The bank which warned about a made-in-China "global recession" as one of 2016's key risks is singing a modestly more optimistic tune on the state of the world economy.

Citigroup Inc. economists led by Ebrahim Rahbari note that the stimulus measures deployed by Chinese policy makers are beginning to bear fruit, and the external backdrop has shown signs of improvement. While global growth remains weak, recent data suggest that "at least for now, it may no longer be weakening," lowering the risk that global GDP growth will fall below 2 percent (at market exchange rates) in 2016, the economists write.

However we're not yet out of the woods. According to Citi's team, there are still a bevy of factors that could derail the global economy's fragile expansion.

Rahbari & Co. highlighted five reasons why they take "only modest comfort" from the recent recovery in commodity prices, the pick-up in Chinese activity, and stable growth in other emerging market economies.

China's backsliding on its pledge to rebalance growth

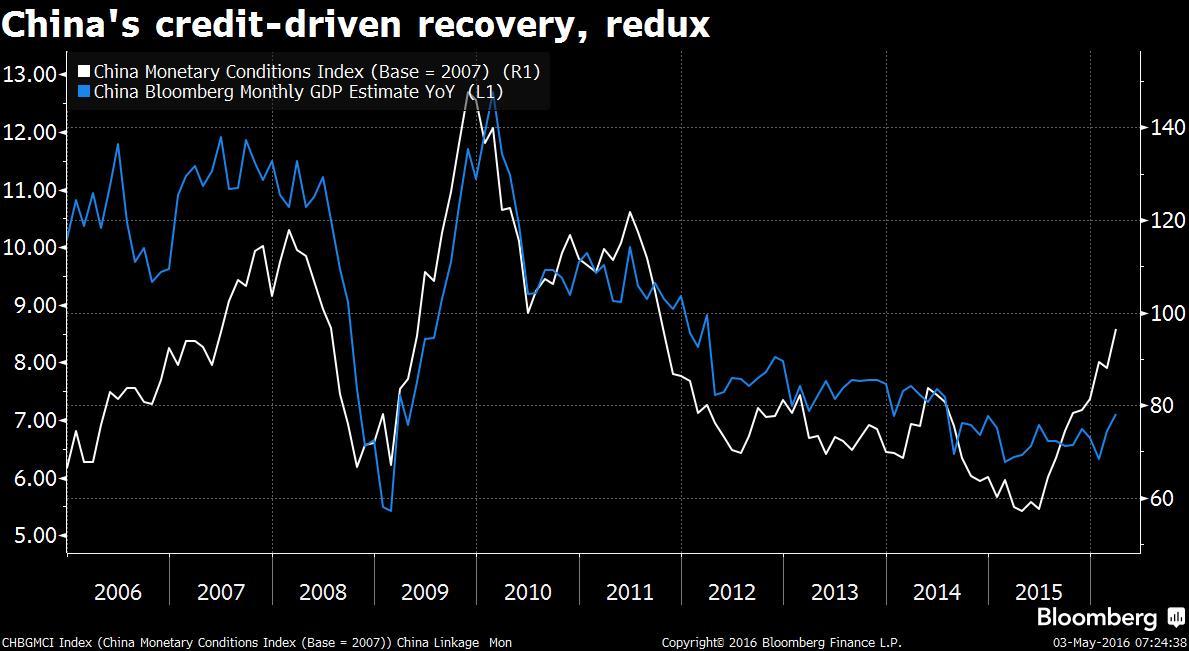

China's recent return to a credit- and investment-led growth model "appears likely to exacerbate existing credit and investment excesses, and increase risks of an eventual credit and financial bust or a long-lasting period of low growth," writes Citi's team.

Indeed, in years past it's taken more and more borrowing for China's economy to expand at a similar pace, ratcheting up fears that credit is being poorly allocated. The stabilization in activity for the world's second-largest economy has occurred in an environment in which financial conditions have eased materially and the credit spigots remain open.

While estimates of Chinese monthly activity have tended to move in tandem with monetary conditions, Citi says it's worth questioning the durability of this growth model.

Emerging markets haven't been fixed just yet

EM asset prices have been flattered by two things—"both of which may prove temporary," write Rahbari and Co. While the U.S. dollar is weaker and expectations of an aggressive Fed tightening cycle have receded, "structural issues persist throughout many EM countries," they say.

The yield on December 2017 eurodollar futures contracts collapsed at the start of this year as the market carnage caused traders to bet that the Federal Reserve would inch interest rates higher at a more gradual pace than previously assumed.

But if those yields retrace higher at the same pace at which they retreated, emerging market economies might not be on as firm a footing as some hope, and the risks to financial stability stemming from a lofty greenback could once again come on the agenda.