Target Retirement 2015 Fund (VTXVX), designed for persons expecting to retire in five years, is a portfolio of preselected index funds automatically rebalanced to become more conservative over time. Currently, its asset allocation is the most aggressive of the three portfolios with exposures of 59% in equities and 41% in fixed income (TIPS).

Other industry sources recommend much higher equity allocations, some over 50%. These allocations force the household to bear significant risk, which in down markets may require them to sell their house to survive financially.

Portfolio Rebalancing, Ongoing Maintenance

In addition to offering its goal-based solutions, ASI also offers portfolio rebalancing technology that allows advisors to rebalance single or multiple accounts, rebalance accounts tied to a household or to a model portfolio. And a growing number of financial institutions are offering this technology to independent advisors through their internal platforms, including Charles Schwab, LPL Financial and TD Ameritrade. ASI has seen the use of its rebalancing program increase 50% over the first half of 2010 compared with 2009.

David Umstead, the founder and president of Cape Ann Capital, a Manchester, Mass.-based fee only RIA, manages more than 100 funds. He constructs these from 18 carefully selected no-load mutual funds using ASI's rebalancing tool, ensuring that the individual fund weights remain consistent with a client's long-term strategic allocation. Early in his career, Umstead, a Ph.D. with more than 30 years in the business, used quantitative tools to help manage institutional accounts at Putnam Investments and State Street Global Advisors. He recognizes the need to bring a well-defined discipline to manage high-net-worth clients.

"The more clients understand the process, the more they buy into the program and can commit to an asset allocation target," he says. This simplifies his management task, he says, because he can make changes to a client's strategic allocation whenever the client undergoes life changes affecting risk tolerance or return objective. They are "not the result of temporary tactical changes," he says.

At a time when people are making decisions about whether to stay in the workforce longer, about how to fund education or delay long-sought dreams, the market cataclysms of 2008-2009 remind advisors that each client's economic situation is unique, that his financial objectives are uniquely determined by his assets (marketable resources) and the goals (claims) against them. To construct a portfolio to meet client needs, an advisor must understand the magnitude and variability of the client's resources and claims and start speaking the language the clients are speaking about those risks that have the greatest bearing on their lives and decisions. Rudd and Torre's balance sheet approach, if nothing else, reminds advisors that risk is something seen in a different light by clients and advisors. That makes it valuable for both.