What Might Turn Stocks Around

We see potential for stocks to get a boost from the following potential catalysts, although admittedly timing is very difficult to predict:

Oil price stability. Stocks have become increasingly tied to oil, making oil prices a potential catalyst for stocks. For example, on Friday (February 12), speculation of an OPEC agreement to cut supply helped drive oil up 12% (no, that is not a typo), the biggest one-day jump since 2009, which helped drive Friday’s 2% rally in stocks. Default fears in the energy sector remain a big concern for both equity and credit investors. Cuts to capital spending by oil producers have reverberated through the manufacturing industry and industrials sector (capital expenditure reductions by the S&P 500 energy sector are expected to approach $50 billion in 2016 according to FactSet-tracked consensus estimates). Concerns have spread to banks, where energy loan defaults are rising. Default fears are not limited to the U.S., as counterparty risk among European banks has become a bigger concern in part due to energy lending.

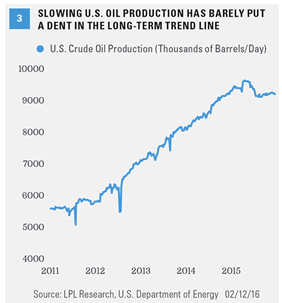

What We Are Watching: More progress toward reducing U.S. production [Figure 3] to recalibrate supply and demand or Saudi production cuts.

Estimated Timetable: 2–6 months.

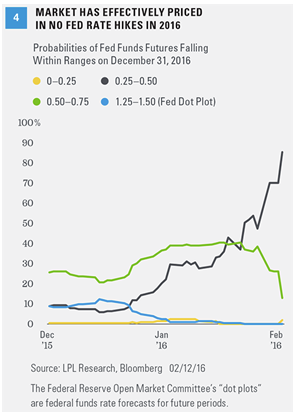

Evidence of a more pragmatic and global Fed. The Federal Reserve (Fed) appears to be more disconnected from markets than it has been in some time. Although Fed Chair Yellen has reiterated that the Federal Open Market Committee (FOMC) will be data dependent, she has given little indication that she expects less than the four rate hikes in 2016, which were conveyed in December 2015. The fed funds futures market has now effectively priced in no rate hikes at all this year [Figure 4]. The Fed and the market are seemingly too far apart for that gap to close soon; however, progress may start at the March 15–16 FOMC meeting and continue through subsequent FOMC meetings in April, June, and July.

What We Are Watching: Commentary from the Fed that closes the gap between its communications and market expectations.

Estimated Timetable: 1–5 months.

Improving credit markets. We put the odds of recession in the U.S. at about 30%. By contrast, financial markets are implying a probability closer to 50%. The energy-sensitive high-yield bond markets are sending a particularly negative signal with spreads near August 2011 levels, when markets were worried about the Eurozone breaking apart and the creditworthiness of the U.S.; they are even wider than the March 2003 bear market bottom following the 2001 recession and accounting scandals of 2002, although credit spreads had already bottomed in November 2002 and were already starting to recover.

What We Are Watching: Investment-grade and high-yield bond spreads to Treasuries. Until spreads stabilize and show progress toward sustained improvement, possibly with help from oil, the market’s recession worries may continue. The timetable for this potential catalyst is likely a bit longer because energy defaults will take time to play out should low prices continue.

Estimated Timetable: 3–12 months.

Stability in Chinese capital flows and currency. Markets remain worried about the potential for China to sharply devalue its currency (the yuan), sparking Asian currency wars similar to 1998 when the Thai baht collapsed. China’s foreign currency reserves have been falling by about $100 billion per month in recent months, largely because the central bank has been defending the yuan in the unregulated “offshore” market, although the Chinese central bank still has approximately $3.2 trillion in currency reserves. Until the market gets comfortable with the outlook for the yuan, which may be helped by better performance by the Chinese economy and a more dovish Fed, it may be difficult for U.S. stocks to sustain a meaningful rally.

What We Are Watching: Slowing Chinese capital outflows and controlled devaluation that leads to stability in the yuan currency.

Estimated Timetable: 3–12 months.

Conclusion

After one of the worst starts to a year for stocks, we do see some cause for optimism. Based on how stocks have historically performed after similarly bad starts to a year, the worst may be behind us. A comparison of market, sentiment, technical, and fundamental indicators to prior bear market lows provides some encouraging signs. And finally, we do see several potential catalysts that could help stocks over the next several months. Although recession odds have risen, a bear market may not necessarily be in the cards.

Thank you to Ryan Detrick for his contributions to this report.

Burt White is chief investment officer at LPL Financial.