For some wirehouse financial advisors, the thought of going independent can be alluring––and a little scary. Leaving the mother ship means cutting the apron strings to comprehensive back-office support and reporting systems required to make a successful advisory practice possible.

Cerulli Associates forecasts that the RIA channel will continue to grow at the expense of the wirehouse channel, and that so-called boutique firms will increasingly be a go-to place for wirehouse advisors breaking away to the RIA space.

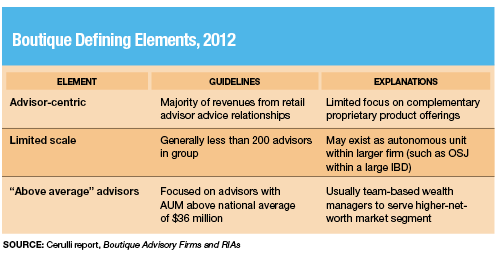

In Cerulli’s report, Boutique Advisory Firms and RIAs: Balancing Scale and Independence for Top-Tier Advisors, the Boston-based consultancy says that defining features of boutique RIAs include a firm of limited scale, a focus on advisors with “above average” asset levels, and an advisor-centric model where advisor-client relationships are paramount.

Some of the better-known boutique firms include HighTower, Dynasty Financial Partners and SeaCrest Wealth Management. Cerulli says these and other boutiques provide platforms and services comparable to wirehouses, but to a smaller advisor base and with greater advisor autonomy.

In a sense, boutique firms can offer a “soft landing” for wirehouse advisors jumping to the RIA space––i.e., advisors get a taste of independence without being too independent.

“This option allows an advisor to take advantage of the office-level infrastructure another advisor has established by essentially renting office space and support on a set cash basis or as a percentage of the revenue the new advisor generates,” Cerulli writes in its report.

As boutiques continue to lure some of the best and biggest advisors from the wirehouse channel, Cerulli posits that wirehouse firms will need to come up with innovative ways to keep them, other than just trying to sign the biggest teams to the longest deals.