"A day or a month is turbulent if the returns across a set of assets behave in a significantly uncharacteristic fashion," Kritzman explained in an October 2008 research paper. "One or more assets' returns, for example, may be unusually high or low, or two assets which are highly positively correlated may move in the opposite direction."

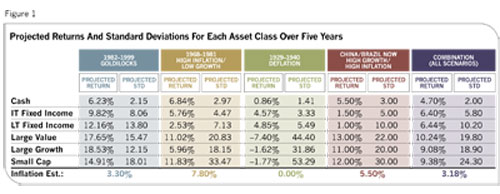

Say you want to illustrate the impact of a high-interest-rate/high-inflation environment on a model portfolio. You would identify a period in history characterized by high rates and high inflation and use the software's pull-down menu to define the period's start and end dates. This period's returns, standard deviations and correlation coefficients are then automatically applied to your portfolio. Using software like this, advisors do not have to manually change the statistical inputs to run a simulation. You can model an economic scenario in just a few clicks.

Another statistical aid in the Windham software applies a "decay factor" to risk and returns, a method for weighting more recent events more heavily (since current returns and risk are usually more important in designing forecasts than older data).

Another problem tackled by Windham Portfolio Advisor is value at risk. "Financial planners tend to focus on just the distribution of outcomes at the end of some horizon," says Kritzman, "and do not pay much attention to what may happen along the way." While the terminal value of a portfolio modeled in financial planning software might be acceptable after 20 or 30 years, the portfolio could dip drastically in value in the meantime-and an investor in bad times might abandon the portfolio altogether before making it to the end. Again, by simulating the effects of turbulent periods, you can show investors the ups and downs he is likely to face by following his investment road map.

Financial planning has always lagged ideas applied in academia and institutions by ten to 20 years, but that knowledge gap is likely to close in the future.

Advisors will need planning apps by the popular software makers to overlay economic scenarios on financial plans. Meanwhile, software companies will need to enlist economists to regularly update apps with the most likely economic scenarios. Advisors must be able to combine three or four of the most likely economic scenarios into a single forecast and then optimize a portfolio to capitalize on what's expected.

The technology and statistical methods make this kind of financial planning for the masses doable. The only question is whether it will be here in time to help clients understand the mess we're in and whether it will help us avoid the worst damage.

Editor-at-large Andrew Gluck, a veteran financial writer, owns Advisor Products Inc., a marketing technology company serving 1,800 advisory firms.