If I were an advisor looking to separate myself from the pack, the first thing I’d do is investigate currency-hedged ETFs. They are the most important innovation in the ETF space in the past three years, and can do more to differentiate your performance from your peers than any other strategy, including fundamental indexing, equal-weighting, low volatility or whathaveyou.

At this point, nearly every investor has significant exposure to international stocks. Whether that’s a 50 percent allocation, a 10 percent allocation or somewhere in between, the message of international diversification has sunk in and advisors routinely provide their clients with exposure to overseas markets.

What most advisors don’t understand, however, is the impact that currency plays in international equity returns.

Consider this headline, which appeared in the Financial Times on December 31, 2010: Miners Help FTSE 100 Post 9% Gain in 2010.

Imagine you bought an ETF on January 1, 2010, tracking the FTSE 100 Index, and that it tracked the index perfectly and had zero fees. At the end of the one-year period, your return would be:

a) 9 percent

b) More than 9 percent

c) Less than 9 percent

d) There’s no way to know.

Most investors (and many advisors) would answer “A”, 9 percent, figuring the fund would match the index perfectly. But the right answer is “d”: There’s no way to know.

Why? Because how currencies perform can have as big an impact on your returns as the underlying equity market your actual invested in.

DXJ And Currency Hedged Japan

The importance of currency hedging first caught ETF investors’ attention in late 2012, when Japan embarked upon its Abenomics experiment. Abenomics was based on the premise that massive quantitative easing could end years of deflation and jumpstart the moribund Japanese economy.

The effort began with a deliberate attempt to drive down the value of the yen against other major currencies, with the goal of boosting inflation and providing advantages to Japanese exporters. It worked: The yen was at 78-to-the-dollar at the end of August 2012, and stands at 98 to the dollar today. Japanese stocks soared.

Investors in the most popular Japanese equity ETF, the iShares MSCI Japan ETF (EWJ), did OK: the fund is up 21.20 percent over the past year. But the Nikkei itself performed spectacularly, rising nearly 50 percent.

Why the disconnect? The falling yen. When a currency weakens against the U.S. dollar, it harms returns for U.S. investors.

Fortunately, investors who saw the yen retreat coming had two clear options: the db X-Trackers MSCI Japan Hedge Equity ETF (DBJP) and the WisdomTree Japan Hedged Equity ETF (DXJ). Those two funds, which hedge the impact of currency on returns, rose 47.96 percent and 39.15 percent respectively over the past 12 months.

Even to this day, however, more money is invested in EWJ ($10.8 billion) than in the currency-hedged alternatives ($150 million for DBJP and $10.5 billion for DXJ).

It’s hard to imagine why. The attack on the yen was pre-meditated and large in scale. Any investor who understood the impact of currency on return would have moved into a currency-hedged product. It seems to me that most people didn’t bother to look.

Is It Just Japan?

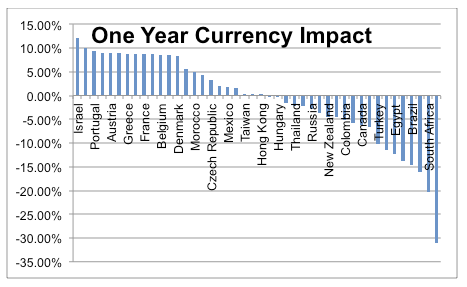

Everyone has heard about the Japan story, and the vast majority of assets in currency-hedged ETFs are currently in DXJ. But the currency impact is not just a Japan story. Over the past twelve months:

• Local investors in South Africa have enjoyed a 15.48 percent positive return, with U.S. investors have lost 4.83 percent.

• Local investors in India have enjoyed a modest, 3.57 percent positive return, while U.S. investors in India have gotten smacked, losing 10.24 percent.

• Conversely, local investors in Israel have flatlined, gaining just 0.23 percent, while U.S. investors have seen a 12.41 percent jump thanks to a rising shekel.

And of course, there is everything in between. The table below shows the one-year impact of currency on U.S. investors putting money to work overseas. The opportunity for tactical profit is enormous.

More Than A Tactical Play

What makes currency hedging so interesting and potentially so important, however, is not tactical investments. Situations like Japan are rare, and few among us can forecast the outlook on the shekel. What’s more interesting is the long-term impact.

I am generally a skeptic of investors who claim they can outperform the broader market. Most are taking on excess risk that has performed well in historical backtests. But currency hedging seems like a legitimate opportunity, because currently, the objective market risks are minimal.

If you believe the dollar is positioned for strength over the next few years – a reasonable supposition, given that we are further along the QE path than many other nations – swapping in currency-hedged exposure could lead to significant outperformance. Since the start of this year, as one example, the db X-trackers MSCI EAFE Hedged ETF (DBEF) has outperformed its non-hedged peer (EFA) by roughly 8 percent. What’s the catch?

There are a few that are worth understanding.

First, while some currency hedged ETFs are popular and liquid, not all of them are. The three I’ve mentioned above all have more than $100 million in assets under management, but there are others like the DB X-Trackers Germany Hedge Equity Fund (DBGR) with just $4 million in assets and relatively wide spreads. You can trade the smaller ETFs if you are careful, but you have to be very careful indeed.

Second, there is the potential – and in some cases the reality – of significant costs.

The way currency hedged ETFs work is that they take your dollars and buy currency forwards. The best way to think of these contracts is like a swap: You loan someone U.S. dollars, which they invest in a U.S. bank account; in exchange, they loan you the foreign currency, which you invest in a local bank account.

The return depends on both the movement of the currency and the difference in interest rates on those investments. Right now, because of the historically low global interest rates, this swap is quite cheap: the short-term interest rate in Japan or Europe is not very different from the short-term rate in the US. But in corners of the market, it gets quite costly. In Brazil, for instance, where short-term rates hover around 9 percent, it can be pricey to hedge currencies.

The good news is that for the major developed markets currency hedging is currently very cheap. That could change over time, of course.

Conclusion

There are always risks in trying to beat the market. I don’t in my personal portfolios. But if I felt compelled to try, the idea of currency hedging would appeal to me. IT offers a differential return pattern tied to a convincing macro thesis with no inherent factor biases in the portfolio.

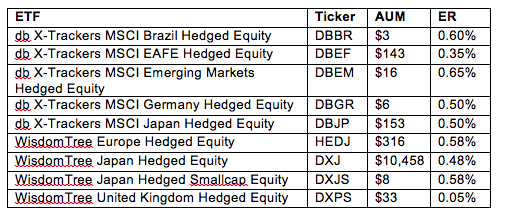

There are currently nine currency hedged ETFs to choose from, including five from DB X-trackers and four from WisdomTree.