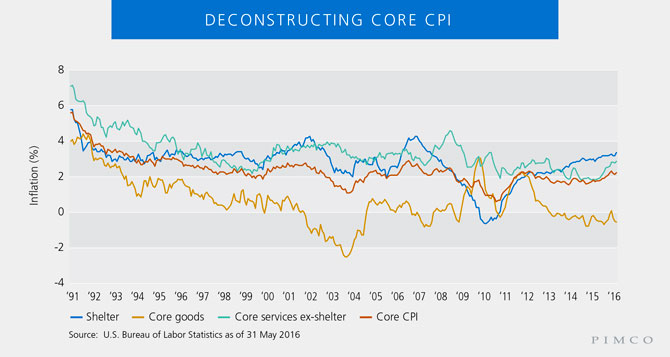

The core Consumer Price Index (CPI) May data released today reminds us that underlying inflation in the U.S. is robust. Growing at a seasonally adjusted 0.203% month-over-month and 2.24% year-over-year, core CPI is running even higher than we thought a year ago when we were forecasting core CPI at 2%.

Once again, strength is coming from the domestic economy. Core service prices have increased by 3.2% since last year. Core services accounts for 60% of the CPI basket, the largest component of CPI. Core goods, which represent only 20% of the CPI basket, were down 0.5% from last year, once again the biggest headwind. Meanwhile, the drag from low energy prices, 9.8% cheaper than a year ago, still weighs on headline inflation. When everything was said and done, headline CPI rose 1% year-over-year.

Looking at the TIPS (Treasury Inflation-Protected Securities) market reaction, with 10-year breakevens trading at 1.46% – down 5 basis points from yesterday – you might conclude market participants put more weight on headline inflation than core inflation. This is surprising because while headline CPI is notoriously volatile, core CPI is a much better indicator of the underlying inflation trend. The best illustration of that point is July 2008, when headline inflation was running at a steamy 5.6%, only two months before Lehman Brothers went bankrupt.

Since 1990, the correlation between headline inflation and the average headline inflation for the next five years is 0.38, but it moves to 0.54 if we use core inflation (versus the same average headline inflation for the next five years). In other words, core CPI is statistically more significant for predicting inflation than headline CPI.

So while one would think core CPI running at 2.2% would have convinced investors to increase their allocation to TIPS and rush for those cheap breakevens, most market participants remain focused on risks from Brexit and also our more secular theme of increased uncertainties.

Which leads me to my last point: While the Bank of Japan isn’t credible when saying it rejects helicopter money, Fed Chair Janet Yellen doesn’t seem offended by the unorthodox idea. “There might be a case for, let’s say, coordination – close coordination with the central bank playing a role in financing fiscal policy,” she said at a press conference yesterday. If this abnormal, indeed extreme situation were to come to pass (and who would have thought that 10-year German debt would be yielding negative rates?), some investors might wish they allocated more of their portfolio to TIPS.

Jeremie Banet is an executive vice president in PIMCO's Newport Beach, Calif., office and a portfolio manager on the real return team.