The markets turned around last week on the prospect of more central bank action. The MSCI World Index of global stocks posted its biggest two-day gain since October 2011 on increased investor confidence that the European Central Bank (ECB) will act to support markets. On Thursday January 21, comments from ECB President Mario Draghi signaled such a move could come as early as March. His comments seemed to turn around more than just stocks; the price of crude oil futures jumped 20%—their biggest gain since 2008. The Bank of Japan and People Bank of China are also expected to add to their stimulus programs in 2016. As oil prices push inflation lower, central banks are considering more stimulus.

Another Central Bank Rescue?

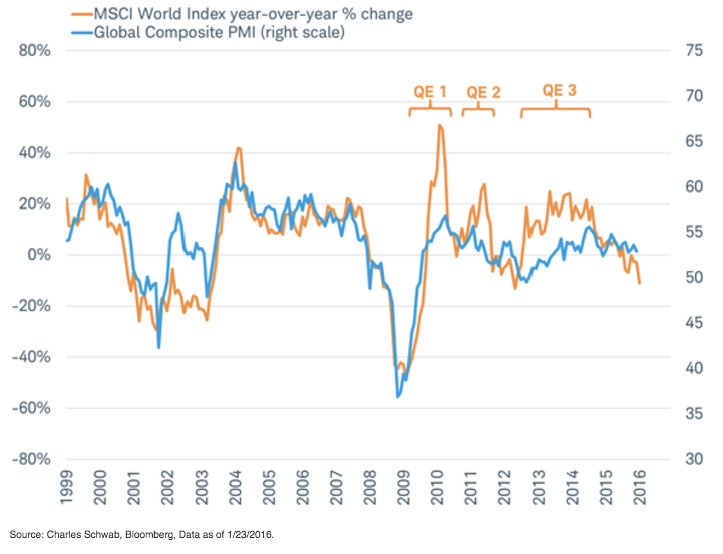

The three “QE” programs in the United States lifted stocks temporarily, but seemed to do little to boost economic activity. This left stock market performance to slide and reconnect with the trend in the economy (reflected by the global composite purchasing managers index) each time the QE bond buying program came to an end, as can be seen in the chart below.

QE Temporary Boosts

A boost in the size of the ongoing QE programs in Europe and Japan may offer a temporary lift for stocks, but economic growth is the only longer-term source of gains. Fortunately, we see signs of improving health in the global economy.

Avoiding A Global Recession

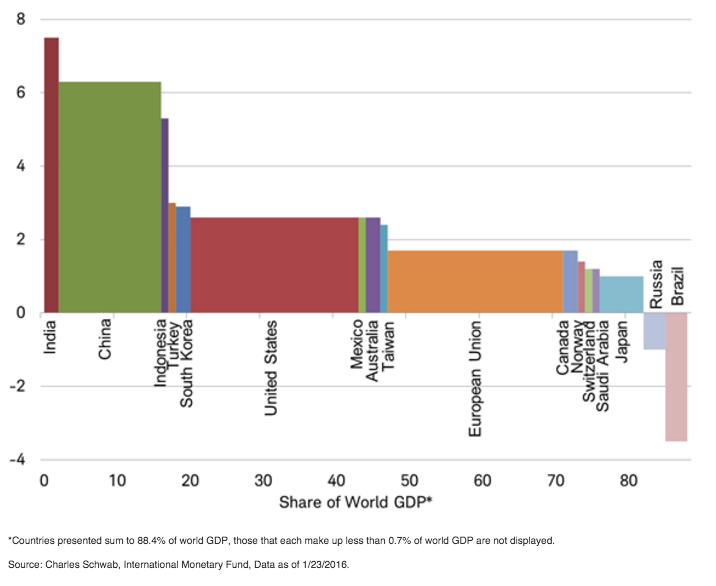

Prolonged global bear markets have always been coupled with global recessions. We don't see a high probability of a global recession in 2016. Last week, the International Monetary Fund updated their global economic forecasts. While they predict that China’s economy will continue to slow, their outlook for the world's largest economy—Europe—was revised higher. That is significant since measured by GDP the European Union is twice as big as China. In addition, as you can see in the chart below, India is now the world’s fastest growing economy. The IMF expects India’s pace of growth to accelerate in 2016. These are some of the reasons why the IMF expects faster global growth in 2016 than last year, tying the recent drop in the stock market to a growth scare rather than an oncoming global recession.

IMF 2016 GDP Growth Forecast And Share Of Global GDP By Country