Passive equity indexes enjoyed a bull market run for several years following the global financial crisis, and it’s difficult to argue against inexpensive yet powerful beta returns. However, the equity markets’ more challenged performance since last summer has reinforced for many investors that the run of high returns and low volatility since 2009 may be over.

Indeed, current full valuations and expectations of slow global growth should lead to much lower returns in our opinion. Thus, simple exposure to equity beta will likely no longer be enough for investors to achieve their return targets.

If anything, a lower-return environment increases investor demand for sources of alpha, and yet excess returns have been hard to find. We believe traditional active managers have struggled recently in part because factor biases, such as value or size, have overwhelmed their skills in stock selection.

Nothing is inherently wrong with tilting portfolios to factors. However, relatively inexpensive quantitative methods can capture known factor exposures – these systematic equity strategies include smart beta and other factor-based approaches. In a sense, these strategies sit between passive beta and active alpha, offering potential value to both institutional and individual investors. That said, it is important to pick smart beta strategies with long-term viability, potentially using similar methods to those for selecting active managers.

ELUSIVE EQUITY ALPHA

Finding excess returns in equities used to be easier. Markets, while relatively efficient, included pockets of opportunity for disciplined investors. With the rise of professional money managers, the obvious mispricings have become rarer and successful excess return generation has become an institutional process.

Further, even for the purest stock picker, we believe excess returns are rarely only stock-specific, but come from both stock-specific and factor returns.

Factor returns represent the performance attributable to systematic factor biases of the portfolio manager, sometimes intended, but more often not. In other words, what is typically referred to as “alpha” is actually a combination of idiosyncratic returns and factor tilts (see Figure 1).

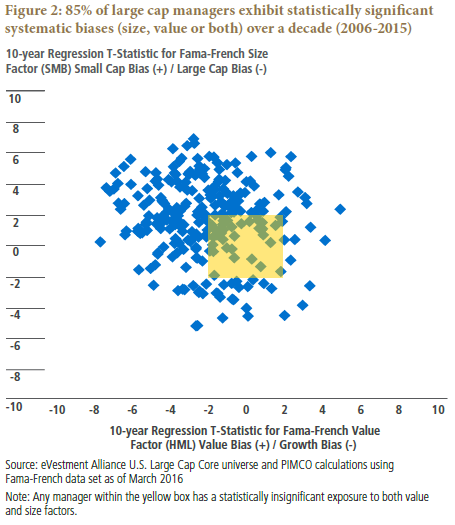

Looking at a universe of large cap managers with a 10-year sample (see Figure 2), we find that nearly 85% have factor biases that are not only statistically significant, but also persistent over long periods of time.

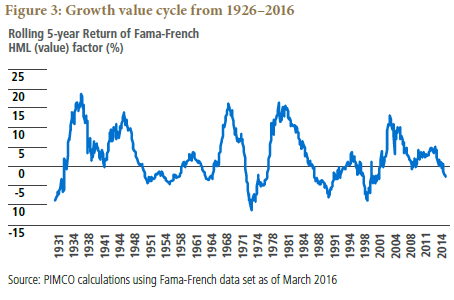

When evaluating managers, it is important to consider that factor returns tend to be cyclical. Performance moves in cycles for paired groups like growth and value, large and small capitalization and high and low quality. For example, while studies show value delivers a return premium over the long term, there are frequent shorter-term periods of growth outperformance (see Figure 3).

This partially explains the real world experience of manager selection, where high-performing managers often seem to underperform right after being appointed. This is because management styles with persistent factor biases go in and out of favor with the markets, leading to the common refrain of the underperforming manager, “My style is out of favor!”

FACTOR BIASES CAN BE A GOOD THING

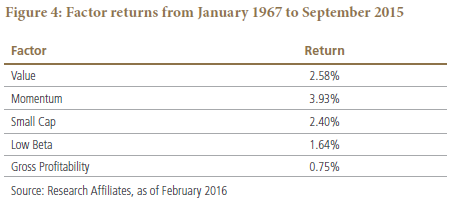

One could argue many managers are not truly active given the persistent nature of these tilts. Unlike “closet indexers,” managers with significant tilts may appear to be quite active and exhibit high active share. And in reality, they may also produce compelling excess returns at times, since factor tilts include premiums that can be harvested (see Figure 4).

Passive strategies usually refer to trading methods that mimic market-capitalization-weighted indexes. Smart beta, on the other hand, uses alternative methods of weighting equity portfolios to capture return premiums and to reduce volatility caused by concentration in high-market-cap stocks. In this discussion, smart beta is a broad term and includes a range of strategies, from single-factor to multi-factor and from static to dynamic factor exposure. Most importantly, these strategies are explicit about the factor exposures they introduce and hence should prove to be reliable ways of seeking to capture the relevant premiums.

Since many of these strategies are indeed systematic and result in a portfolio with relatively slowly changing constituent weights, the costs associated with managing them tend to be lower than those of many active strategies. Interestingly, for taxable investors, low turnover rates of some smart beta portfolios confer another benefit of minimizing short-term capital gains, which often are taxed at higher rates.

Therefore, when confronted with the choice between active and passive, investors – both institutional and individual – should consider systematic approaches where factor tilts are harvested as part of the strategy, offering some of the benefits usually associated with active management at a potentially lower fee.

HOW TO TELL IF SMART BETA IS SMART

Selecting active managers requires significant due diligence and a deep understanding of how they may add value. The prevailing view in the industry is that one should select managers with quality research, consistent investment criteria and high active share, emphasizing potential returns arising from stock selection. The analysis also should acknowledge the manager’s factor tilts, with the manager fully aware of these factor biases and able to articulate why they should exist in their portfolios, and why they ultimately should benefit portfolio performance.

Selecting the right systematic equity or smart beta provider demands similarly careful analysis and quantitative evaluation. Good questions to serve as a guide to manager selection include:

– Is the strategy over-reliant on back-tested results or is there a live track record to evaluate?

– Does the manager offer an intuitive and rational explanation as to why the strategy should work in the future, or is the model more of a black box?

– Is the strategy overly simplistic, which could lead to unintended consequences such as high industry concentration or exposure to “value traps?”

– Does the strategy take into account liquidity and transaction costs, which affect capacity and implementation? – Are the models static or do they evolve and incorporate new insights driven by ongoing research?

Factor-based strategies are not a silver bullet that leads to consistent outperformance. Even the most robust strategies will experience periods of underperformance versus traditional indexes. These periods can be relatively long – as illustrated by the recent experience of value underperforming growth over the past 10 years. But this underperformance can also be explainable, particularly if the strategy is transparent, and over time these factor exposures can be accretive to portfolio performance.

We believe a more challenging market environment lies ahead, but investors have more tools today. And through thoughtful due diligence, investors can target that much-needed outperformance over traditional capitalization-weighted equity indexes.

Andra F. Pyne is an executive vice president and product manager in PIMCO's Newport Beach, Calif., office, focusing on equity strategies.

Markus Aakko is an executive vice president and account manager in the Newport Beach office, servicing institutional clients.