Oil prices have fallen nearly 70% from $107 per barrel in July 2014 to near $33 in February 2016. The reason is well known and summed up perfectly in a recent report from the International Energy Agency—the oil market is drowning in oversupply. The magnitude of the decline has surprised market participants and sparked a host of fears about domestic and global economic growth. In a market full of negative headlines, it is important to remember that while lower oil prices are a threat to energy companies and oil-exporting countries, there are other areas of the market that may benefit.

In part 1, we review potential sector and industry beneficiaries if oil prices remain low for the foreseeable future. In part 2, we will take a closer look at the consumer, as well as the countries and regions across the globe.

HOW TO POTENTIALLY BENEFIT FROM LOW OIL

Businesses can benefit from lower oil prices in two ways: through cost savings (for companies using oil as a production input) and through consumers, as they spend more of their energy savings. Both methods can lead to potentially higher profits.

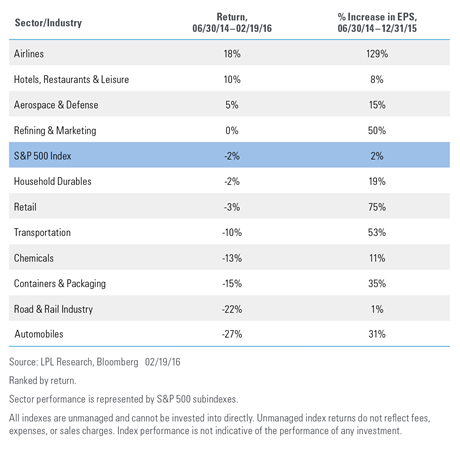

Low oil prices translate into lower fuel and energy costs for companies and more income for consumers, but not necessarily stock gains. Figure 1 shows stock returns and earnings growth from sectors that are expected to benefit from lower oil prices. A few sectors have managed gains in a difficult market environment and, perhaps more importantly, all have witnessed better financial results (as measured by earnings per share [EPS]). Some sectors have been punished, as market sentiment remains fragile due to concerns about future demand offsetting the benefit of lower energy costs. Still, if the U.S. avoids a recession and oil prices remain lower for longer, the valuations assigned to these industries may seem low in hindsight.

Figure 1. Many Industries that Benefit from Lower Oil Prices Have Been Punished by Market Sentiment

POTENTIAL SECTOR WINNERS

Airlines

Airlines stand to possibly benefit both from cost savings and increased consumer demand. As of the third quarter of 2014, prior to the steep drop in oil prices, fuel accounted for approximately 31% of costs, on average, for U.S. airlines.[1] As of the third quarter of 2015 (latest available data), that number had fallen to 18%, and may fall further given continued oil price declines. In 2015, U.S. carriers used 541 million more gallons of fuel than they did in 2014, as revenue passenger miles increased by almost 6% between October 2014 and October 2015.[2] However, even with the higher fuel usage, airlines saved almost $16 million (or 33%) compared with 2014 spending, as the average price paid per gallon fell from $2.86 to $1.86.

Fares decreased by approximately 5% and 3%, respectively, in 2014 and 2015, according to Consumer Price Index (CPI) data. Lower fares may increase demand and, along with lower costs, may boost airline profitability. Earnings results support this, with the S&P airlines industry seeing profit margins increase from 3% in the fourth quarter of 2014 to more than 15% in the fourth quarter of 2015. Trailing 12-month EPS more than doubled over the same time period, while revenue per share was also up more than 28%.

The improved financial results helped the S&P Airlines Index rise 18%, compared to a 2% decline for the broad market as measured by the S&P 500, from mid-2014 through February 19, 2016. Airlines may not have been able to take full advantage of lower oil, however, because many companies had hedged fuel costs. Although this was a positive during periods of rising fuel costs, it prevented many airlines from fully realizing the benefits of lower oil prices. Increased competition and a strong U.S. dollar have also hurt performance recently; but ultimately, the airlines industry is one beneficiary of lower oil prices.