Wall Street pros have dived headlong into dark pools, exclusive private exchanges where they can trade stocks with each other in secret. Now comes an entrepreneur with a new twist: a dark pool for the masses, especially young investors.

Call it a kiddie pool.

Jumping into this pool takes a bit of faith. From his base near Boston, Tony Weeresinghe is trying to get customers to quit online brokerages and trade via his fledgling trading system at Ustocktrade LLC.

Weeresinghe, a former executive at the London Stock Exchange, says his pint-size pool is cheaper than the E*Trades of the world. It offers $1 stock trades -- compared with $4 to $7 at the established companies -- as well as no minimum account size.

Plus, Weeresinghe says, Ustocktrade provides a bit of adventure -- and operates primarily as a philanthropy. All that appeals to one of his target audiences, college students, who make up a fifth of customers. The CEO views inexpensive investing as a way to help clients pay off school loans.

“The whole idea was to democratize the wealth,” Weeresinghe said. “The younger generation is much more adventurous.”

Big investors have embraced dark pools because they want to keep their strategies from rivals and avoid driving up the prices of stocks they want to buy. They make less sense for small-timers, former industry regulators say.

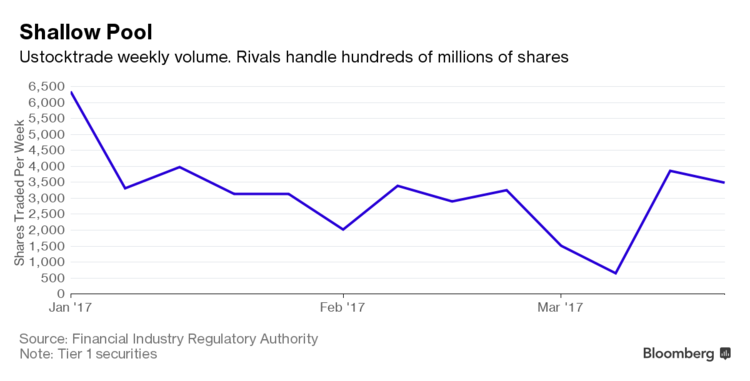

What’s more, Ustocktrade tells customers on its website they will be trading with their peers, but there often aren’t enough to make that work. Unlike other exchanges, Ustocktrade never sends orders to other venues for trading. So, as the company discloses in its user agreement, clients end up doing business with a single sophisticated pro, a so-called superuser, Weeresinghe himself.

In all cases, the company said it guarantees it will offer the official best market price, which it shows customers on their trading slips along with the precise second of their trade.

Still, the superuser isn’t obligated to step in, so the company notes that, in difficult market conditions, it might not be able to fill orders. This situation troubles some former regulators and investor advocates.