Most portfolios have enjoyed some recovery in recent weeks from the Fed fear factors that roiled the markets in May and June. But this spring’s market gyrations emphasize the importance of holding onto some basic truths about short-term versus long-term investing.

Active traders may try to make big short-term money by identifying mispriced assets and picking the right stocks and industry sectors. But for most investors, with longer-term horizons, using the power of diversification is what matters most for reducing the likelihood of portfolio losses and maximizing long-term returns. Knowledge about how different stock market sectors move in relation to the broader market over a multi-year time horizon can provide the roadmap to better investment results.

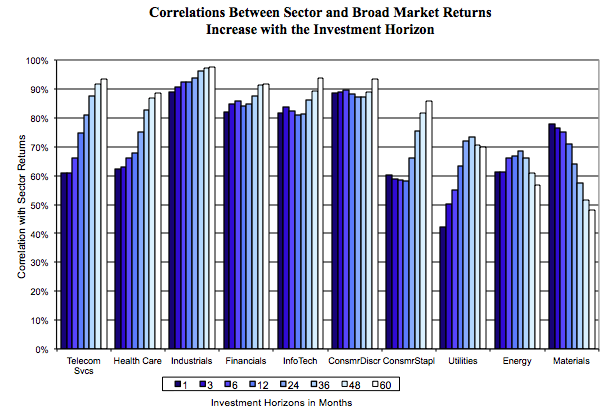

An analysis by the National Association of Real Estate Investment Trusts (NAREIT) yields some surprising findings. In the short-term, the returns of many industry sectors show only moderate correlation to the broader market, and thus seem to provide portfolio diversification. However, on a five-year basis, most stock market sectors are approximately 90 percent correlated with the S&P 500 Index. Consequently, spreading your investments across industry sectors provides relatively little meaningful diversification over the longer term.

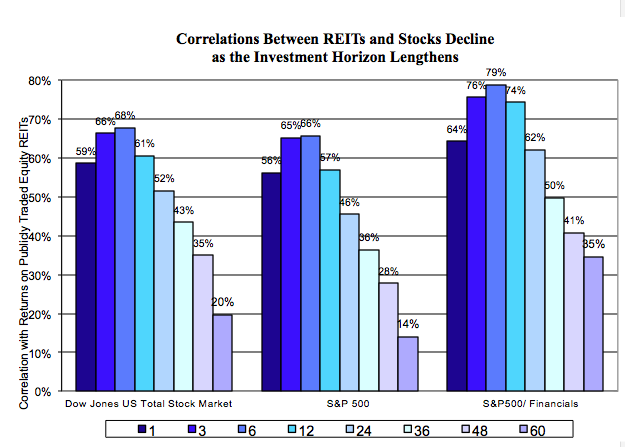

There is one segment of the stock market, however, that provides dramatically lower – and steadily declining – correlations to the broader market over holding periods ranging from six months to five years: publicly traded REITs. Adding REITs to a portfolio offers potentially more promising opportunities for portfolio diversification within the stock market.

Over time, most sector movements match the stock market

If you look at very short-term time periods – a day, a month, six months – there are considerable differences in the movements of different stock market sectors. In technical terms, correlation with the broader market is relatively low.

But for most sectors, the longer the period, the closer the individual sectors tend to match the overall stock market trend. A NAREIT analysis used public market data to compute correlations for various industry sectors versus broad market benchmarks such as the Dow Jones Total Market Index and the S&P 500 Index from January 1990 through March 2012, and looked at investment horizons ranging from one-month (annualized) returns to 60-month (annualized) returns.

The charts below show how return correlations between several industry sectors and the Dow Jones Total Market Index increase as the investment horizon lengthens. Over a 60-month (five-year) time horizon, many sectors – including industrials, financials, technology, healthcare, consumer discretionary, and telecom – are correlated with the stock market as a whole by 89 percent or more. Energy and materials industry stocks are less correlated as they are linked more than other industry sectors to commodities cycles.

These kinds of changes can make a huge difference in portfolio strategy. They suggest that many stock sectors provide little diversification benefit relative to the broad market for investors with relatively long investment horizons.

Perhaps even more surprising, the same pattern holds when listed REIT returns are compared with the Financial sector of the stock market—the sector in which equity REITs are classified. For example, the REIT-stock correlation is measured at 79 percent over six-month investment horizons, but only 35 percent over 60-month investment horizons.

Source: NAREIT

Let’s keep in mind that REITs today play a meaningful role in the U.S. economy, real estate sector and capital markets. They essentially house various kinds of dynamic economic activity such as where we work, where we shop, where our goods are made or shipped, the apartments, hotel rooms and health facilities many of us may use, and even where our data is stored. At the end of 2012, U.S. REITs owned about $1 trillion in commercial real estate assets, and they directly and indirectly supported some 1 million U.S. jobs.

The REIT approach to real estate investment has a long and sustained track record of success and shareholder value creation. Publicly listed U.S. equity REITs have provided competitive total returns compared to other assets. Indeed, U.S. REIT total return performance over the past twenty years has outstripped the performance of the S&P 500 Index, the Barclays U.S. Aggregate Bond Index and other major equity and fixed income indices, as well as the rate of inflation.

While REITs and many other stocks and bonds were jostled by market turmoil in May and June of this year, the dip in REIT share prices relative to the broader market may represent an entry point for some investors to an asset class that should be a staple of long-term investment portfolios. The potential portfolio diversification power of REITs, coupled with their competitive total return performance, high dividend payouts and potential inflation-hedging capability, underscore the benefits of REIT allocations for many investors with longer-term objectives.

REITs offer the most long-term diversification

With publicly traded REITs, however, the pattern is reversed: publicly traded equity REITs. As the chart below shows, correlation with the broader market is only moderately high even when measured over short investment periods. But it declines dramatically when investment horizons lengthen. This makes REITs a potentially beneficial asset for portfolio diversification for investors with longer-term horizons.

For example, the correlation of listed equity REIT returns (as measured by the FTSE NAREIT All Equity REITs Total Return Index) and the Dow Jones Total Stock Market Index is 68 percent over six-month horizons, but only 20 percent over 60-month horizons. And for the S&P 500 Index, correlation with REITs is only 14 percent over 60-month horizons.

Portfolio risk and returns – with and without REITs

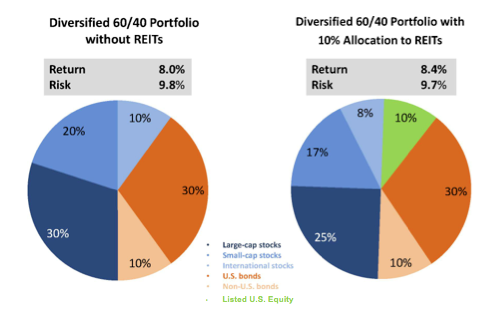

A key portfolio benefit of diversification is the potential to increase long-term returns without taking on additional risk. Diversification aims to mitigate portfolio volatility, the risk that investors will see strong up-and-down cycles in the total value of their portfolio.

The chart below illustrates how long-term investors can take advantage of greater diversification opportunities with larger holdings of listed REITs within their stock portfolios. Reallocating 10 percent of a diversified 60 percent stock/40 percent bond portfolio to equity REITs would have improved annual returns by 0.4 percentage points per year on average for the 20 years from 1992 to 2012. That could add up to substantial additional dollars over time without additional risk compared to a portfolio without REIT holdings.

Diversification with Equity REITs Potential to Increase Returns without Increasing Risk

Back to fundamentals

Market data demonstrate that a diversified portfolio that includes listed REITs can reduce the volatility and risk of loss and enhance long-term returns. There is also a fundamental case for investing in REITs to gain exposure to U.S. economic trends and the general long-term rise in commercial real estate rents and values that propel REIT stocks as the economy grows.