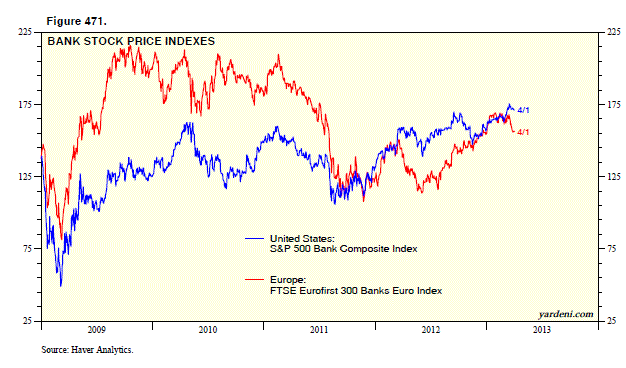

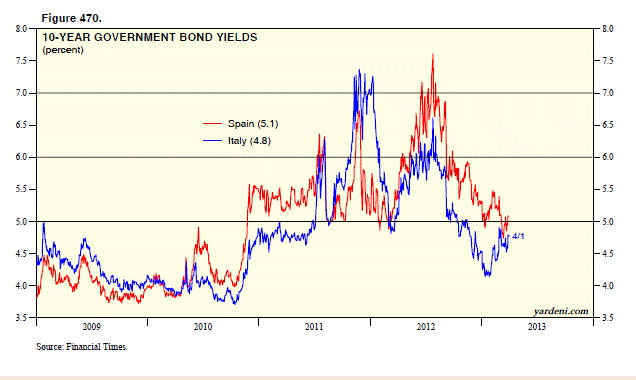

Cyprus may be a one-off unique situation. So far, it hasn’t triggered a financial meltdown comparable to Lehman. However, there is at least one similarity that is disturbing: Both reflected “bailout burnout” by policymakers. On the other hand, this time financial market participants may be less panic prone knowing that the ECB will do whatever it takes to defend the euro. When Lehman hit the fan, no one had a clue of the Fed’s unprecedented QE response to the resulting financial crisis. So far, Italian and Spanish government bond yields remain relatively low. The S&P 500 Bank stock price index is down only 2.5 percent since March 15.

Today's Morning Briefing: Seasonal Adjustment? (1) Bernanke’s spin on wacky seasonal pattern. (2) Stay or go? (3) Timing corrections is tricky. (4) BLS economists beg to differ. (5) Europeans get agitated in the spring, then go to the beach in August. (6) Triple top? (7) Still aiming for 1665 for S&P 500 by yearend. (8) Cyprus and Lehman are examples of “bailout burnout.” (9) Fiscal drag nicks US M-PMI. (10) EMs emerging more slowly. (11) Little Kim is having growing pains. (12) Q1 shows relatively broad bull market. (More for subscribers.)

Dr. Ed Yardeni is the president of Yardeni Research, Inc., a provider of independent global investment strategy research. Yardeni explores trends in the economy and financial markets that are vital to a broad spectrum of investment decision-makers.

While the Cyprus Moment seems to have come and gone, the risk is that the country’s bailout plan has set the stage for a run on euro zone banks. The biggest shocker, of course, was that the deal included a “bail-in” of uninsured depositors in Cypriot banks and the imposition of severe capital controls. Fears of a possible financial contagion are reflected in the 7.6 percent drop in the FTSE Eurofirst 300 Banks Euro Index since January 28. Also down ytd are the stock markets of Greece (-4.3 percent), Spain (-3.2), and Italy (-9.2).

While the Cyprus Moment seems to have come and gone, the risk is that the country’s bailout plan has set the stage for a run on euro zone banks. The biggest shocker, of course, was that the deal included a “bail-in” of uninsured depositors in Cypriot banks and the imposition of severe capital controls. Fears of a possible financial contagion are reflected in the 7.6 percent drop in the FTSE Eurofirst 300 Banks Euro Index since January 28. Also down ytd are the stock markets of Greece (-4.3 percent), Spain (-3.2), and Italy (-9.2).

![]()

Cyprus & Lehman (Excerpt)

April 2, 2013

« Previous Article

| Next Article »

Login in order to post a comment