Real estate investment trusts, and the exchange-traded funds that invest in them, have defied expectations recently by outpacing most other market sectors and thriving against the backdrop of a shaky real estate market, a slowing economy and rising unemployment.

The rebound that started in the spring of 2009 followed a nearly two-year drubbing of real estate stocks that drove the FTSE NAREIT All REIT Index down more than 50%. During the worst period between September 2008 and March 2009, several real estate ETFs lost more than 60% of their value.

Investors who moved back into the asset class soon after its darkest hours had passed, however, were well rewarded. At the end of July, the real estate index was up nearly 54% for the year, while the SPDR S&P 500 Index ETF (SPY) returned only 14%.

Despite strong recent returns for the group, Paul Simon of Tactical Allocation Group in Birmingham, Mich., isn't impressed. "I think REIT ETFs are fully valued by a number of metrics at this point," he says. "Their yields aren't that attractive compared to some bonds or utility stocks. And the economy faces a lot of headwinds, which will make it hard for companies to raise rents."

Cautious Outlook

Many analysts share a cautious outlook on the real estate market and the REIT exchange-traded funds whose fortunes hinge on it. Job growth, which has a strong influence on the commercial real estate that these investments focus on, has been stagnant or trending downward this year.

Despite the strong performance of real estate stocks, the commercial real estate market remains weak in many areas. A double-dip recession could further crush the commercial market, making it even more difficult for real estate companies to obtain credit. While rising property values, low borrowing costs and access to credit would benefit REITs over the long term, the convergence of all those positive trends anytime soon appears unlikely.

High stock prices are also an issue. Because dividend increases haven't caught up with the surge in prices since last spring, the yields have plummeted. Eighteen months ago, the major diversified U.S. REIT ETFs sported dividend yields in the 7% to 8% range. Now yields stand at about half those levels.

"It's clear that U.S. REITs are not paying the level of dividend yields that they have in the past," observes Dan O'Connor, managing director of global real estate forecasting at Charles Schwab. "The key to dividend growth is a rise in income from properties, which is being constrained by the recession and high unemployment. Payouts will grow over time. But it's going to be a gradual process."

With the real estate market still in intensive care, investors need to be more selective in their exposure to the group, warns Kenneth Leon, vice president at Standard & Poor's Equity Research. "Navigating through the weak economic outlook for commercial real estate and finding the more stable sub-industries with exposure to REITs are important now," he says. "Clearly, unfavorable market conditions can put pressure on cash flow and pose fundamental risk for a REIT to maintain its tax qualification by having to pay dividends."

Yet there are also reasons for longer-term optimism. Stock offerings launched during the last year have helped many REITs clean up their balance sheets. With their access to capital markets, publicly traded REITs are in a better position to ride out the recession and scoop up attractive properties at distress sale prices from their financially strapped competitors. A cyclical upturn in the economy would give the sector a big boost. And with interest rates on bonds and other income-producing investments so low, even the shrunken REIT yields look decent by comparison.

Those prospects encourage some analysts. "We believe investors are viewing REITs as a more attractive investment today than they have in the past few years," says Carol Kemple, a REIT analyst with J.J.B. Hilliard, W.L. Lyons. "Several of our covered companies have raised their dividends this year, and we believe a few more will increase their dividends later this year or next year. Now that REITs have improved their balance sheets, we believe the next area of focus will be to improve occupancy and rents, and for some companies to look for attractive acquisitions."

Improved capital markets and positive liquidity trends led rating company Fitch to upgrade its outlook for U.S. equity REITs from negative to stable in June. However, the firm warned that while some companies may get ratings upgrades, a number have higher levels of debt and more speculative development pipelines and may be vulnerable to downgrades.

The REIT ETF Menu

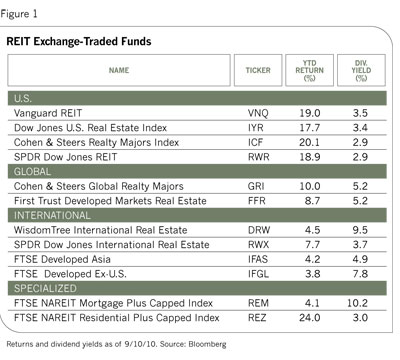

Although REITs and their ETF prices have risen substantially since last year, the market volatility could create opportunities for those investors with a positive long-term outlook who want to pick up shares on dips in the market. The growth in REIT ETFs started several years ago with diversified U.S. REIT indexes and has expanded to include global and international markets, and even swelled to include such narrower niches as mortgage REITs and industrial properties. There is now a diverse stable of about 20 real estate indexed options to choose from. Here is a brief rundown of what's available.

Diversified U.S. REITs: The domestic publicly traded REIT universe is a relatively small one consisting of 134 companies. Of these, 111 are equity REITs that own and often manage commercial real estate and derive most of their revenue from rental income. Twenty of the remaining 23 REITs provide debt financing for commercial or residential properties by investing in mortgages and mortgage-backed securities. The others are hybrid REITs that engage in both activities. All of them are required by law to distribute 90% of their taxable earnings to shareholders in the form of dividends.

Because there are so few U.S. entities, the ETFs in this space tend to hold many of the same securities, and familiar names such as Simon Property Group, Vornado Realty, Public Storage and Boston Properties typically dominate the funds' top ten holdings. The returns and yields in the group also tend to be fairly similar. Expense ratios range from 0.12% for the Vanguard REIT ETF (VNQ) to 0.47% for the iShares Dow Jones U.S. Real Estate Index (IYR), the most liquid of the group. An expense ratio of 0.25% puts the SPDR Dow Jones REIT ETF (RWR) in between the other two options.

One offering, the iShares Cohen & Steers Realty Majors Index (ICF) is a more concentrated ETF that holds just 30 of the largest and most liquid REIT companies. That tight focus appeals to Morningstar analyst Patricia Oey, who finds this higher-quality portfolio favorable in the current challenging operating environment for real estate firms.

Diversified global and international REITs: "U.S. REITs now make up only about one-third of global real estate securities," says O'Connor. "So if you are just sticking to that corner of the market, you're missing out on the growth dynamics and diversification available from the other two-thirds of the investment universe." Because many foreign REITs have not rallied as strongly as their U.S. counterparts, their yields are somewhat higher.

This group focuses mainly on developed markets. A larger investment universe and more diverse geographic coverage means returns and yields are likely to vary more than they do within the U.S. group. The offerings in this group include the iShares FTSE EPRA/NAREIT Developed Asia Index Fund (IFAS), which focuses on markets in Hong Kong, Japan, Australia and Singapore. Another iShares offering, the FTSE EPRA/NAREIT ex-U.S. Index Fund (IFGL), includes those countries as well as markets in France, the U.K. and Canada. Both have expense ratios of 0.48%.

The most actively traded fund of this group, the SPDR Dow Jones International Real Estate Fund (RWX), has a larger presence outside of Asia than most of its competitors and an expense ratio of 0.59%. There are also global ETFs with both U.S. and foreign exposure, including the Cohen & Steers Global Realty Majors (GRI) and the First Trust FTSE EPRA/NAREIT Developed Markets Real Estate Index Fund (FFR).

Specialized and mortgage REITs: Mortgage REITs once dominated the market but now occupy only a small corner of it. The only REIT in this area, the iShares Mortgage Plus Capped Index Fund (REM), follows an index of mortgage REITs and banks and has a dividend yield of about 10%. S&P has assigned an overweight rank to the ETF.

At 25% of assets, Annaly Capital Management is by far the largest holding. Low short-term interest rates have enabled the company to profit from the spread between its cost of borrowing to buy mortgage-backed securities and the income generated by its portfolio. Other prominent holdings in the fund are Chimera Investment Corp., MFA Financial, New York Community Bancorp and Redwood Trust. Three other iShares REITs focus separately on residential real estate; industrial and office properties; and shopping malls and retail centers.