Key Points

• Treasury Inflation-Protected Securities (TIPS) can offer protection against inflation, as their principal values rise and fall with changes in prices.

• While consumer inflation remains below the Federal Reserve's 2% target, it has been edging upward.

• Lower-than-usual breakeven rates suggest TIPS may offer an attractive entry point, relative to Treasury securities, for investors seeking inflation protection.

Does inflation protection make sense when inflation is low? That partly depends on the price, in our view.

Inflation poses a risk to investors because rising prices erode the real return on an investment over time. Though prices have been rising slowly in recent years, the annual inflation rate averaged 4.1% from 1970-2015. Your investments would have had to return at least that much just to keep your portfolio treading water during that period.

While we don't expect inflation to be that strong going forward—our forecast is for inflation to average 1.5% from 2016 to 2025—investors may still wish to include an inflation-hedging component in their portfolios.

Treasury Inflation-Protected Securities (TIPS) are one way to do this. TIPS offer protection against inflation, and may now be priced at an attractive level.

What are TIPS?

TIPS are a type of U.S. Treasury bond whose principal amount adjusts with inflation, as measured by the Consumer Price Index for All Urban Consumers, or CPI-U. When the CPI-U rises, so does the principal value of a TIPS. If prices contract, so does TIPS value. When a TIPS matures, an investor receives either the adjusted principal or the original principal, whichever is higher.

But that's not the only inflation protection provided by such securities: TIPS also pay a fixed rate of interest twice a year that is based on the fluctuating principal value. That means a TIPS investor would get larger interest payments if prices were rising, and smaller payments should deflation set in.

Like traditional Treasuries, TIPS are initially issued with principal values of $1,000, and can have initial maturities of five, 10 or 30 years. To get a sense of how they work, imagine a five-year TIPS issued with a 1% coupon. If the inflation rate over the first year is 2%, its principal value would rise to $1,020 (a 2% increase in the initial $1,000 principal). As a result, the interest payment at the end of the first year would be $10.20 (the 1% coupon rate multiplied by the $1,020 adjusted principal). Note that TIPS make semiannual coupon payments, so this example is for illustrative purposes only.

Note that in a deflationary environment, a TIPS' principal could drop below its $1,000 initial value. But at maturity, TIPS are redeemed at the higher of the inflated/deflated value or the original principal value. In other words, they never pay less than the initial principal value at maturity. Investors who buy and sell in the secondary market should take caution, however: If deflation were to hit after you bought a TIPS in the secondary market, then you turned around and tried to sell it before maturity, it's possible that you might receive less than the initial principal value.

TIPS vs. traditional Treasuries

So how do TIPS stack up against regular Treasuries? The first thing to understand is that TIPS tend to offer much lower yields to reflect the potential for a rising principal (and interest payments). So if you want to compare two securities of comparable maturities, you have to calculate how much inflation you'd need over the life of a TIPS for it to break even against a regular Treasury.

For example, if a 10-year TIPS offered a yield of 0.1% and a 10-year Treasury offered a yield of 1.6%, the 10-year breakeven rate (the difference between the two) would be 1.5%. If inflation is higher than the breakeven rate over the life of the TIPS, the return—assuming you hold the TIPS to maturity—would be higher than the return from a traditional Treasury with a comparable maturity.

Breaking even

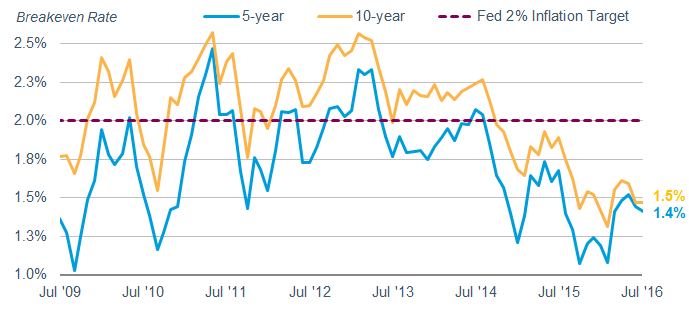

TIPS breakeven rates today are well below historical averages, meaning the inflation bar is lower than in the past. The five-year breakeven rate is 1.4%, compared with a historical average of 1.9%. The 10-year breakeven rate of 1.5% is below its long-term average of 2%.1 Remember, a lower breakeven rate means it takes less inflation for TIPS returns to match those on a comparable Treasury, and higher inflation can mean even higher returns.

Breakeven rates have been trending lower and are below the Fed's 2% inflation target

Source: Bloomberg, monthly breakeven rates as of 7/21/2016.

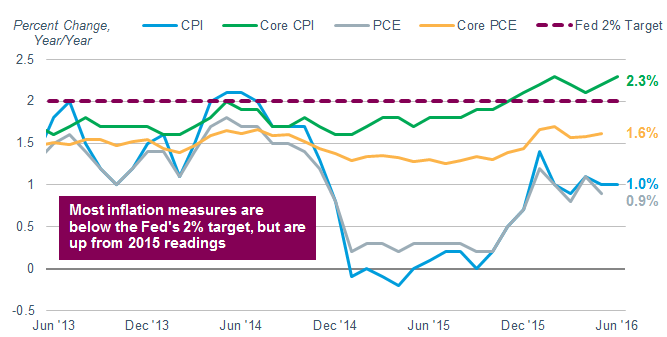

TIPS breakeven rates are likely so low today because most inflation measures are low. In June, the CPI-U rose by only 1% on a year-over-year basis. That marked the 23rd straight month in which that measure had been below the Federal Reserve's 2% inflation target. The trend has been up more recently, however.

Through the first nine months of 2015, the year-over-year change in the index was between –0.2% and 0.2%. While the 1% reading in June 2016 was still well below historical increases, it was an improvement.

Other measures of inflation are moving higher as well. The Personal Consumption Expenditures Index (PCE) was up by 0.9% on a yearly basis in May 2016; that index was also stuck in a rut throughout much of 2015, with most year-over-year readings coming in at 0.3% or below.

Core measures of inflation, those that exclude the volatile food and energy components, have also been moving higher, and some are even above the Fed's 2% inflation target. The 12-month change in core CPI has above 2% in each month since December 2015, while core PCE has been above 1.5% since January 2016.

Most inflation measures have been gradually rising

Source: Bloomberg. Monthly data, as of 6/2016 for CPI and Core CPI, and as of 5/2016 for PCE and Core PCE. CPI is represented by the U.S. CPI Urban Consumers index; Core CPI, by the U.S. CPI Urban Consumers Less Food & Energy index; PCE, by the U.S. Personal Consumption Expenditures Chain Type Index; and Core PCE by the U.S. Personal Consumption Expenditures Core Price Index.

One factor that could push inflation higher is the recent rising trend in commodities prices. The more-than-50% drop in the price of oil from mid-2014 through mid-2015 helped pull the CPI-U into negative territory. Prices today are much closer to where they were one year ago, so low commodity prices should exert less drag on the inflation rate than they did in 2015.

The Federal Open Market Committee (FOMC) expects inflation to rise in the years to come. The median projections for both PCE and core PCE in 2018 are 2%, according to the FOMC Summary of Economic Projections.

So, if breakeven inflation rates for 10-year TIPS are 1.5% or below, that means the market is much less sanguine about inflation than the FOMC. If the inflation rate comes in at or above FOMC projections, inflation protection through TIPS may be underpriced today relative to traditional Treasuries.

Tempered expectations

TIPS are still government bonds, meaning they come with many of the same risks and rewards of traditional Treasuries, including low, or even negative, yields.

Yields on TIPS with maturities of seven years or less are negative, while 10- and 30-year TIPS offer yields of 0.1% and 0.7%, respectively.2 Buying a TIPS at a negative yield doesn't necessarily mean the total return, if held to maturity, will be negative, since the principal amount and coupon payments can rise. In other words, there would have to be no increase in the value of the CPI-U index over the life of the TIPS for it to deliver a loss.

TIPS' low coupon rates can be a concern for investors looking for more income. And lower coupons help increase a security's duration—a measure of interest rate volatility—meaning their prices may be more volatile than those of traditional Treasuries when interest rates rise or fall. Like any other bond, the market value of a TIPS—whether held individually or through mutual funds or exchange-traded funds—can rise and fall with changing rates.

What to do now?

If you're looking for inflation protection, we believe TIPS make sense today. With breakeven rates well below their historical averages, we think they offer reasonable value compared with traditional Treasury bonds. If inflation continues to move higher, and approaches or even surpasses the Fed's 2% inflation target, TIPS should perform well relative to traditional Treasuries. But yields and coupon rates on TIPS are still low, so return expectations should be tempered. Investors considering TIPS today should consider them relative to traditional Treasuries, and focus on the inflation-protection benefits rather than the yields they offer.

1Bloomberg, as of 7/21/2016. Five-year breakeven average from 1/2002 through 7/2016; 10-year breakeven rate average from 8/1998 through 7/2016.

2As of 7/21/2016.

Collin Martin, CFA, is director of fixed income at the Schwab Center for Financial Research.