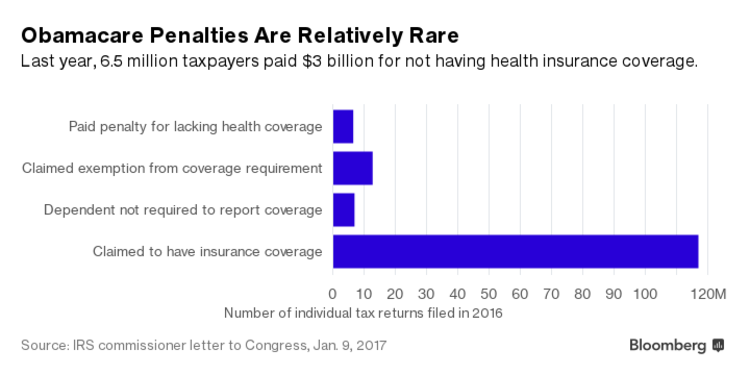

This tax season, millions of Americans are supposed to pay a penalty if they don’t have health insurance. At least, that’s what the Affordable Care Act requires. As the April filing deadline approaches, however, Americans have reasons to think they might get away with not paying what they owe.

After President Donald Trump took office, the Internal Revenue Service changed the way it handled the health coverage question on tax returns. Initially this tax season, the agency was automatically rejecting "silent" tax returns—those that didn't indicate whether the taxpayer had insurance coverage. The IRS reversed course a few weeks after Trump, on his first day in office, ordered agencies to ease the burdens of complying with the ACA. The unsuccessful Congressional effort to repeal and replace the ACA only added to the confusion.

The reversal has prompted a debate among accountants and other tax preparers on what to tell clients to do about their Obamacare penalties, also known as "shared responsibility payments." The penalty starts at $695 per adult without coverage.

Emily Wallace, 55, wasn't sure how to handle the $962 she owed for not having insurance. "I'm one of those fiftysomethings that the ACA really hurt financially," she said. The resident of Greenwood, S.C., goes without insurance because it would cost more than $7,000 a year to sign up for her husband's workplace policy and about $9,600 to buy a policy on the Obamacare exchange. She doesn't qualify for subsidies because of her husband's income, which also boosts the penalty she owes for not having insurance.

"It seems to me more wise to pay the penalty and save as much as we can for routine doctor visits," she said.

There are risks to filing a so-called "silent return" and skipping the penalty. "Legislative provisions of the ACA law are still in force until changed by the Congress, and taxpayers remain required to follow the law and pay what they may owe," the IRS said in a statement. The agency added that "taxpayers may receive follow-up questions and correspondence at a future date."

Some tax preparers will refuse to help clients file silent returns. Enrolled agents—accountants, lawyers, and other tax experts who are certified by the IRS and required to meet certain ethical and legal responsibilities—are the most likely to balk. The National Association of Enrolled Agents told its members that they "should continue to help taxpayers comply to the full extent of the law."

Not all tax preparers agree. Nina Tross, an enrolled agent who is also executive director of the National Society of Tax Professionals, said she warns her clients about the possible consequences of disobeying the ACA. But she lets them file a silent return if they want.

"They can make the choice," Tross said. And many are choosing to try to avoid their Obamacare penalty, she said. "They're rolling the dice on this, and the IRS is letting them."

The largest U.S. tax preparation companies, TurboTax, owned by Intuit Inc., and H&R Block Inc., are both letting customers file silent returns—while warning them of the possible consequences. A silent return may "increase the risk of an IRS notice or audit," H&R Block spokesman Gene King said. Tax preparers also point out there are other, legal ways to avoid the penalty, through multiple exemptions based on financial hardship and other criteria.