June 23, the day the United Kingdom votes on whether to remain in the European Union, is circled on every calendar on every trading desk globally. The vote will likely be very close, and while the most recent opinion polls show the likelihood of a “leave” vote increasing, though with a margin of error and a sizable undecided vote, the outcome is still unknown. Financial markets had been pricing in the U.K. remaining. However, as the polls have tightened, we see an increasing probability of a Brexit reflected primarily in the relative weakness of the British pound, but also in British stocks, particularly in the financial sector. Should the U.K. vote to leave the EU, a multi-year process to negotiate the details will take place. The financial market implication will be more immediate, and could be negative for a wide variety of financial assets until the markets obtain a better understanding of what really will happen as a result.

WILL THEY STAY OR WILL THEY GO?

The British rock band The Clash’s hit “Should I Stay or Should I Go?” is #228 on Rolling Stone’s list of greatest rock songs. It’s a short, simple song about the inability to decide whether to stay in a relationship or leave it behind. The questions are practical, not emotional. It’s a good metaphor for the Brexit question. To be sure, there are emotional issues tied to the Brexit decision, especially regarding immigration and what is widely considered an unacceptable loss of sovereignty to the European bureaucracy, often simply referred to as Brussels. These issues are hard to quantify, both in how they shape the political environment and how changes in that environment will ultimately impact policy.

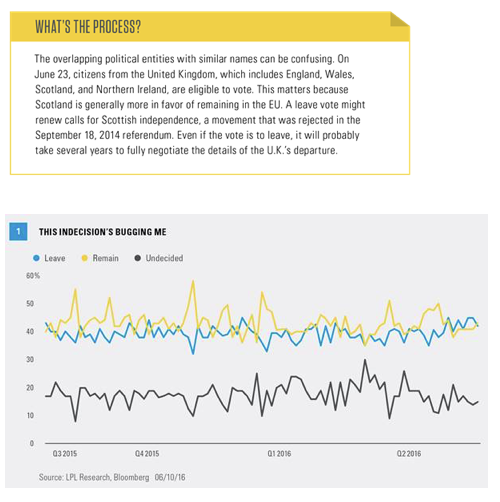

On the other hand, we can make some reasonable estimates on the impact of the upcoming vote, regardless of the final outcome. Polling data suggest that the vote will be very close [Figure 1], with some very recent polls showing an increase in the leave vote. However, as polls in the U.K. have been unreliable, traders and financial participants have been using other sources to gauge public opinion, notably betting—it is legal to bet on political events in the U.K. Around 10-20% of people are still undecided according to polls, which is increasing the uncertainty surrounding the outcome.

To evaluate the potential stock market impact of a Brexit, we must make certain assumptions about the near term. Proponents of the Brexit suggest that leaving the EU would be good for the U.K. They note that Brussels saddles U.K. companies with thousands of pages of rules covering the minutia of commerce. Some examples of those causing the most outrage are rules governing the curvature of bananas and a proposal to sell eggs by weight, rather than a set price per dozen. It is quite possible that there may be a long-term, positive impact for the U.K. if it leaves the EU. But in the near term, we believe it is safe to assume the Brexit would cause an initial sharp decline in the pound against the euro, and that both would decline relative to the U.S. dollar, Chinese yuan, Japanese yen, and other major global currencies. We also would expect a decline across almost all global equity markets, simply on the economic uncertainty created.

IF I GO THERE WILL BE TROUBLE…

What is the potential impact on the markets in the event of a Brexit? To help answer this question, we ran a scenario analysis assuming that the British pound would decline 10% following a Brexit vote. We used a model that examined the historical relationship between stocks in various indexes and how they were correlated to a move in currency. This sort of model has limitations; there are always multiple factors that move stocks. When viewing events that are by definition extreme, we are assuming, reasonably, that the event will be a dominant factor in the performance of the stock. The objective of this analysis is not to pinpoint exact potential stock market gains or losses, but rather to assess the approximate magnitude of the movement and what segments of the market are more likely to have an extreme reaction.

Although we normally think about this sort of currency volatility with respect to emerging, not developed, market currencies, it does not seem out of place in this context. On Friday, June 10, 2016, the pound fell 1.4% just on the announcement of a new poll favoring a Brexit. Based on historical relationships, this scenario suggests a decline of 4.6% for European stocks overall (measured by the EuroStoxx 600 Index), with a decline of as much as 11% in British stocks (measured by the British stocks in the MSCI All-Cap World Index). The analysis also suggests that the mining, energy, and financial services sectors would be hardest hit in all countries, but especially the companies in those industries within the U.K. Under this same scenario, we would expect an approximate 3% decline in U.S. stocks (per S&P 500 Index), with relative weakness in the same sectors as in Europe: energy, mining and financial stocks. Keep in mind that this is a hypothetical scenario analysis and is not a guarantee of future performance. Actual results will vary.

IF I STAY IT WILL BE DOUBLE

Some segments of the market, particularly of the U.K. stock market, are more vulnerable than others. Larger U.K. stocks receive most of their revenue from outside the country (between 70–80%), whereas smaller stocks, represented by the FTSE 250, get less than 50% from outside the country. At first, this seems like an odd detail. But if you look at the largest stocks in the market, you see many global banks, mining, and energy companies. These companies may be based in the U.K., but they do business and, in the case of commodity companies, have most of their physical assets outside the country. Overall, it is estimated that across FTSE 100 companies, 55% of their total assets are held outside of the U.K.

Therefore, it can be argued that many large U.K. companies are British in official corporate domicile only. They are in fact global companies, especially those involved in finance and commodity production. Those sectors alone account for roughly 50% of U.K. market capitalization. The thought of the U.K. being less integrated in the global economy is one reason these companies are so sensitive to the Brexit vote. Those companies that actually manufacture in the U.K. and export goods would gain some benefit from a weaker pound. But a British mining company with mines in Australia and South Africa could expect no such benefit, although non-British shareholders still suffer the loss on their holdings. More than half of all the shares of British companies are held by foreign investors.

DON’T YOU KNOW WHICH CLOTHES EVEN FIT ME?

Financial services are the poster child for the issues regarding the Brexit. Financial stocks throughout the EU have been negatively impacted by the possibility of the U.K. leaving; London is either the corporate headquarters or the European hub for about half of all the world’s biggest financial services companies. This uncertainty, and the possibility of loss of access to markets, may cause European financials to significantly underperform the broader European markets [Figure 2]. Financials also bring into focus some of the complicated issues regarding regulation, especially the belief that the EU overregulates industries and doesn’t know which rules really fit which institutions. But most large financial firms are global; therefore, British companies operating in Europe will be required to comply with EU law, regardless of whether the vote is for or against a Brexit.

A major issue is referred to as “passporting,” the series of rules that allow financial firms to provide services in a country without having a physical presence in that country. If the U.K. leaves the EU, U.K. banks’ passporting rights would likely have to be renegotiated; in addition, non-European banks that have access to the entire EU by maintaining a physical presence in London might lose this ability as well. The potential loss of passporting rights is a major concern for global financials.

The European Commission is in the process of revising many rules regarding the sale of financial service products under the unwieldy name Markets in Financial Instruments Directive II (MiFID 2). Every institution seeking to do business in Europe will be required to comply with this new directive, regardless of their country of domicile and membership in the EU.

CONCLUSION

There is a great deal of uncertainty regarding both the outcome of the Brexit vote and the long-term impact of the U.K. leaving the EU. Regardless of the ultimate outcome, financial markets hate uncertainty; we can see this in the relative weakness of the British pound. The markets are also concerned that the U.K. leaving would strengthen independence movements in Scotland, the Basque region of Spain, and similar movements across the continent. Financial stocks are likely to be most impacted by a Brexit; they would suffer all the economic uncertainty but would receive neither regulatory relief nor the benefit of a weaker currency. Financials in Europe have underperformed significantly recently as a result. We expect that energy and mining stocks would also suffer should the U.K. vote to leave.

With apologies to Joe Strummer and Mick Jones.

Burt White is chief financial officer for LPL Financial.