· Intellectual property (R&D)

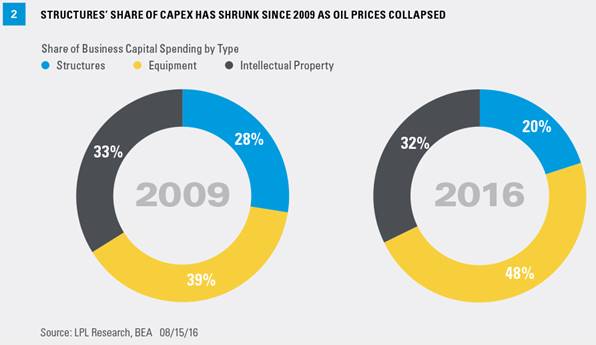

Business spending on structures has decreased overall (down 6% since Great Recession trough) and currently represents a smaller portion of overall spending—the major culprit being the huge drop in oil prices. At the start of the current economic expansion in the second quarter of 2009, business investment in structures accounted for roughly 30% of all business spending. Today, it accounts for just 20%, reflecting the massive pullback of investment by businesses in the oil and gas business, in response to the 70% collapse in oil prices between mid-2014 and early 2016. (See Figure 2 for a breakdown of all shares of business capital spending by type.)

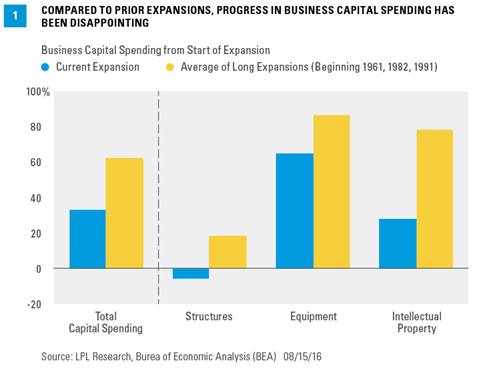

Business spending on equipment has increased by 65% since the Great Recession low; however, that still puts it behind the nearly 90% increase in this category at this point in the other recoveries.

The final category of business capital spending is intellectual property, which can be thought of as business spending on R&D. Companies spent an annualized $700 billion on R&D in the second quarter of 2016, a disappointing 30% higher from the Great Recession low of $549 billion. This category provides the platform for economic growth, more business spending, and higher productivity later on. To put the 30% gain from the recession low in perspective, in the first seven years of the last three economic expansions, spending on R&D had increased by 78%. Spending in this category includes computer software, R&D in chemicals, pharmaceuticals, computers and semiconductors, aerospace and defense, and motor vehicles, but also intellectual property (IP) developed by non-profits, educational institutions, and entertainment-related IP in TV, film, and the internet. Although the U.S. is among the world leaders in this type of spending, the slow pace of R&D spending in this business cycle is a concern.

Looking at all the major categories of business capital spending, only one component is running ahead of the pace seen in prior recoveries—transportation equipment, which has seen a 300% increase in spending in this recovery, far exceeding the gains seen prior expansions. But recall that two of the three major U.S. auto companies were in bankruptcy as this expansion began, which likely boosted spending in this category in this cycle.

WHAT’S IMPACTING BUSINESSES’ CONFIDENCE?

As we discussed in the Weekly Economic Commentary, “Building Blocks,” the slowdown in potential GDP growth in the U.S. since the end of the Great Recession is a result of a slowdown in the growth of the labor force and in the growth rate of productivity, or output per hour worked. Of the two, the slowdown in productivity is the more concerning. Wise investments by businesses (and governments) today are laying the foundation for sustainable economic growth in the years and decades ahead. While the U.S. remains above average among developed economies in the percentage of GDP dedicated to R&D spending, it lags global competitors like Germany, Korea, and even Japan.

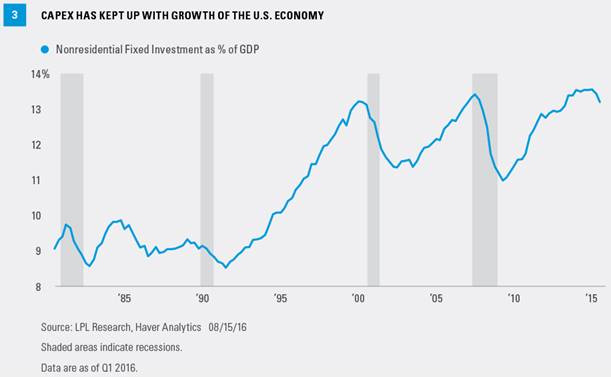

We note in our Midyear Outlook 2016: A Vote of Confidence that business capital spending as a share of GDP is close to an all-time high [Figure 3]. But, with the average age of the capital stock at 50-year highs, and interest rates low, corporate interest burdens low and corporate cash levels near records, why haven’t businesses invested more in this business cycle? This question has baffled market observers, pundits, politicians, and policymakers, and there isn’t one good answer. Confidence (or lack thereof) among business owners in the economic recovery itself (even though it’s entering its eighth year), is clearly holding back investment, and fear of another Great Recession has kept plenty of businesses from drawing down their cash piles to investment. A lack of clarity on the regulatory and legislative fronts has not helped either, and surveys of small business owners consistently list “too much regulation” as a growth impediment. The nature of the last downturn—the most severe economic downturn in 70+ years—is still clearly having an impact on investment, but that fear has not stopped businesses from hiring, making acquisitions, paying out dividends, or buying back stock in this cycle.

Ultimately, businesses’ confidence—driven by certainty and clarity on many fronts—helps to determine the path of business capital spending. For example, capex in the oil and gas business may pick up in the second half of 2016 should producers become more confident that oil and gas prices have bottomed out for the cycle. In order for businesses to open up their wallets and spend, they need to have certainty that the business cycle is still going strong; that the legislative, tax, and regulatory environment is capex friendly; that rates will remain low; and, of course, that their investment today will pay off for their employees and shareholders tomorrow. Thus far, some combination of fear of the past and uncertainty about the future has prevented business capital spending from taking off; but in order for our economy to thrive in the coming years and decades, businesses must have the confidence to spend now.

John Canally is chief economic strategist for LPL Financial.