Financial markets reacted swiftly and sharply on Friday, June 24, 2016, to the unexpected decision by the United Kingdom (U.K.) to leave the European Union (EU) in a nationwide referendum held on June 23, 2016. Ahead of the vote, most financial market participants and political observers thought that the U.K. would vote to remain in the EU, and markets spent most of the day Friday adjusting to the reality that the U.K. will likely leave, sending equity prices lower, and bond and gold prices higher. The uncertainty in the markets, tightening financial conditions, and other potential impacts to the U.S. economy may influence the Federal Reserve’s (Fed) path of future rate hikes.

MARKETS AND ECONOMIES CRAVE CERTAINTY

Much of the volatility on Friday was due not only to the fact that the vote was unexpected, but also to heightened uncertainty around instability in the U.K.’s government and the actual path to exit. Markets and economies across the globe typically do not react well to such uncertainty.

The process by which the U.K. will leave the EU in the wake of last week’s referendum is governed by Article 50 of the Treaty of Lisbon, which created the current EU structure in 2009. The Article is just 260 words, effectively saying that there will be negotiations between the parties that can take up to two years. The complication arises because of the continued political uncertainty in the U.K.’s government. The negotiations would have begun over the weekend of June 25–26 and in the early hours of Monday, June 27, 2016; however, the political uncertainty in the U.K. grew worse in the wake of the resignation of U.K. Prime Minister David Cameron on Friday. Cameron is fighting within his own Conservative Party over who will succeed him (and when), while a similar upheaval is underway in the opposition Labour Party.

The lack of political order in the U.K. leaves global market participants less certain that the U.K.’s separation from the EU will be quick and amicable. Of course, markets crave certainty. A quick resolution to the U.K. political crisis and the start of negotiations with the EU would be welcomed by markets; but at this juncture, that looks unlikely to happen anytime soon.

WHAT IS THE DIRECT IMPACT OF THE BREXIT ON THE U.S. ECONOMY?

The U.S. economy is largely driven by internal consumption and investment, which should insulate it from the worst global impacts of the Brexit—although that does not mean the U.S. economy is completely immune. Exports have more than doubled as a share of the economy in the past 35–40 years [Figure 1], but are still under 15% of gross domestic product (GDP), compared to the economies of the U.K. (30% of GDP are exports), EU (40%), and Japan (20%). The U.S. exports close to $125 billion of goods and services to the U.K., accounting for about 5% of our exports, and another $375 billion to the rest of the EU, accounting for 17% of our exports; therefore, the direct impact to the U.S. economy from the expected slower growth in the U.K. and Eurozone is quite small.

In the first two days after the vote, the dollar has strengthened versus both the British pound and the euro, making our goods and services more expensive. Although the weaker pound may help to lift the U.K.’s exports to the U.S. and rest of the world, the turmoil and uncertainty surrounding the negotiations (especially if they are long and drawn out) is likely to impair the U.K. economy, and to some extent, the economy in the EU as well.

As a result, there may be a decrease in U.S. exports to the U.K., which, at the margin, is a drag on the U.S. economy. U.S. financial corporations in particular (banking, insurance, investment banking) have an outsized exposure to the U.K. and Eurozone economies, and we will be closely watching their response in the coming days and weeks. Increased financial market turmoil may also weigh on consumer, business, and investor confidence as well, and potentially slow or delay consumer and business spending (and hiring decisions), which would likely negatively impact the U.S. economy. On balance, in our view, the longer the uncertainty surrounding the U.K.’s relationship with the EU persists, the more damage will be done to the global (and U.S.) economy. This potential damage, in turn, may lead to additional financial market turmoil, further impacting the U.S. economy.

BREXIT AND THE FED: LIKELY JUST ONE HIKE THIS YEAR

Just before trading began in U.S. equity markets on Friday, June 24, 2016, the Fed issued a statement noting that it is “carefully monitoring developments in global financial markets, in cooperation with other central banks, following the results of the U.K. referendum on membership in the European Union.” The Fed also noted that it is prepared to “address pressures in global funding markets, which could have adverse implications for the U.S. economy.” With fiscal policy in most nations (Japan and China are key exceptions here) largely off the table, financial markets are looking once again to central banks for guidance. The Fed’s statement on financial markets and global funding markets echoed those made by other major central banks on Friday morning.

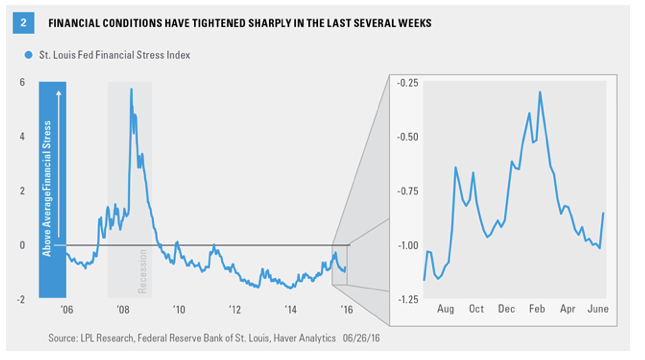

Figure 2 looks at one of the measures of financial conditions the Fed monitors, the St. Louis Fed’s Financial Stress Index, which is an aggregate of 18 indicators that reflect financial stress in the stock and bond markets. Although still well below levels seen during 2007–09, financial stress has been moving up in recent years, and peaked late last year and early this year. Financial stress, as a proxy for financial market conditions, has ebbed since the start of the year, but over the past few weeks—and especially last week—it moved sharply higher.