MIXED RESULTS

Retail

Energy cost savings point to retail as a beneficiary of low oil prices, but results are mixed. Forward-looking investors have punished some companies in anticipation of a slower economy while rewarding those showing greater resilience. However, financial results, on average, have been strong, with earnings growth for retailers over the period rising by 72%.

Retail stocks overall have fared slightly worse than the broad market during the past 19 months, declining by 3% (S&P 500 Retail Select Index) compared to a 2% decline for the S&P 500, but these results hide a disparity. Stocks of the 30 largest retailers, based on market capitalization, are up 31% (S&P 500 Retail Index) during that period. The retail group contains a broad range of companies from online retailers, home improvement stores, and traditional stores.

TECHNOLOGY DEALS A BLOW TO PEAK OIL THEORY

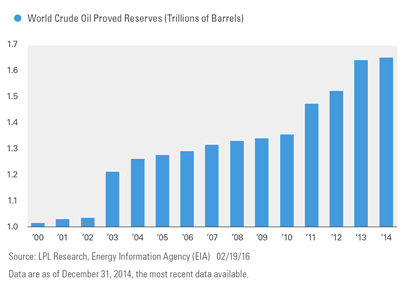

The oil supply glut can best be illustrated by showing the rapid growth of reserves in recent years. The U.S. Energy Information Administration (EIA) tracks two important metrics related to oil reserves: proved reserves and technically recoverable resources. Proved reserves refer to the amount of oil that is able to be recovered economically at current prices and with current technology [Figure 2]. Unproved technically recoverable resources are broader, and include “tight oil,” commonly refered to as shale oil, and other types of unconventional resources.

Figure 2: World Proved Reserves Have Increased Steadily over the Past 10 Years

Proved reserves have increased steadily over the past few years, partly due to increased oil prices, which make it economically feasible to extract oil that may have been too expensive to recover previously. However, the EIA’s estimate of unproved technically recoverable resources related to tight oil increased at a much faster rate. Though the EIA is continuing to assess tight oil resources across the world, estimates increased from 32 billion barrels in 2011 to 345 billion in 2013, and have since been updated to nearly 419 billion barrels. To put this in perspective, the 313 billion barrel increase between 2011 and 2013 is larger than the entire proved reserves of Saudi Arabia (280 billion barrels). As technology continues to evolve, access to previously unknown reserves is likely to develop, meaning the world isn’t likely to run out of oil anytime soon.

WHAT IS THE CASE FOR OIL STAYING LOWER FOR LONGER?

Although higher oil prices remain in our memory, a number of factors suggest oil prices may remain low relative to what we have experienced in recent years.

Short term:

1) U.S. production has proven resilient in the face of lower prices and supply is down only modestly. Though this may change in the near future, the resiliency of U.S. oil producers has surprised markets.

2) OPEC has shown reluctance to cut supply, driven by fear over losing market share.

3) Russia and other nations more dependent on oil revenue continue to pump to maintain cash flow for national budgets.

4) Iran may add more than 1 million barrels a day of oil in the absence of sanctions.

Long term:

1) Improving technology and higher fuel efficiency mandates may reduce demand.

2) Environmental concerns continue to increase demand for alternative energy.

3) Continued improvements to battery technology and electric car capabilities may expand the use of electric vehicles.