The U.S. presidential election is only ten weeks away, and one key topic has been largely absent on the campaign trail in this “unusual” election year: the deficit. While both Hillary Clinton and Donald Trump have floated plans to cut and/ or reform taxes and make significant investment in the nation’s infrastructure (see our Weekly Economic Commentary from August 22, 2016, “Fiscal Policy—String Theory,” for more details), talk of the debt and deficit on the campaign trail has been overshadowed in this election, to put it kindly. We are hopeful that the three scheduled presidential debates, set for September 26, October 9, and October 19, 2016, may provide a forum for such a discussion, as they have in past election cycles. In this week’s commentary, we assess the current state of the deficit and debt as fiscal year (FY) 2016 draws to a close on September 30, 2016, and look ahead to the medium and long-term status of the deficit.

A Look Back

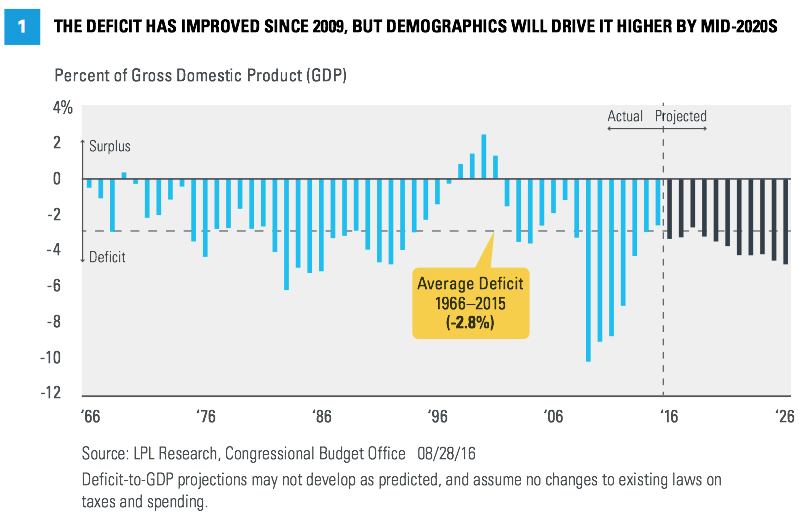

According to a recent report by the nonpartisan Congressional Budget Office (CBO), the United States will likely run a $590 billion deficit in FY 2016, a $152 billion deterioration from the $438 billion deficit racked up in FY 2015. If the CBO is correct, FY 2016 would mark the first year since 2009 that the deficit has increased from the prior year. As a percent of nominal gross domestic product (GDP), the deficit in FY 2016 is expected to be 3.2%, up from 2.5% in FY 2015 [Figure 1], leaving the public debt- to-GDP ratio—a key metric for global financial markets to assess the creditworthiness of a country—at just under 77% [Figure 2].