Now that the presidential battle lines have been clearly drawn, with Donald Trump running on the Republican ticket and Hillary Clinton running on the Democratic line, Wall Street has reacted with…nothing much. The day after the announcement that Clinton had clinched her party’s nomination, the S&P closed up 2.72 points. Yawn!

And since Trump became the Republicans’ presumptive nominee in early May, the markets have moved about 3 percent, a rally that’s concurrent with the Federal Reserve’s retreat from its declaration that it would raise interest rates very soon.

Can portfolios have politics? They can’t avoid it. Elections mean change and uncertainty—usually a bad thing for the stock market—and investments have to weather the emotional burden, which drags down returns. And an election like the one we’re facing now, with its deeply felt partisanship and anger, is the worst kind.

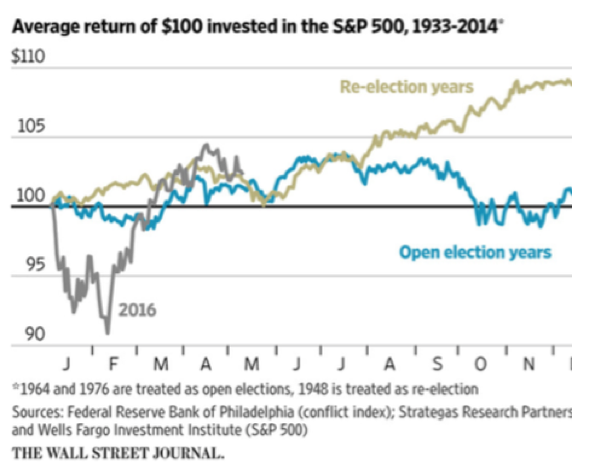

Take a look, for instance, at this chart, first published in The Wall Street Journal, which compares investment returns during elections of incumbent presidents (called re-election years) to investment returns with no incumbent (called open-election years):

The uncertainty is certainly a damper on market performance. In addition, according to research by the Federal Reserve Bank of Philadelphia, the more partisan the general political environment, the more of a damper it places on growth—so much so that they created a Partisan Conflict Index that compares stock market performance to the level of political agreement as reported in a list of newspapers (the index counts the frequency of articles, not their tone). According to a paper by Marie Azzimonti, the economist whose research was the basis for the index, “a 10 percent increase in the partisan conflict index is associated with a 3.4 percent decline in aggregate private investment in the U.S.”

So what’s an investor to do?

Hang On

Isn’t that what you tell clients? Do you really want to:

a) predict who will be president?

b) encourage unreasonable jubilation or panic?

I know one advisor, for instance, who said, “If Donald Trump wins, we should all go to cash,” because of his proposal to renegotiate the value of Treasury bills. She was only partially joking; such an action would have hugely negative global repercussions. For that reason, though, its likelihood is extremely low.

Some Republican diehards may state that a Clinton victory would make them trade their stocks for gold bars. To that point, here’s a quote from Warren Buffett, that very, very successful investor: “I have no views as to where [gold] will be, but the one thing I can tell you is it won't do anything between now and then except look at you. Whereas, you know, Coca-Cola (NYSE:KO) will be making money, and I think Wells Fargo (NYSE:WFC) will be making a lot of money and there will be a lot— and it's a lot—it's a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that."

Plentiful statistics are available to prove—or disprove—that one party or another is good for financial markets. Many pundits have already shared their thoughts on which candidate would be best for the stock market.

There are other intangibles that may bear some discussion as well. There are some important uncertainties to discuss with clients.

Crucial Distinctions

Like all situations that give clients misgivings, an election is a teachable moment to share with clients. For one thing, uncertainty’s dampening effect on asset prices quickly dissipates once the uncertainty is resolved—and the political uncertainty we face over the election will be resolved on November 9.

And yes, the candidates’ economic priorities are quite different. So are the choices that Congress will make, depending on who holds power.

Take, for instance, the Department of Labor’s fiduciary rule, to which President Obama has given priority: Under a Trump Administration and a Republican Congress, it could well go away. The Dodd-Frank financial laws, put in place after the financial crash of 2008, could be significantly loosened as well. Under a Clinton Administration and a Democratic Congress, though, Dodd-Frank could well be tightened. And the movement to raise the minimum wage, already gaining momentum in more liberal areas, could pick up steam, with both bad results (costlier payrolls) and good ones (a more prosperous middle class with more money to spend).

What Really Counts

Today, though, our economy and asset markets respond to much more than domestic politics. We are part of a complex and interdependent global economy, and the world economy has as much bearing on our markets from week to week as the jobs report.

Most of the time, if your clients’ portfolios are allocated for the long term, your conversation is a lot different than if you’re purely tactical. We believe in avoiding the drama of the markets’ daily churn. This gives you the ability to reassure your clients that, over time, with careful planning, they are likely to achieve their goals. They can remain on track to take that trip or fund the trust for their grandchildren.

So enjoy the election drama—or ignore it—but don’t feel like you’re going to have to move clients to cash or gold come November 9. At least, not for investment purposes.

Nicole Newlin is president of Efficient Advisors, a Philadelphia-based turnkey asset management firm that works with financial advisors to bring smart, low-cost investing to their clients. Efficient Advisors is committed to bringing proven practices and fresh thinking to the professional management of your clients' wealth.