Our analysis of earnings conference call transcripts for the first quarter earnings period provides a mixed picture. The good news is that economic fears and drags from oil and the dollar are abating and earnings are almost certainly putting in a growth trough. However, conference call transcripts do not suggest sentiment is improving much, and management commentary is consistent with a continued slow growth environment. All of this casts some doubt regarding the strength of a potential second half earnings rebound.

SLOW BUT STEADY GROWTH

Corporate executives generally try to stay away from the “R” word (recession) when talking to investors. That is clear by the small number of mentions the word receives on earnings calls. In fact, the word came up just three times during first quarter 2016 earnings reporting season, the fewest in at least six quarters and consistent with the market’s view (and ours) that recession odds have fallen in recent months. We believe the odds of recession over the next 12 months are no higher than 20% currently, factoring in economic and market data and the risk of a potential policy mistake.

Companies do continue to make cautious comments about the U.S. growth outlook. For example:

· “The consumer is on solid footing and despite the noise in the data and some of the volatility in the markets, global growth will continue, albeit at a moderate pace.” (Major bank)

· “On the economic front, we see moderate growth in the global economy.” (Transportation provider)

· “If taken to the highest level from where we see the economy, I think we still see the overall economy progressing in that 2–2.5% range.” (Railroad)

· “Global economic growth remained weak during the first quarter. In the U.S., estimates indicate growth has slowed further since late 2015.” (Energy company)

Based on management commentary, over the past three months companies have transitioned from a more difficult macroeconomic environment to slow, but steady. LPL Research’s economic forecast suggests more of the same—approximately 2.5% real gross domestic product (GDP) growth for the balance of 2016.*

*Our forecast for GDP growth of between 2.5–3% is based on the historical mid-cycle growth rate of the last 50 years. Economic growth is affected by changes to inputs such as: business and consumer spending, housing, net exports, capital investments, and government spending.

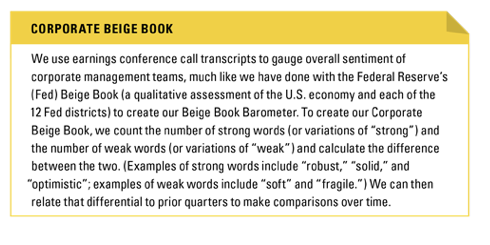

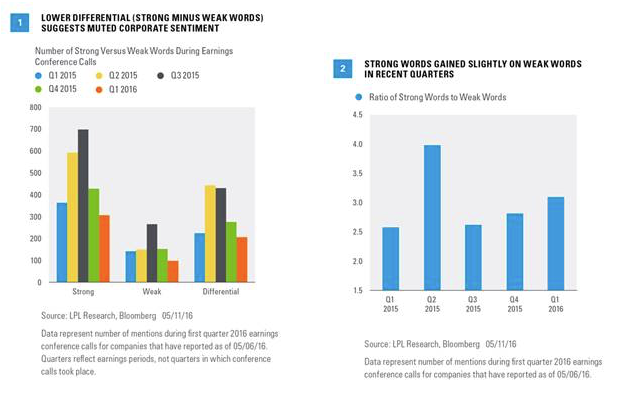

MIXED CORPORATE BAROMETER

When we count positive and negative words from earnings call transcripts, the picture is mixed, consistent with the slow growth environment of recent years. As shown in Figure 1, based on the difference between strong words and weak words, management sentiment was actually a bit less positive during the first quarter of 2016 than during the prior three quarters. Given how jittery markets were in early 2016, the quarter-over-quarter drop in sentiment by this measure is surprising.

Interestingly, the number of macroeconomic comments overall, good or bad, has been in decline in recent quarters. To adjust for that, we can look at the ratio of strong words to weak words and see that the strong words have been gaining share against weak words over the past three quarters, consistent with our sense that the mood has become a bit better [Figure 2].

CURRENCY IMPACT FADING

The reversal in the U.S. dollar is a big piece of the transition out of the earnings recession. The improving year-over-year comparisons for the dollar have no doubt contributed to fewer mentions of currency on earnings calls [Figure 3]. Currency mentions have been halved since the third quarter of 2015, when the dollar’s year-over-year change was 17% (recall that all else equal, a strengthening dollar reduces international profits of U.S.-based multinationals). Some of this decline reflects fewer macro comments from management teams in general, but the trend is clear. After a percentage point or so of drag on S&P 500 earnings in the first quarter of 2016, we expect currency to boost earnings over the balance of the year and perhaps contribute a full percentage point to S&P 500 earnings later in 2016.

Should the U.S. Dollar Index stay where it closed on May 13, 2016, for the rest of the year, the dollar would drop from a 2% headwind for earnings in the first quarter of 2016 to a tailwind of about 2% in the second and third quarters and over 3% in the fourth quarter.

With hundreds of companies commenting on currencies, it is not difficult to find interesting insights from management teams about the currency environment. Here are some examples:

· “And one positive is that we will get a big help from currency as it turns from a headwind into a tailwind beginning in the next quarter.” (Airline)

· “The weakening U.S. dollar gave us some relief.” (Chemicals producer)

· “So with the current circumstances of the world and what everybody is talking about in terms of real negative interest rates and so forth, that actually favors weakness to the dollar for us right now.” (Healthcare products)

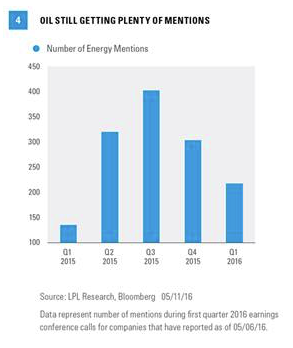

OIL STILL IN THE PICTURE

Oil’s rise from the February 2016 lows in the mid-$20s per barrel to the mid-$40s (as of May 13, 2016) eased concerns about the negative impact of low prices and led to fewer oil mentions on conference calls [Figure 4]. The rebound in oil prices has provided some light at the end of the tunnel. Energy sector profit fears have begun to fade, as have concerns about the profitability of other commodity-sensitive areas. The topic did still get plenty of mentions.

Oil could show year-over-year gains in the third quarter if it stays in the range of mid- to high $40s. We believe this is possible, based on the trend in U.S. production cuts and expected continued growth in global demand (consistent with the Energy Information Administration, which raised its oil price forecasts on May 10, 2016).

Comments from oil and gas industry management teams reflect the ongoing uncertainty:

· “If a lower-price environment persists for longer, we will adjust and pursue even more significant cost savings and even greater cuts in capital to continue to lower our cash flow breakeven.” (Energy producer)

· “We’re focused on lowering the breakeven cost of the business. Now for perspective, if we were in a steady-state world of sustained $45 per barrel oil prices, we believe we could cover the capital required to maintain flat production and pay our dividend with cash from operations.” (Energy producer)

· “In the first half of 2016, we're still oversupplied by about 1.5 million barrels per day. We do expect to see convergence in the second half with the seasonal demand growth, but that's going to widen again in the first half of 2017.” (Energy producer)

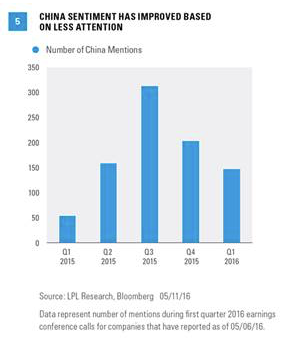

SLOWER CHINA EVIDENT

Stock market gains over the past three months have been partially due to more sensible policy and greater stability in China. Although risks remain, we see the drop in the number of China mentions on this quarter’s earnings calls as encouraging [Figure 5].

Comments from some more China-focused companies generally reflect optimism amid slower growth:

· “In China, growth continued to decelerate; however, economies in Japan and Europe showed some modest improvement compared to the fourth quarter.” (Energy company)

· “The world wrings its hands about slowing growth rates in China; and China was 6.5%. And I think if any other country of the world was growing 6.5%, we’d all be doing cartwheels and investing heavily.” (Healthcare products)

THE BOTTOM LINE

Earnings fell sharply during the first quarter of 2016 relative to the first quarter of 2015 and were about flat excluding the downtrodden energy sector. We did get a small upside surprise in earnings results this quarter, consistent with history, and a trough in the earnings growth rate has almost certainly been put in. But another decline—the third or fourth in a row depending on the data source—is hardly worth celebrating.

More encouraging though, we did see slightly more optimistic than usual guidance. Thomson-tracked consensus estimates for the next 12 months were revised lower by 1.4%, compared with the recent historical pattern of 2–3% negative revisions (fourth quarter 2015 earnings season saw a more than 5% haircut). The better economic environment during March and April 2016 helped, as did the dollar and oil reversals.

The most important earnings question is still tough to answer: Are consensus estimates for mid- to high-single-digit gains in earnings in the second half of 2016 more credible? This earnings season provided little evidence that companies are seeing a growth pickup (nor does our economic analysis). This casts some doubt regarding the strength of a potential second half earnings rebound, which may need help from the economy, market forces (oil and the dollar), and corporate efficiency (strong profit margins).

Burt White is chief investment officer for LPL Financial.