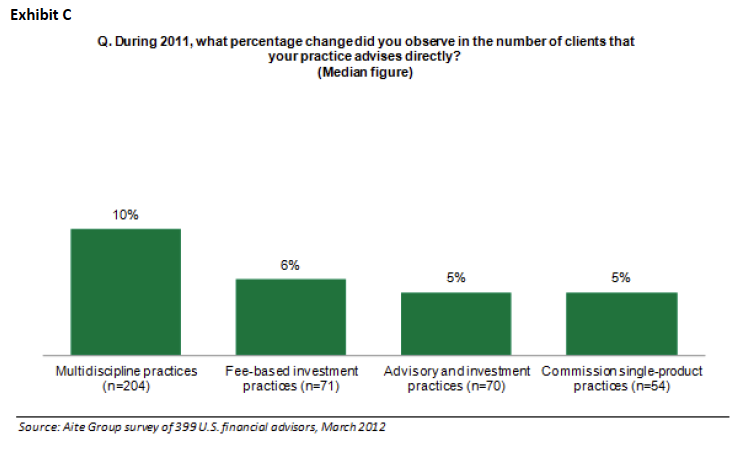

This is due partly to referrals and partly to the greater stability that comes from lower economic sensitivity and greater client loyalty. Multidiscipline practices weather market downturns better than single-discipline practices, because demand for benefits and insurance tends to be steadier than the demand for investment and financial planning advice during those periods. These practices also develop higher client retention rates as they uncover and meet needs across all areas of their clients' financial lives.

Multidiscipline practices also tend to have a desirable client profile. They attract a higher percentage of clients with characteristics that advisors value, including higher levels of investable assets, business ownership and willingness to pay for a financial plan. They also are more appealing to young advisors, who are a critical component of practice growth and succession planning.

Biggest Challenge: Access to Expertise

An expertise gap separates successful multidiscipline firms from the rest of the pack. Successful multidiscipline firms earn significantly higher revenues than their competitors. Multidiscipline practices with at least six staff members averaged revenues per client of $4,020, almost 80 percent more than their smaller peers. They also outpaced the other practices in our survey, which averaged less than $3,200 per client regardless of the number of employees. We believe this is because the most successful practices have staff with expertise across all disciplines. This enables them to cross-sell to satisfy clients' holistic needs.

While larger firms are currently realizing the greatest benefits from multidiscipline practices, we believe it's possible for smaller firms and firms with a single-discipline focus to achieve the same benefits of their larger counterparts. While it's difficult for a young firm -- or a traditionally single-discipline firm -- to immediately hire in every discipline, such a firm can partner with a multidiscipline broker-dealer to get up to speed quickly and cost-effectively. The advantages of a multidiscipline practice can be achieved without overwhelming overhead costs, allowing a practice to evolve and fully adopt the model over time.

Build a High Performing Practice While Increasing Valuations

Find a partner that offers multidiscipline product expertise and access. Especially in the early stages of building your multidiscipline practice, your company can't afford to hire full-time experts in every field. Get help from a firm that has experts in areas outside your core expertise. Areas to consider include:

-- Insurance: Life insurance, annuities, long-term care and wealth transfer solutions.

-- Benefits: Health/wealth/welfare, retirement planning, executive benefits and corporate property and casualty.

-- Access: A firm that can offer you access to institutional-level investment and advisory products with features and pricing that you couldn't offer on your own, along with consulting to help you identify, prospect and sell them.

Grow smartly. You can start offering multidiscipline services by working with a strong partner. As your business grows, you can add staff with various skill sets selectively.

Use integrated technology. Technology requirements for multidiscipline practices are complex. You need technology that's easily integrated so you gain a holistic view of your business. Good technology means you don't get bogged down with manual calculations and workarounds. The right independent broker-dealer can help eliminate your technology hassles.

Offer and charge for financial planning. Clients don't always value what they don't pay for. You need to charge enough to support the services you offer. This makes your practice more productive and profitable.

Your Next Steps

You'll find more details about multidiscipline practices in the white paper, "Multidiscipline Practices: The Business Model of the Future - Today."

To obtain a copy of "Multidiscipline Practices: The Business Model of the Future - Today," click here or call 800-966-9474.