Job growth may be slowing, but when put in a broader context, it may also be at the height of its new potential. In last week’s Weekly Economic Commentary, “Yet Another Disconnect,” we wrote that according to several Federal Reserve (Fed) officials, monthly job gains as low as 125,000 per month in the U.S. would be enough to tighten the labor market, take up slack in the economy, and push up wages and ultimately inflation. Meanwhile, financial markets would likely view such a slowdown in jobs creation as a signal that economic growth was waning, and that perhaps the next move from the Fed would be a rate cut, not a rate hike. This week, we take a closer look at why job growth as slow as 125,000 per month may be sufficient to take up slack in the labor market, and expand our analysis beyond the U.S. to other developed economies.

SLOWING POTENTIAL

Productivity (as measured by output per hour worked) is slowing, not only here in the U.S., but around the world. The roots of slowing productivity have sparked a lively debate in academic circles that has occasionally crossed over into the mainstream—especially when productivity is mentioned by a member of the Federal Open Market Committee (FOMC). The debate is whether the slowdown in productivity is cyclical (largely due to the nature and severity of the Great Recession), structural, or something else—that something else usually being a “measurement problem.”

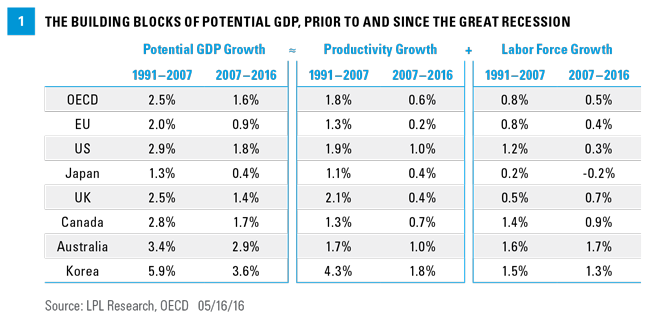

Productivity matters because it’s the building block for how fast the economy can grow. The maximum gross domestic product (GDP) growth rate (formally known as “potential GDP”) is equal to productivity growth plus labor force growth. Figure 1 illustrates the “building blocks” for potential GDP. The figure compares potential GDP, productivity, and labor force growth among nations in the Organization of Economic Cooperation and Development (OECD)* as a group and the seven largest economies within the OECD over two periods: the decade and a half prior to the onset of the Great Recession (1991–2007) and since the onset of the Great Recession (2007 to present).

*OECD nations include: Australia, Austria, Belgium, Canada, Chile, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, South Korea, Luxembourg, Mexico, Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, U.K., U.S.

The Organization of Economic Cooperation and Development (OECD) brings together the governments of countries committed to democracy and the market economy from around the world to support sustainable economic growth, boost employment, raise living standards, maintain financial stability, assist other countries' economic development, and contribute to growth in world trade.

In the decade and a half prior to the onset of the Great Recession, potential GDP in the OECD ran at 2.5%, ranging from highs of 5.9% in South Korea and 3.4% in Australia, to lows of 1.3% in Japan and 2.0% in the EU. In the U.S., potential GDP growth averaged close to 3.0%. Since 2007, driven by low economic growth, a widening skills mismatch in the global labor force, subpar business capital spending, constrained fiscal spending, and heightened economic and financial market volatility, the potential growth rate among OECD nations has dropped to 1.6%. In the past eight years, potential GDP growth has slowed significantly in every one of the top seven nations in the OECD relative to its pace prior to the Great Recession. Japan saw the biggest deceleration, with the EU and U.S. seeing significant declines as well.

WITH AN AGING POPULATION IN PLACE, PRODUCTIVITY MATTERS

Taking a closer look at why potential GDP growth has slowed since 2007 relative to the 1991–2007 period, we find slowdowns in both building blocks of potential GDP: labor force growth and productivity. Labor force growth is largely determined by birth rates, although in some nations net immigration (or lack thereof) can play a role. The labor force grew at 0.8% per year in the OECD between 1991 and 2007, and then slowed to just 0.5% since then. This slowdown is mostly demographic, although in the U.S. and other nations, some people of working age have dropped out of the labor force after not finding a job for several years, or because they stayed in school (or went back). In Japan, the labor force is shrinking; and in the EU, labor force growth is near zero. Among the seven largest OECD economies, only Australia has seen its labor force growth accelerate versus the pre-Great Recession period.

Productivity growth in the OECD has declined from 1.8% per year from 1991–2007 to just 0.6% in the 2007–2015 period. Each of the largest seven nations have seen a dramatic slowdown in productivity, with notable deceleration in the EU (1.3% to 0.2%), the U.K. (2.1% to 0.4%), and Japan (1.1% to 0.4%). As we noted in last week’s commentary, productivity in the U.S. has slowed as well. Although there is agreement among global policymakers that productivity across the developed world has slowed since 2007, there are disagreements among policymakers and academics researching the issues regarding the causes. One point of contention is measuring productivity in a global economy that has rapidly become more service oriented and technology driven, making it more difficult to capture productivity the old fashioned way, i.e., measuring the amount of goods output by the factory based on the number of hours of labor it took to make them.

THE PATH FORWARD

Since the end of the Great Recession, the causes of—and potential remedies for—the anemic pace of economic growth have been hotly debated by investors, businesses, and policymakers alike. Of the two building blocks of potential GDP, labor force growth is the least flexible, with demographics and long-term secular labor trends difficult to reverse in the short term. There is some reason for optimism on the productivity side of the equation, however.

Still, improvement from the recent tepid pace of productivity will likely require, at minimum, more coordination between businesses, labor, and governments at all levels, and almost certainly more monetary and fiscal policy coordination among policymakers worldwide. For example, businesses need to invest more in refreshing and updating aging plants and equipment and in new technologies at a much faster pace than what we’ve seen since 2007. Governments around the globe should be encouraging more spending on infrastructure (both public and private), training more workers and potential workers to be more productive in the 21st century economy, and keeping regulatory burdens low to allow businesses to thrive.