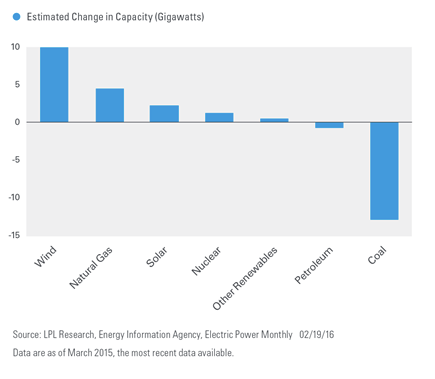

The persistence of low oil prices may give the sectors discussed above a tailwind, assuming a fairly steady path for the broad economy. Outside of a major shift in policy from OPEC, or a surprise pickup in economic growth that pushes demand higher quickly, the case for a spike in oil prices over the short term appears unlikely. While we believe that current low oil prices may not be sustainable, they may remain subdued over the intermediate term given that supply and demand are not projected to equalize until sometime after late 2016; in addition, technology improvements and environmental concerns may keep a lid on oil prices in the long term. Even the steep decline in 2015 wasn’t able to stop the momentum of renewable energy, with petroleum-based power generation losing ground to renewables such as wind and solar, though natural gas also saw gains [Figure 3].

Figure 3: Lower Oil Prices Didn’t Stop the Momentum of Renewable Energy in 2015

CONCLUSION

Outside of a surprise production cut from OPEC or an acceleration in global growth, low oil prices may linger. Long-term factors may keep oil prices low relative to recent years, which may mean that $100 oil is the anomaly in the future. This would be a headwind for the energy industry and countries exporting large amounts of oil, but consumers overall are likely to benefit from lower prices, as are the sectors and industries of the market exposed to lower energy input costs or increasing consumer disposable income.

Anthony Valeri is investment strategist for LPL Financial.