It’s once again time for our annual August report called “Charts for the beach”. Take a look at five of our favorite charts that highlight what we think consensus is currently missing. Remember the best method for inserting an umbrella in the sand is to rock it back and forth!

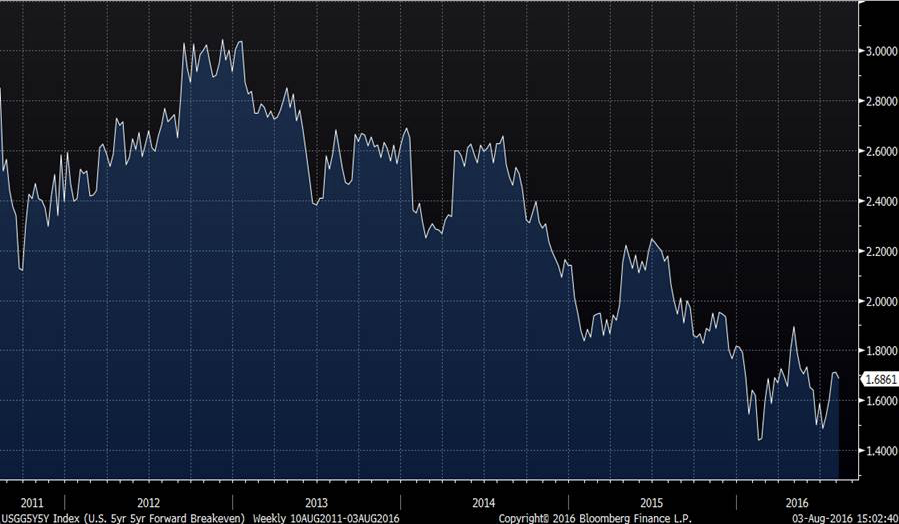

Inflation expectations may have bottomed

Richard Bernstein is chief executive and chief investment officer at Richard Bernstein Advisors.

Not the end of the world

Our first table compares the current market environment with that of 1999/2000, and one will note the stark differences between the characteristics of a true “bubble” and today’s market. For example, the S&P 500®’s PE ratio in 1999 was 31 and the 10-year T-note was at 6.4%. Today, the PE is high by some standards (24), but the 10-year note is a mere 1.5%.

Source: Richard Bernstein Advisors LLC, Standard & Poor’s, Bloomberg Finance L.P. *TMT = Technology, Media, Telecom

The 5-year 5-year forward breakeven, supposedly the Fed’s favorite measure of inflation expectations, may have bottomed last February. Most equity and fixed-income portfolios seem incorrectly positioned if inflation expectations do indeed continue to increase. Anyone see the irony that “lower for longer” is now the widely accepted interest rate forecast at a time when inflation expectations might be troughing?

Source: Bloomberg Finance L.P.

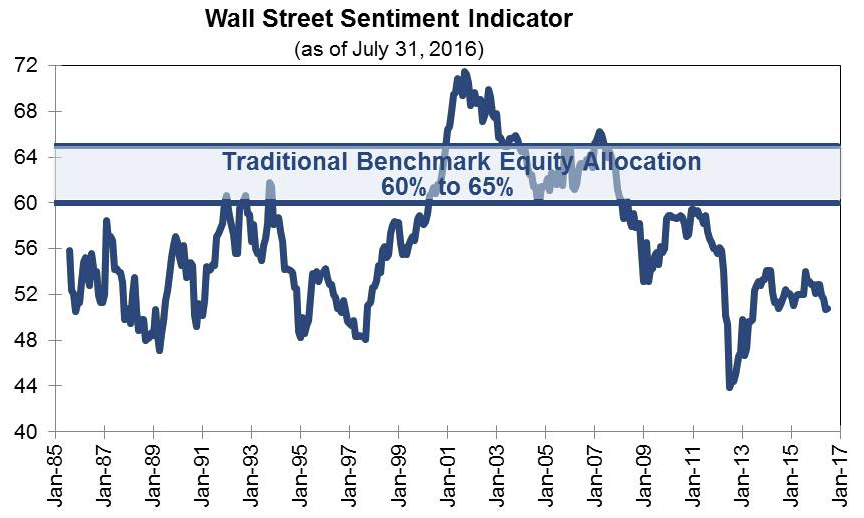

Everyone hates equities

Our Wall Street Sentiment Indicator, which is a measure of the consensus recommended asset allocation by Wall Street firms, continues to show that Wall Street prefers other asset classes to equities. Importantly, this was true throughout the entire bull market of the 1980s and 1990s. The only times in the last 30 years Wall Street recommended overweighting equities was just prior to the “lost decade” in equities and in early 2007, just before the onset of the bear market. Today, Wall Street is back to the bullish sign of suggesting that investors underweight equities.

Source: Richard Bernstein Advisors LLC

Is anything positive about Brexit?

The precipitous fall in the British Pound could help the earnings of UK multinational companies. That positive idea though is being buried in the symphony of comments on Brexit’s negative effects.

Source: Bloomberg Finance L.P.

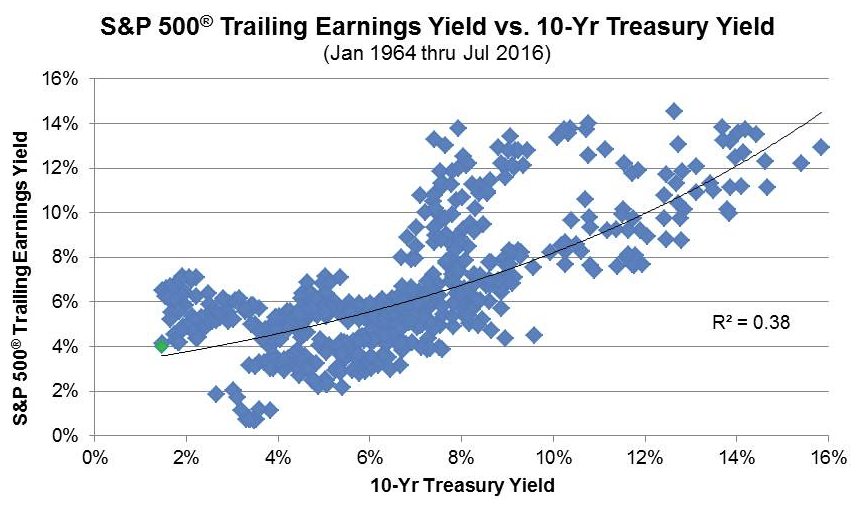

US stocks are fairly valued

RBA remains quite out of consensus in our view that the US equity market is not overvalued. One must keep in mind that it is not 7 years ago, and the market is not dirt cheap. However, our work suggests that the market is roughly fair value when the current S&P 500® earnings yield is compared to the current 1.5% 10-year note.

Source: Richard Bernstein Advisors LLC, Standard & Poor's, Bloomberg Finance L.P.

Charts For The Beach—2016

August 10, 2016

« Previous Article

| Next Article »

Login in order to post a comment