Uncertainty is the bane of financial markets, and uncertainties over monetary policy can be especially gut-wrenching. Former Federal Reserve Chairman Ben Bernanke, an advisor to PIMCO, has famously said that monetary policy is 98% communication and 2% action. Clearer communications by China could go a long way toward reducing uncertainty and restoring calm in global markets, and it has made some progress. Christine Lagarde, head of the IMF, said she was “delighted” by China’s recent communications effort.

Tony Crescenzi is an executive vice president, market strategist and generalist portfolio manager in PIMCO's Newport Beach, Calif., office.

China has been clearer about its policies since the G-20 meeting in Shanghai in February, where a “ceasefire” in the global currency war seems to have been declared and China’s central bank governor Zhou Xiaochuan clarified the PBOC’s foreign exchange policy. The calm that has followed is likely to persist in 2016 because China is hosting a series of G-20 meetings, including the heads of state in early September, and it will probably want to convey a sense of stability.

The return of state control

What’s so different about the new global monetary order? China’s integration into the global financial system, and in particular its inclusion into the IMF’s SDR, has reintroduced an element of state control into the world’s foreign exchange system, something that has been missing since the Bretton Woods system ended in the early 1970s, which itself was a managed system lasting about 25 years. The post-Bretton Woods regime has been far different: a free-floating free-for-all that some believe is at the root of a very volatile era in exchange rates.

What, then, is so bad about having an element of state control returned to global foreign exchange? Again, we return to uncertainty. Unlike the Bretton Woods era, when markets operated with an understanding of what the governing states intended with respect to exchange rate movements, investors today are unsure because China only recently began its communications effort.

Uncertainty over the direction, depth and speed of movement in China’s currency can complicate monetary policymaking throughout the world and cloud the economic outlook, especially for nations that compete and trade with China. Like ripples in a pond from drops of water, developments in China ripple throughout the global economy and the financial markets.

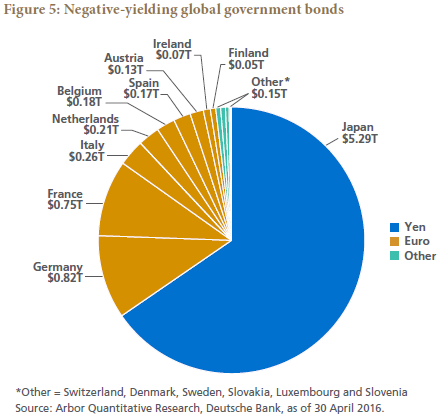

The impact has extended to the Federal Reserve, whose monetary policy since last year can accurately be described as “made in China” as China’s actions altered the Fed’s projected course on interest rates. The European Central Bank and Bank of Japan have also been affected, each taking actions in response to global economic and financial strains emanating from China. Their actions, in turn, contributed to market volatility, in particular Japan’s decision to lower a key policy rate below zero, thrusting two-thirds of Japan’s $7.0 trillion in government bonds into negative-yielding territory (see Figure 5).

While an element of state control could turn out to be a positive development owing to the certainties it creates, for now uncertainty remains in force, albeit less so than at the start of 2016. Investors nonetheless eventually will adapt to the new order, and as long as China is successful in transforming its economy, they could well see the sunny side of China’s integration into the world’s financial system.

Notes:

1http://www.worldbank.org/en/country/china/overview

2World Bank

China And The New Global Monetary Order

June 8, 2016

« Previous Article

| Next Article »

Login in order to post a comment