It’s been nearly a decade since the global financial crisis prompted an onslaught of regulations intended to abolish excessive risk-taking and make the financial system safer. Yet the implementation of reforms – and their disruptive effect on financial business models – will peak only over the next few years. As Dodd-Frank and Basel regulations come into force and a further wave of regulatory reform is announced, we believe banks will exit more non-core businesses, specific funding gaps will become more acute and dislocations between public and private markets will become more frequent. Each will create investment opportunities for less constrained and patient capital to capture economic profits being ceded by banks.

The lengthy process of financial sector reform is not a surprise given its complexity. Passed in July 2010, for instance, the Dodd-Frank Wall Street Reform and Consumer Protection Act runs to more than 350,000 words. Many details were left to administrators to define – and at the end of 2015, fewer than 60% had been implemented. Basel III regulations, intended to increase liquidity and decrease leverage at banks, were published in late 2009, but will not be fully implemented until 2019. Bankers are already fretting over “Basel IV,” a collection of rules being contemplated that would tighten the screws even further.

Although most banks have increased their capital significantly, they face intense shareholder pressure to improve returns on capital. Yet even tighter regulatory capital requirements and mounting compliance costs will continue to pose challenges. Between 2011 and 2015, for instance, JPMorgan Chase nearly doubled its compliance and controls staff to 43,000, or 18% of total staff. Leadership changes at Barclays, Credit Suisse, Deutsche Bank and others underline the pressures these institutions face.

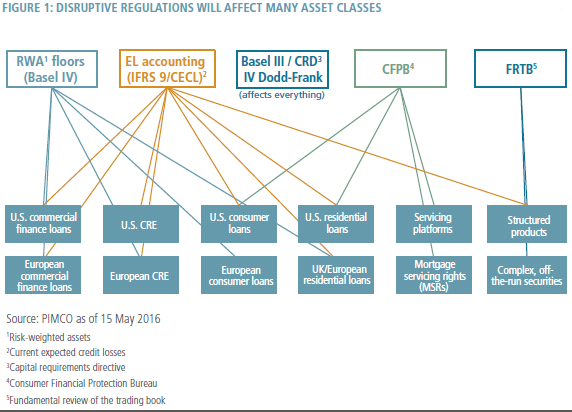

Figure 1 illustrates the complex web of regulation that will create ongoing pressure on banks in the form of:

-

Higher capital requirements

-

Higher loss provisioning

-

Higher compliance costs