Dividend stocks have been thriving in the low interest rate environment. Dividend-paying stocks, which we define as stocks with higher dividend yields than the broad equity market, have garnered support as investors increasingly use stock dividends as a substitute for fixed income in the low interest rate environment. But has the market’s thirst for yield gone too far? Are these stocks in a bubble? This week we take a look at high-dividend-paying stocks to assess whether these stocks are in a bubble and if investors should actually view high dividend yields as a warning sign.

DIVIDEND MANIA

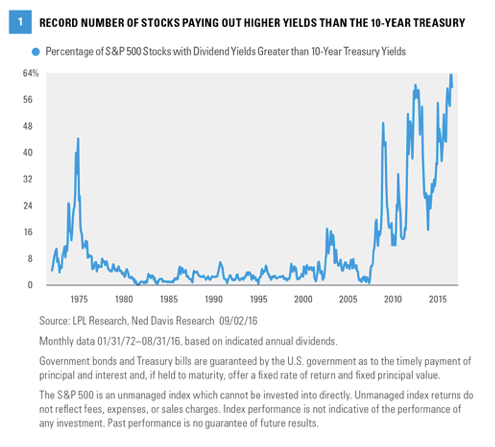

There are a number of reasons for the increased popularity of high-dividend-paying stocks. First, bond yields are near record lows due to central bank stimulus worldwide and low inflation, leading investors to increasingly favor higher yields offered by equities over bonds — despite the higher volatility that comes with that swap. In fact, the percentage of S&P 500 stocks with dividend yields higher than the 10-year Treasury yield is over 60%, which is the highest it’s been since at least 1970 [Figure 1]. No wonder more investors are turning to equities for yield.

Friday’s slightly weaker than expected jobs report (released on September 2, 2016) will potentially add to the enthusiasm for dividend-paying stocks, as the report may take a September 2016 Federal Reserve (Fed) rate hike off the table (we still expect a Fed rate hike in December after a largely election-related pause at the Fed meeting in early November).

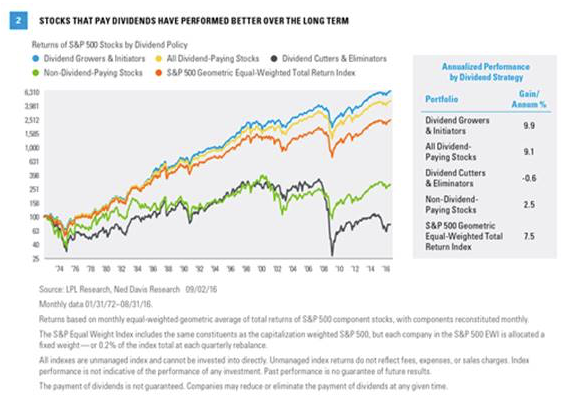

Stocks that pay dividends have also performed better over the long term. Figure 2 separates stocks by dividend policy and shows that stocks that have paid dividends have returned 9.1% annualized since 1972, compared with just 2.5% annualized for non-dividend-paying stocks. Though more scarce, companies that have initiated or grown their dividends have historically performed best, with a 9.9% annualized return over this long period. Companies know that investors like dividends and they deliver them as much as they possibly can.

ARE DIVIDEND PAYERS EXPENSIVE?

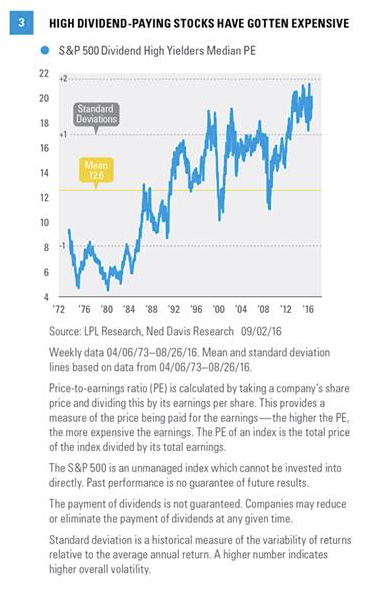

Have investors become overly excited about dividend payouts? Perhaps. Figure 3 shows the median price-to-earnings ratio (PE) of high-dividend-paying stocks, at just over 19, has risen well above its more than 40-year average of just over 12.5 (that’s nearly two standard deviations, which is a pretty big margin). That’s expensive. But when comparing the PEs of high-yielding stocks against the broad market, they do not look so expensive—the median PE of the S&P 500 is 24, also well above its long-term average near 16. (Note that because median calculations are not dominated by mega caps, median valuations provide a broader picture of stock valuations than market cap weighted valuation measures, although we believe both valuation measures have merit.)

We have written repeatedly that we believe the equity market is slightly expensive. We have also noted that the popular dividend-paying sector, utilities, is richly valued at a premium to the S&P 500 on a market cap weighted PE basis (11% premium to the S&P 500 as of September 2, 2016). So although we would agree that the market’s thirst for yield has pushed valuations of high-dividend-paying stocks above fair value, it is hard to make the case that they are much more expensive than the stock market as a whole; thus, we do not think these stocks are in a bubble.

In addition, we do not expect high PEs to be a catalyst for a sell-off in high-dividend-paying stocks. Should stocks sell off, especially if accompanied by a rise in interest rates that makes those dividends relatively less attractive when compared with bonds, then we would expect high yielders to suffer as much—if not more than—the broad market. This was the experience during the Fed “taper tantrum” in May and June 2013, which saw interest rates rise sharply, the S&P 500 pull back 6%, and high-yielding stocks lead the way down.

ARE DIVIDEND PAYERS STRETCHED?

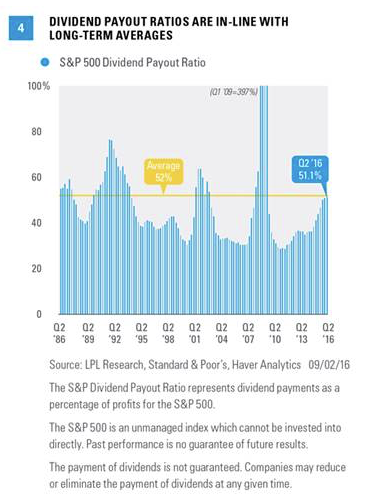

How can dividends keep climbing when corporate profits are still stuck in the mud? Dividends for the S&P 500 are growing at a rate of about 5.5% annually, while earnings for the S&P 500 fell 2% year over year in the most recent quarter (second quarter of 2016). Although analysts’ consensus forecasts are for mid-single-digit dividend growth to continue over the next 12 months (according to FactSet data), clearly this pace of growth without profit growth is not sustainable over the long term. Something’s got to give.

The S&P 500’s payout ratio helps show that these dividend payouts are not out of line relative to corporate profits [Figure 4]. In fact, dividend payments as a percentage of profits for the S&P 500 are actually still in-line with the long-term average, after climbing from the depths of the financial crisis. Dividend growth may be limited until companies can generate more profit growth, but payout ratios do not suggest companies are over-distributing (we see a similar story with share repurchases as we discussed in Midyear Outlook 2016).

Might profit growth help the dividend picture? If the oil and U.S. dollar drags ease further, corporations should start to generate earnings growth—we expect a potential increase into the mid-single-digits during the fourth quarter of 2016 and hopefully a bit better as 2017 begins. Better economic growth in the U.S. and emerging markets, we believe, may also help give profits a potential lift in coming quarters, which could be accompanied by more dividends.

INVESTMENT IMPLICATIONS

If dividend growth continues and high-dividend-paying stocks are not all that expensive, should we load up our portfolios with equity income ideas? If suitable, we believe investors should consider reserving a meaningful portion of equity portfolios for stocks that provide the potential for above-average yields, but we continue to favor growth-oriented and less interest rate sensitive areas of the equity market over higher-dividend-paying value stocks, as we continue to expect interest rates to move higher over the balance of 2016 and into next year.

Among equities, we suggest the following for consideration:

· Energy/MLPs. Master limited partnerships (MLP) offer very attractive yields (the Alerian MLP Index yield is 7.2%), which can vary depending on the product’s structure. Oil prices have rebounded nicely off of the lows earlier this year and could be buffeted, we believe, by the sharp cuts in oil production in the U.S. and demand growth. The traditional energy sector, which yields a good amount more than the S&P 500 (2.8% versus 2.1%), should benefit if oil prices potentially move back into the $50s over the next several months.

· REITs. We believe the economic backdrop is favorable for potential real estate investment trust (REIT) gains. The U.S. economy is growing steadily and creating jobs consistently, but not enough to overheat, in our opinion. Inflation is modest but rising gradually, a favorable condition for cash flow growth of real estate assets. We have not seen signs of overbuilding in the commercial real estate markets, a positive sign for the possible continuation of the real estate cycle.

· Pharmaceuticals. The broad healthcare sector offers lower yields than the S&P 500, but the pharmaceutical industry group is yielding 2.5% and has continued to generate solid earnings growth. We expect the Affordable Care Act to remain intact in most election scenarios. Political headlines that have led to the group’s recent underperformance have created long-term value, in our opinion.

CONCLUSION

Dividend-paying stocks have been thriving in the low interest rate environment as investors increasingly use stock dividends as a substitute for fixed income in the low interest rate environment. Although the market’s thirst for yield has pushed valuations of high-dividend paying stocks above fair value, it is hard to make the case that they are much more expensive than the stock market as a whole; and certainly do not appear bubble-like. And payouts do not look overly stretched. So consider keeping a portion of your portfolios reserved for some dividend-paying stocks, especially those in areas with more favorable growth prospects, and discuss any potential changes with your financial advisor prior to investing.

Burt White is chief investment officer for LPL Financial.