I. Conventional Wisdom for Commodities and Precious Metals

Conventional wisdom holds that commodities and precious metals, individually or collectively, are relatively useless in protecting an investor’s portfolio against rising inflation. If we expect recent excess monetary stimulus to result in consumer prices spiking upward, then the inclusion of such assets within a portfolio will have little if any beneficial impact.

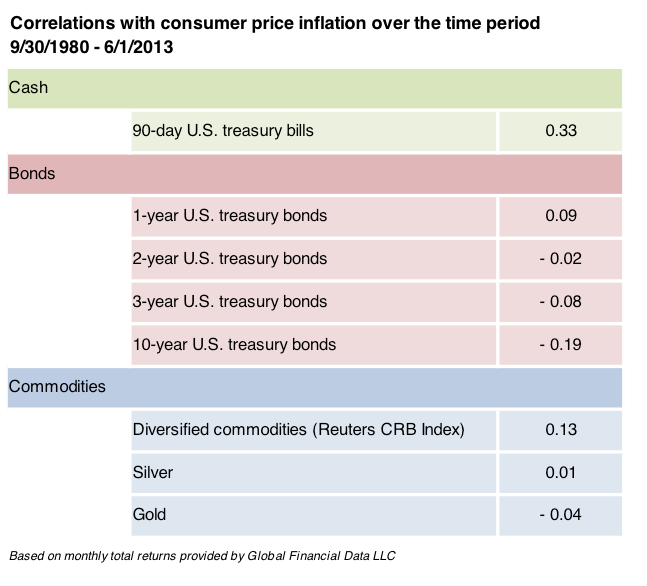

The basis for this perspective is recent experience. Specifically, over the last 33 years, these two asset categories have provided little to no inflationary protection. Worse yet, over this time period, cash equivalents had been a far more powerful inflation-offset. The summary statistics are as follows:

As shown by these correlations, commodities have tended to appreciate in conjunction with rising inflation (and vice versa). However, the effect has been so weak (i.e., a correlation of just 0.13) as to be inconsequential. As a result, many have concluded that commodities and precious metals provide no protection against the ravages of inflation. This conclusion, however, is incorrect and remains unsupported by the data. Its falsehood results from an evaluation of the relative behaviors (e.g., commodities versus inflation) during a time period for which there was no appreciable increase in inflation. The contention I put forward below and back up with the relevant data, is that both of these asset categories (and in particular their usage in combination) provides an outstanding inflation mitigant. Let’s examine the data.

II. Basis For The Claim

The analysis presented herein compares monthly all-urban consumer price inflation with the coincident performance of cash equivalents, bonds, and commodities:

• Cash equivalents are represented by 30-day US Treasury bills,

• Bonds are represented by 1-, 2-, 3-, and 10-year US Treasury bonds, and

• Commodities are represented by the diversified CRB commodity index, spot silver, and spot gold.

All data were provided by Global Financial Data, San Juan Capistrano, CA and spanned the time period 12/31/1896 through 6/1/2013. By using past returns, I am in effect assuming that the future will be characterized by return patterns similar to the past - although how we get there or the associated causality may be different. The last 117 years provides a robust characterization for our potential future, in that it contains two great depressions, several great recessions, a number of extended periods characterized by prolonged rapid economic growth, and most importantly, eleven episodes of rapidly rising inflation.

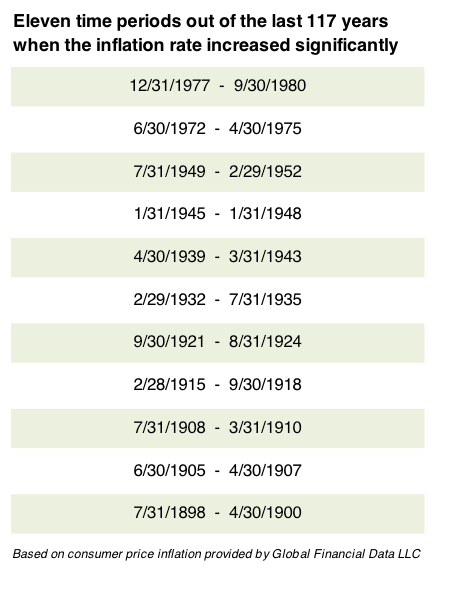

During these eleven episodes, commodities and precious metals performed well. It is critical to understand that these eleven periods were not defined by high absolute levels of inflation (e.g., inflation at 9% instead of at 1%). Instead they were characterized by a large, absolute increase in the level of inflation. For example, inflation increased from a prior +1% to a new higher +9% or inflation had been running at -10% and then increased to a new higher rate of +1%. In other words, the second derivative of the consumer price level reached an exceptionally high value. The eleven periods of pronounced increase in the rate of inflation were:

Again, to reiterate, these periods are not defined by high absolute inflation rates. Instead they are characterized by sizable increases in the rate of inflation. It is during these periods that investor expectations for future inflation skyrocketed. Nevertheless, observe just how different one period can be from the next:

Consider the sixth period spanning 2/29/1932 through 7/31/1935. For the 18 months just prior to the initiation of this sixth episode, consumer prices had changed by -14.55% (i.e., they had fallen by 14.55%). However, by the end of this sixth episode, the most recent 18 months had experienced an increase in the price level of +3.79%. From beginning to end, the rate of inflation had realized an absolute increase of +18.34% (i.e., 18.34% = 3.79% minus -14.55%).

Consider the first period spanning 12/31/1977 through 9/30/1980. For the 18 months just prior to the initiation of this first episode, consumer prices had increased by 20.34%. However, by the end of this first episode, the most recent 18 months had experienced a far more modest increase of only 9.33%. From beginning to end, the rate of inflation had experienced an absolute increase of +11.01% (i.e., 11.01% = 20.34% minus 9.33%).

Collectively, these eleven episodes of significant increase in the rate of inflation (large positive second derivative of the price level) comprised 30.25 years from out of the last 114.62 years (12/31/1896 – 6/1/2013). In other words, our economy experienced problematic increases in the rate of inflation 26% of the time. It was during these 30+ years that commodities and precious metals performed unusually well. Just how well, is the subject of the next section.

III. Simulations And Results

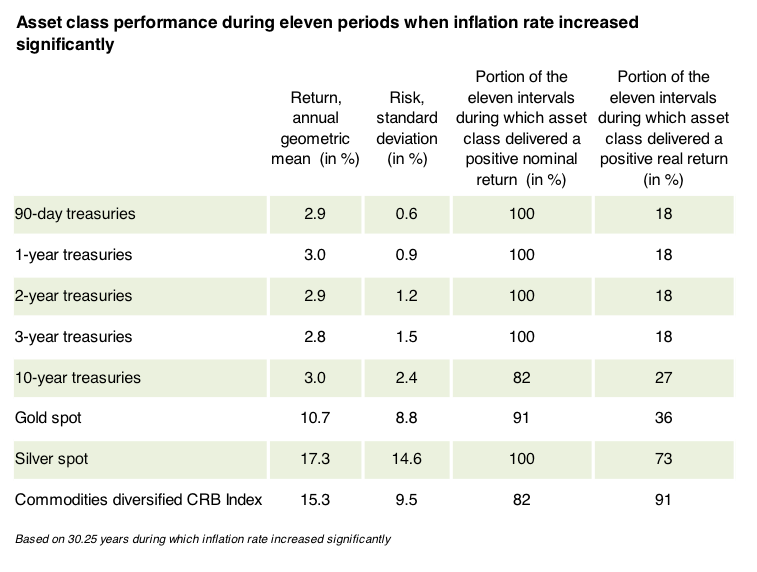

The following table provides the summary statistics for each of the eight asset categories evaluated in this article. These results are restricted to the specific 30.25 years identified above and reveal what happens when the rate of inflation shifts upward.

The last three columns, of this table, provide the summary statistics for spot gold bullion, spot silver bullion, and for diversified commodities as represented by the CRB total return index. Consider the last column (diversified commodities). During the eleven episodes characterized by major increases in the level of inflation, the CRB Index returned an average annual geometric return of 15.3% with an annualized standard deviation of 9.5%. Moreover, these returns were positive in 82% of the intervals (nine of the eleven intervals) and were greater than the rate of inflation, delivering a positive real return 91% of the time (ten of the eleven intervals). Clearly, commodities and precious metals deliver surprising robust and attractive return patterns during periods of significant inflation increases.

IV. Conclusions

If the Federal Reserve loses control over the financial economy (as opposed to the real goods and services economy) and is unable to prevent the rapid monetization of the history-making level of private bank reserves (reserve balances held by banks at the Fed) and the associated increase in the velocity of money, then we are likely to experience a twelfth episode of increased inflation levels. During such a period, commodities and precious metals can be expected to perform well.

History provides some idea as to what we could expect. Potentially, such a future period might most closely mimic the eighteen months ending on 2/28/1951. During this eighteen month period, unannualized inflation and asset class returns were as follows:

Just prior to the inception of this eighteen month interval, inflation had been running at a quite benign 1.3% rate (over the preceding eighteen months), much as it is today. But by the 2/28/1951, the rate of inflation had shot upward by +6.7% (i.e., 6.7% = 8.0% minus 1.3%). This is the sort of environment during which one would expect commodities and precious metals to perform well. As advisers to our clients, our role is to help them understand the type of environment during which such specialized asset categories will outperform. History demonstrates that they will lag and underperform unless we experience a sufficiently large spike upward in the rate of inflation (as opposed to a simple spike upward in the price level) - we require a large increase in inflation, not just a high level of inflation.

Rob Brown, PhD, CFA is chief investment strategist at United Capital Financial Advisers, LLC.