High-quality bond strength following the Brexit vote is likely to persist if history is any guide. Flight-to-safety buying, which is typical in response to market or geopolitical shocks, propelled Treasuries to strong gains in response to voters in the United Kingdom (U.K.) deciding to leave the European Union (EU). Investor response wasn’t all about the economic uncertainty, however. Brexit results are likely to influence central bank policy, a key driver of bond prices and yields. Negative potential economic implications and the likelihood for more market-friendly central bank policy from the Bank of England (BOE) and Federal Reserve (Fed), the two major central banks that were the most likely to raise interest rates, may continue to reinforce the lower for longer theme in the bond market.

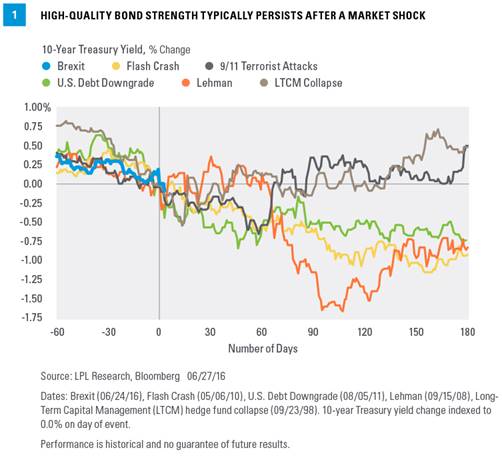

A look back at prior market shocks over the past 20 years shows that Treasury yields typically remain low even after an initial shock [Figure 1]. The only instance in which the 10-year Treasury yield closed higher after the first 30 days following a market shock (surprisingly) occurred following the Lehman Brothers bankruptcy on September 15, 2008. Knock-on effects and the extraordinary policy response over the remainder of 2008 would ultimately lead to a larger decline in subsequent months.

U.S. Treasuries may be considered “safe” investments but do carry some degree of risk including interest rate, credit, and market risk. They are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

With the exception of the period following the September 11, 2001 terrorist attacks, high-quality bond prices witnessed additional gains and lower yields over the subsequent three months. The 10-year Treasury yield closed just over 0.25% higher in the 90 days after September 11, 2001; it finished modestly lower, over the same time period, following the collapse of the Long-Term Capital Management (LTCM) hedge fund in the fall of 1998.

Six months after a market shock event, the data are more mixed, with two cases showing a rise in Treasury yields. Still, the increase of 0.5% over six months is unlikely to provide much relief in today’s low-yield world. Such a rise in yields, if repeated, would translate into modest losses for intermediate high-quality bond investors; but history shows that weakness took time to develop.

FUNDAMENTAL DRIVERS

Bond market strength has not been strictly a knee-jerk reaction to a market shock. Rising economic risks and more market-friendly central bank expectations are providing fundamental support for Treasury prices post-Brexit. On the economic front, the Brexit decision led to downward revisions to U.K. economic growth forecasts, and increased recession risks". Economic implications are also negative for broader Europe, even if the U.S. remains more insulated. The additional headwinds confronting European economies as a result of the Brexit provide additional support for high-quality bond prices.

Central banks are also expected to take a more benign path in response to the Brexit. Fed Chair Janet Yellen previously stated that the Brexit is a risk the Fed is watching and cited it as a reason to refrain from raising interest rates at the recent June Fed meeting. The Brexit is likely to keep the Fed on hold for longer and further pushes back the timing of additional Fed rate increases.

The BOE is now expected to cut interest rates and may restart bond purchases (known as quantitative easing or QE). Over the past two years, expectations regarding the BOE have changed substantially. The BOE was once expected to be the first major central bank to raise interest rates, but now it’s expected to join a growing list of central banks lowering interest rates.

Central bank policy is a key driver of bond prices and yields. Potential rate hike risks from the BOE and Fed are now reduced (and possibly reversed in the BOE’s case), and therefore, so is the potential risk to high-quality bond prices.