A client says: “I need to raise cash. My son, Bobby, invested in some silly scheme to cash in on the EU crisis and lost everything. We are continually bailing him out of big mistakes like this. I wish he were more like his sister, Rose, who can turn anything into a success. We are even making Rose the CEO at our family business and restricting Bobby’s stock so he can’t get any more money for his foolish schemes. He has to earn his own way; I’m not going to help him anymore.”

Now, Bobby is resentful and angry with his parents and his sister, Rose. He continues to speculate in risky schemes and complains that he is not getting his “fair share” of the company earnings; Rose takes a salary as CEO but Bobby only gets enough to pay the taxes on the pass through income. Now the client comes back to you and says that Bobby is joining forces with an investment bank to try to force the sale of the company to a private equity firm to “free up” his capital. Things are getting ugly fast.

Additionally, Rose, who has had exceptional performance for years, is having a hard time because the market for the company’s goods has changed; the company is now playing “catch up” with their competitors.

Why didn’t anyone predict this turn of events? Originally, the solution seemed simple: severely restrict Bobby’s ability to control assets and promote Rose -- a solution designed to “cure” Bobby and reward Rose. But nothing is that simple, especially in a family business.

These “sensible” solutions to the problems are actually enabling the behavioral problems in the family and business and will ultimately lead to disaster. Clients come to you for advice, but what they really need is a setting where they can learn how to fully analyze the family and business situation without falling victim to immediate pressure and leaping to an easy, but inadequate, solution. As the advisor, you can motivate family and business members with confidence in the potential of successful change. And you need tools to define problems, formulate and test solutions, implement solutions, and avoid solutions that spawn more problems in the future.

One such tool is modeling, which deals with internal feedback loops and time delays that affect the behavior of the entire system. What makes modeling different from other approaches to diagnosing and preventing problems in complex family and business systems is the feedback loops, which help describe how even seemingly simple systems can be counter intuitive.

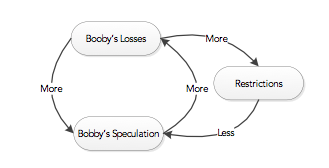

Back to Bobby, who is chronically speculating and losing money. Every time he has a financial crisis, the family leadership intervenes to “bail out” Bobby, and further restricts Bobby’s access to capital. This model looks like:

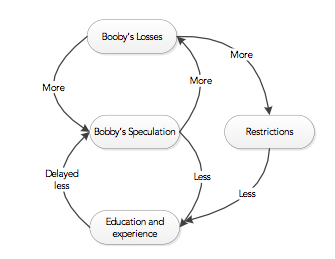

It is now obvious that the restrictions on Bobby never included any instruction or mentoring on how and when to invest capital or judge risk, and Bobby becomes resentful of the capital controls of the client, and then of Rose, as the family leadership. But if the restrictions had been removed, Bobby (over time) could have learned how to manage investments and judge risk. So the reality of the situation actually was:

The client works with Bobby to perform well in the short term while teaching him the insights and long-term sustaining decisions that family leaders seek to have Bobby adopt. A clear picture in the client’s “mind’s eye” and a collective shared vision with Bobby about his role in the family and business system avoids the pressure for the “quick fix” and the resulting cycle of interventions that ultimately creates systemic gridlock.

1. Modeling Action Steps:

a. Identify the original symptom.

b. Map all the “quick fixes” that appear to keep the solution under control.

c. Identify the impact the quick fix solutions have on other parts of the system.

d. Identify fundamental solutions from multiple perspectives.

e. Map unintended effects of quick fixes that undermine the fundamental solution.

f. Find the connection between the fundamental relationships, as well as any links between the effects and solution that cause gridlock.

g. Identify high level actions from the perspective of the client and other organization members.

2. Drafting Prescriptive Actions:

a. Encourage patience - the family leadership should focus on the fundamental solution, but may need to use quick fix solutions to buy time.

b. Elicit multiple viewpoints in the family to differentiate between fundamental and symptomatic solutions, and to gain consensus around an action plan.

c. Explore potential side effects of proposed solution(s) before implementation.

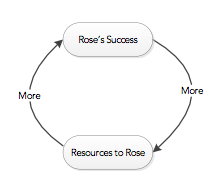

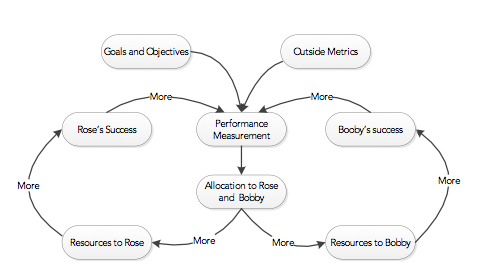

Now, look at the situation where there does not seem to be a problem, such as Rose as CEO of the company. By every measure of performance, Rose excels. At first, the “backing a winner” strategy does not seem to have drawbacks, and looks like:

f

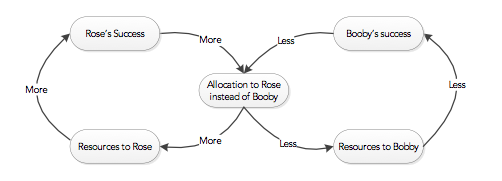

But family resources are finite -- resources given to Rose are not available to Bobby. As Bobby is less and less successful, he gets fewer and fewer resources and Rose, as she is more and more successful, gets more resources.

The error is that the client relies on performance measurements based on what Rose has done in the past, and is not using any performance measurements based on what Bobby has done in the past. The result is that Rose, complacent in her success, does not foster innovation. Because Bobby was always seen as a “marginal” performer in the company, his ideas were ignored until he left. Now, given industry changes, your client recalls that some of Bobby’s ideas for the business would, actually, have given the business a competitive advantage if they had listened to him.

An alternative is to integrate a measuring system for allocation of resources between Rose and Bobby that takes into account the goals and objectives of the company and outside metrics based on industry, market, and other trends.

1. Diagnostic Action Steps:

a. Investigate historical origins of competencies; identify potential complacency traps.

b. Investigate initial conditions and the origins of “rules”.

c. Evaluate the current measurement systems; are they set up to favor current family/business systems over alternatives?

d. Map internal views of family/business success. What are the operating assumptions of “success”?

e. Obtain external views of family/business success. Ask “outsiders” for alternative strategies.

f. Assess the effects on the family/business innovative spirit. Is the current system excluding or limiting the spirit of experimentation that will lead to new alternatives?

g. Continually scan for gaps and areas of improvement.

2. Drafting for Prescriptive Actions

a. Evaluate the current measurement systems to determine if they are set up to favor the established practices over alternatives.

b. Identify the goals and objectives that will refocus on the definition of success to the broader Family/Business system.

c. Calibrate internal views of success against external indicators to identify potential competency traps.

Conclusions

These broad, generic examples fail to reveal important variables that are part of the real family and real business organizations. Your skill will identify the specific leverage points for sustainable change to behavior at an individual or organizational level. Care must to be taken in applying modeling to Family/Business systems in too technical a manner. There is a wide variety of ways that the individuals within the family and the business can behave within the scope of these models. Modeling is useful for communication, vision, and testing, and general prescriptive decisions by those outside of the Family/Business system. For those inside the system, modeling reveals the specific leverage points to make sustainable changes to the behavior of individuals within the system in a more abstract manner, thereby avoiding some of the risk likely of dysfunctional behavior in the future.

Matthew F. Erskine is principal of The Erskine Company LLC, a strategic advisory firm located in Worcester, Mass., that offers expertise in the management of unique family assets, including multimillion dollar family businesses, numismatics collections, fine art and Americana collections, commercial and residential real estate holdings, and family compounds. For more information, visit www.erskineco.com.