...And Entered 2013 With Even Greater Momentum

The Road Ahead—Keep Your Seat Belts Fastened

Our Outlook

Of course, risks are still eminent, the most immediate being the political process in Washington, D.C., in a post-fiscal cliff environment. Still bubbling on the surface are the unresolved imbalances in the European Union. Economic recoveries in emerging economies may not be vigorous.The Middle East seems to be simmering with potentially destructive political and social unrest. Also, debt deleveraging threats are not totally in the rear view mirror, nor are the inflation possibilities There’s no denying it’s been a whirlwind ride this past year for U.S. equity investors. But so far, it’s been worth the price of admission. While facing a litany of macroeconomic concerns, investors have experienced double-digit returns in equities markets even amidst the twists, turns, bumps and grinds of slowed growth in China, a broadening recession in Europe, the U.S. Presidential election, and no true resolution around the fiscal cliff (just to name a few).

There’s no denying it’s been a whirlwind ride this past year for U.S. equity investors. But so far, it’s been worth the price of admission. While facing a litany of macroeconomic concerns, investors have experienced double-digit returns in equities markets even amidst the twists, turns, bumps and grinds of slowed growth in China, a broadening recession in Europe, the U.S. Presidential election, and no true resolution around the fiscal cliff (just to name a few).

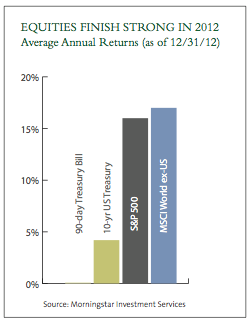

Equity Markets Finished 2012 Strongly...

Amidst all these obstacles, however, 2012 ended well for the global equity markets. Despite ongoing  risks and headwinds, U.S. and non-U.S. stock markets had increases of 16 percent and 17 percent, respectively.While there was the downside of political turmoil muddling growth forecasts in the U.S., Europe and China, it was counterbalanced by the corporate sector sustaining strong profit growth and margins, even in adifficult environment.

risks and headwinds, U.S. and non-U.S. stock markets had increases of 16 percent and 17 percent, respectively.While there was the downside of political turmoil muddling growth forecasts in the U.S., Europe and China, it was counterbalanced by the corporate sector sustaining strong profit growth and margins, even in adifficult environment.

Interestingly, though, the confluence of debt deflation and policy reflation led to a market sentiment that belied the actual returns.Things may not have “felt” so good, but in reality, the financial markets performed better than most people forecasted. For example, in the U.S., politics dominated the headlines and the equity markets. Even as a stalemate regarding budget talks and the looming fiscal cliff continued to plague the markets, U.S. stocks closed 2012 with solid gains in total returns, thanks in large part to solid earnings and strong cash flow yields.

As 2012 came to a close, cyclical stimulus overpowered structural headwinds and pushed stock prices higher. Building on a relatively solid year for the markets, it seems that many of the same themes have carried over into 2013.

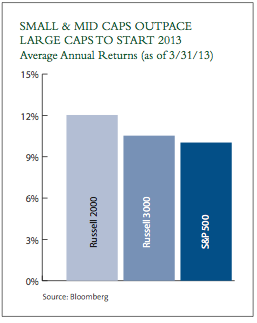

U.S. stocks resumed their rally in the first quarter of 2013, with major and unexpected corporate  earnings and a strengthing economy. Foreign stocks followed suit, but notched smaller gains due to currency depreciation and economic weakness abroad. U.S. investmentgrade bonds fell slightly as interest reates inched higher during the quarter.

earnings and a strengthing economy. Foreign stocks followed suit, but notched smaller gains due to currency depreciation and economic weakness abroad. U.S. investmentgrade bonds fell slightly as interest reates inched higher during the quarter.

Small- and mid-cap stocks outperformed large-caps , and value stocks outshined shares of growth companies. A more stable economy, less political dysfunction, and the Federal Reserve’s ongoing easy money policy provided a tailwind for the first quarter’s rally. Foreign stocks generally did not fare as well, as investors worried about another flare-up in Europe’s debt crisis, as well as policy tightening in China.

The fact is, U.S. and global economies are improving —however uneven the road getting there may seem. Equity markets have had double-digit increases for four straight years and we hope that trend continues for a fifth year. But risks remain— continuing concerns over the sequester, European debt crisis (Cyprus being the latest example) and unrest in the Middle East continue to present challenges. of course, we would like to achieve political compromise rather than be forced to act in fear of it, but investors understandably remain cautious. Again, the bumpy ride.

An enormous amount of work remains to be done across the Eurozone.The momentum in emerging markets such as China and India is still slow after years of strong growth. But global economic data has begun to stabilize thanks in part to efforts by central banks worldwide. Some countries have introduced fiscal stimulus, and there will probably be more to come from virtually all of the major players. As a result, after being stuck in negative territory, leading economic indicators are now stabilizing or improving.

But positive signs have emerged through all this. Several of the chronic dysfunctions that have long held back the U.S. economy are beginning to normalize.This is true of U.S. housing, credit and, to a lesser extent, employment rates. In addition, corporations continue to grow earnings, with more than $1.7 trillion in cash on balance sheets ready to deploy, and overall equity valuations remain attractive.

Although equity markets could be sporadic in the near-term, these economic trends would seem to support further progress. As a result, investors may be ready to put cash back to work and move into higher-risk assets. In this vein, there are certain areas to look for when evaluating companies today, including:

While corporate America have proven themselves to be very resilient through the current cycle, improving productivity, cutting costs and shoring up balance sheets in the face of a slowing global economy, year- over-year earnings growth is beginning to slow. Companies

are citing slowing revenues as the cause for lower profits and many are facing currency-translation losses on foreign revenue due to a weakening euro.

Key catalysts for growth in this environment moving forward include:

If we continue to see modest improvement in global growth driven by increased business spending, the recovery could encourage a shift from cash and bonds into equities, especially if there’s deterioration in fixed income returns. Monetary policies are steadily becoming more accommodating, with all major central banks aiding with the improvement in broad money, credit and overall financial conditions. Unlocking the considerable private savings in corporate America could spark increased spending and hiring.

from exploded central bank balance sheets.With these risks still persisting, active management and strong research will likely continue to be integral to capturing the compelling investment opportunities in today’s equities markets.

George V. Young is a partner at St. Denis J. Villere & Co. having worked there since 1986. He has a B.A. from the University of Virginia. He was a board member of the Louise S. McGehee School having served previously as president of the board. He is past president of the Financial Analysts of New Orleans and currently serves as president of the Louisiana Civil Service League. He is currently treasurer of Lambeth House, is President of the Hurstville Association, and chairman of the Endowment Committee of Trinity Episcopal Church.

Coming Back To The Potential "Staying" Power Of Equities

June 19, 2013

« Previous Article

| Next Article »

Login in order to post a comment