I. Conventional Wisdom for Commodities and Precious Metals

Conventional wisdom holds that commodities and precious metals, individually or collectively, are relatively useless in protecting an investor’s portfolio against rising inflation. If we expect recent excess monetary stimulus to result in consumer prices spiking upward, then the inclusion of such assets within a portfolio will have little if any beneficial impact.

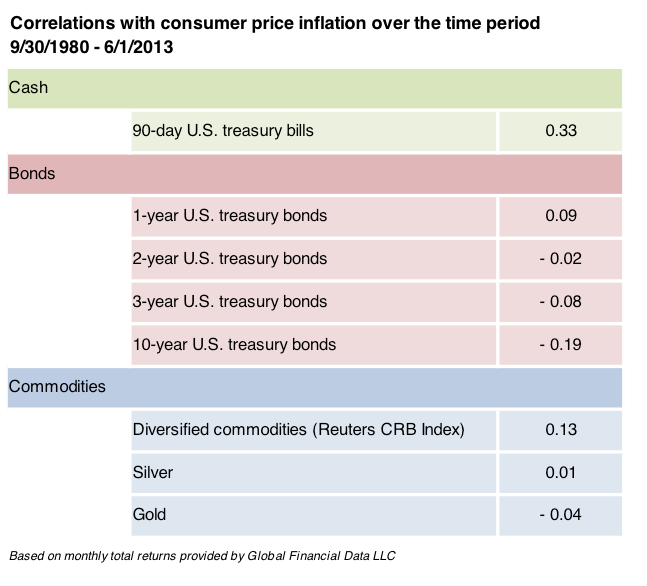

The basis for this perspective is recent experience. Specifically, over the last 33 years, these two asset categories have provided little to no inflationary protection. Worse yet, over this time period, cash equivalents had been a far more powerful inflation-offset. The summary statistics are as follows:

As shown by these correlations, commodities have tended to appreciate in conjunction with rising inflation (and vice versa). However, the effect has been so weak (i.e., a correlation of just 0.13) as to be inconsequential. As a result, many have concluded that commodities and precious metals provide no protection against the ravages of inflation. This conclusion, however, is incorrect and remains unsupported by the data. Its falsehood results from an evaluation of the relative behaviors (e.g., commodities versus inflation) during a time period for which there was no appreciable increase in inflation. The contention I put forward below and back up with the relevant data, is that both of these asset categories (and in particular their usage in combination) provides an outstanding inflation mitigant. Let’s examine the data.

II. Basis For The Claim

The analysis presented herein compares monthly all-urban consumer price inflation with the coincident performance of cash equivalents, bonds, and commodities:

• Cash equivalents are represented by 30-day US Treasury bills,

• Bonds are represented by 1-, 2-, 3-, and 10-year US Treasury bonds, and

• Commodities are represented by the diversified CRB commodity index, spot silver, and spot gold.

All data were provided by Global Financial Data, San Juan Capistrano, CA and spanned the time period 12/31/1896 through 6/1/2013. By using past returns, I am in effect assuming that the future will be characterized by return patterns similar to the past - although how we get there or the associated causality may be different. The last 117 years provides a robust characterization for our potential future, in that it contains two great depressions, several great recessions, a number of extended periods characterized by prolonged rapid economic growth, and most importantly, eleven episodes of rapidly rising inflation.

During these eleven episodes, commodities and precious metals performed well. It is critical to understand that these eleven periods were not defined by high absolute levels of inflation (e.g., inflation at 9% instead of at 1%). Instead they were characterized by a large, absolute increase in the level of inflation. For example, inflation increased from a prior +1% to a new higher +9% or inflation had been running at -10% and then increased to a new higher rate of +1%. In other words, the second derivative of the consumer price level reached an exceptionally high value. The eleven periods of pronounced increase in the rate of inflation were: