While the legal definition of causa proxima is captured in the aforementioned quote, I often use the phrase in describing why the media is always looking for a proximate cause as to why the markets went this way or that. Back in the 1970s, when the markets would do this or that and nobody could figure out why, we always blamed it on the Middle East wealth funds because NOBODY knew what they were doing. Over the past few weeks, however, as the equity markets became more susceptible to the downside, the media’s causa proxima has been fears that, if the UK leaves the EU, it could cause a domino effect as other countries leave, as well. I would remind folks that even if the Brits do “leave”, it will be a few years before the separation process would be complete. I would also remind investors that my contacts in the UK do not think a “leave” vote is a fait accompli. In fact, if the vote is to “stay,” it could spark a pretty dynamic rally for the world stock market.

Speaking to this point, my friends at the keen-sighted GaveKal organization (I own some of their funds) recently wrote that if the UK “leaves”, it most certainly gives the country more freedom. As Charles Gave writes:

My starting point is that I cannot remember a single incident of increased freedom being followed by a sustained decline in living standards – not one. And even ardent ‘remainers’ would be hard pressed to argue that an exit from the regulatory and nondemocratic EU monster would not boost economic freedom in the UK.

Charles concludes by noting:

To summarize, if Brexit materializes, there will be dislocation, but it will offer an immense opportunity for those willing to take risks and extend the duration of their views. The end of horror is always better than a horror without end, runs the German saying, and it must be said that they are specialists in this topic. Meanwhile, back at my trading turret, I am being deluged with questions like, “Is the bond market telling us we are going into a recession?” Andrew and I have discussed this point ad nauseam by noting it is all about capital flows. If you are a German insurance company needing to park funds, in Germen Bunds you get a negative return 10 years out on the yield curve, but a positive return in US govies. Even more impressive is the fact that Europeans are buying US munis, but that’s a discussion for another time. (Continued on page 2) “In the law, a proximate cause (aka causa proxima) is an event sufficiently related to a legally recognizable injury to be held to be the cause of that injury.”

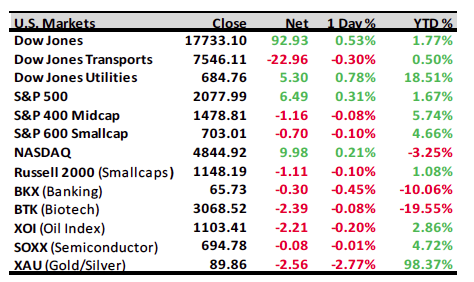

Yesterday, the S&P 500 (SPX/2077.99) retreated to its 2040-2050 support zone following last Tuesday’s MACD very short-term “sell signal”

registered when the SPX closed below 2078.40. That pullback has rebuilt the equity market’s “internal energy”, suggesting a move above the 2080-2082 should produce the “legs,” if the Brexit vote is to “stay,” for a move to new all-time highs. This potential upside “vault” is supported by the extremely oversold reading from the McClellan Oscillator (see chart where green is the MO), the negative sentiment readings, our internal energy indicators, and many other metrics. This morning, the preopening futures are flat; crude oil is up 1.5%; the Brexit vote is tilting towards “stay” as the UK morns the murder of Jo Cox, an advocate of “staying”; and dozens of diplomats urge for military strikes against Syria’s Assad.

Jeffrey D. Saut is chief investment strategist at Raymond James.